Bulls liquidated amid war fears

Each day, Coinrule will run through the state of the digital assets market for Blockbeat, your home for news, analysis, opinion and commentary on blockchain and digital assets.

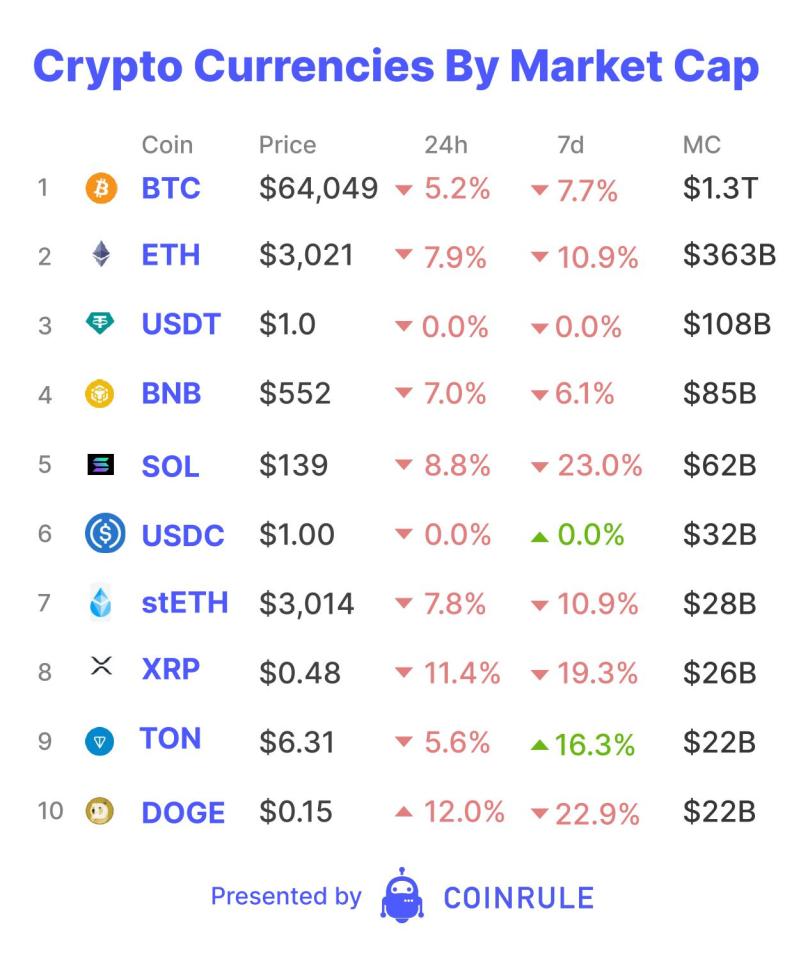

Over the weekend, Crypto traders received a strong reminder about the risks of trading with leverage. In the immediate aftermath of Iran’s drone and missile launch against Israel, Bitcoin and other Crypto assets experienced flash crashes. Bitcoin dropped from $70,000 to $60,000 in a matter of minutes. Leverage allows traders to borrow against their collateral position and trade with significantly larger sizes than they would otherwise. However, any price drop can wipe out your position. The exchange then ‘liquidates’ your position and keeps your collateral. In total, $1.2 billion worth of leverage positions were liquidated over a 24h period. This is the highest day of liquidations in the 15 year history of Bitcoin.

While Bitcoin bounced back and recouped some of the losses relatively quickly, the event reminded traders of March 2020’s COVID crash. Over a short period of time, the Bitcoin price crashed over 60% as fears over lockdowns and the impact of COVID on the economy mounted. Of course, what eventually followed was one of the biggest rallies of all time starting from summer 2020.

What will happen from here on will strongly depend on whether the conflict escalates and how global markets react at Monday’s opening. Should the conflict spiral further, a wider equities crash and run for safety is likely to hit ‘risk-on’ assets like crypto hard. If not, maybe at least some leverage traders have learned a lesson.