Bulb Energy: Bidding war lights up as Centrica pulls out of race for fallen energy firm

The bidding process for the UK’s seventh biggest energy firm has narrowed down to two suppliers, amid reports British Gas owner Centrica has opted against a final offer for the collapsed supplier.

City A.M. understands from industry sources two energy firms remain in the running to acquire Bulb Energy (Bulb) and its 1.5m customers, Octopus Energy (Octopus) and Masdar Energy (Masdar).

There is also the possibility the two suppliers could present a joint offer for Bulb, as first reported in The Financial Times, with Masdar providing funds and Octopus overseeing Bulb’s customers.

A decision is expected by the end of the month, with the sales process being handled by US investment group Lazard.

There are multiple media reports suggesting Ovo Energy is still weighing up an eleventh-hour bid, but that it would need to raise finances amid thousands of redundancies and market volatility.

The supplier refused to comment when approached by City A.M.

Bulb’s troubled financial state exposed

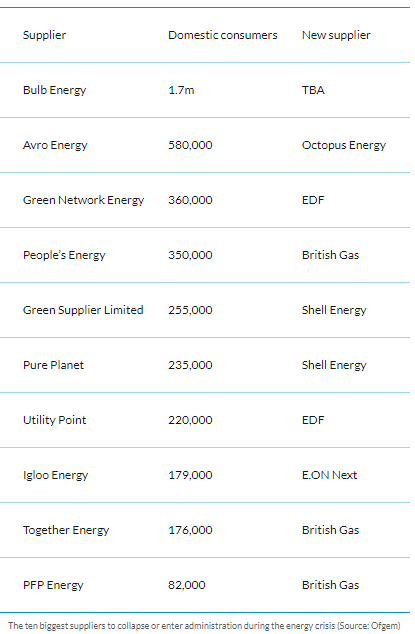

Bulb became the first energy firm to drop into special administration last November, with the supplier deemed to big to enter the supplier of last resort process used by 28 other collapsed suppliers.

It has remained on life support ever since, propped up by regular transfusions of public money, which could total £3bn – making it the biggest state bailout since Royal Bank of Scotland in 2008.

Bulb remains in a perilous financial state, with the details of its losses and financial difficulties exposed in an administrator report last week.

Teneo revealed that Bulb has racked up an £886m loss in the six months since nationalisation – and had a cash balance of £96m.

This would mean it has reported a loss of nearly £600 for every household it provides energy, with firm having spent over £1.5bn on power and gas, while it has taken just under £1.2bn in customer receipts between November and May.

The energy firm has been unable to hedge properly – and has instead been required to buy gas at premium rates – a somewhat ironic situation, considering the firm’s insufficient hedging strategy was a key contributor to its demise.

Its chief executive Hayden Wood, is also still being paid his £250,000 per year in taxpayer funds, despite steering the firm into administration.

Meanwhile multiple creditors, are owed £585m – although it is unclear how or if they will be paid.

However, Sequoia, an infrastructure fund is guaranteed to receive its original £55mn investment and has earned a £10m dividend since November.

It swooped into court proceedings last November to prevent AlixPartners becoming administrator of Bulb’s parent company, Simple Energy.

Instead, Interpath Advisory took on the role, and has charged £3.7m, or £800 an hour for 4,646 hours, since Bulb collapsed.

A further £2.5mn in legal fees, mostly to law firm Freshfields, has been partially paid and Lazard – which is handling the sale, is expected to receive £1.5m.

The Financial Times has reported that Teneo is expected to receive tens of millions of pounds for its services.

Octopus, Masdar and Teneo declined to comment.

Centrica has also been approached by City A.M.