Bulb deal signals energy sector shift as Octopus boosts customer base

“We need to make sure Bulb’s customers are well looked after. It’s fair to say there’s been a wide range of different experiences with customers that have been through these supply failures.”

This is what Greg Jackson, chief executive of Octopus Energy (Octopus), told City A.M. in March, when pressed on he would make a bid for the fallen energy firm.

He now hopes they will be “well looked after” at Octopus, having wrapped up a historic takeover of his former rival – closing the curtain today on a protracted eleven-month saga.

The deal boosts his customer base sixty per cent, amid historic industry volatility and soaring household energy bills – and will eventually make Octopus the fourth biggest domestic supplier with over five million customers.

In Downing Street, the feeling will be one of relief that Bulb’s sorry stint as a de-facto nationalised energy firm is finally over – which is expected to cost bill-payers over £4bn.

New Prime Minister Rishi Sunak and BEIS Secretary Grant Shapps will now likely turn their focus to both this winter’s supply scramble, and Downing Street’s work with Ofgem to reform the energy industry following the collapse of 30 suppliers in the past 15 months.

After all, Bulb’s failure also reflected endemic issues within the energy crisis – which the watchdog has sought to resolve with fit and proper person rules, financial stress tests and market stabilisation charges as it seeks to pivot the industry towards sustainability and away from switching and unrealistic growth plans.

Jackson told City A.M. earlier this year the energy market needs to shift from dozens of market stalls in a crowded town square to a model closer to supermarkets – where distinctive offerings can be provided by a dozen or so credible names.

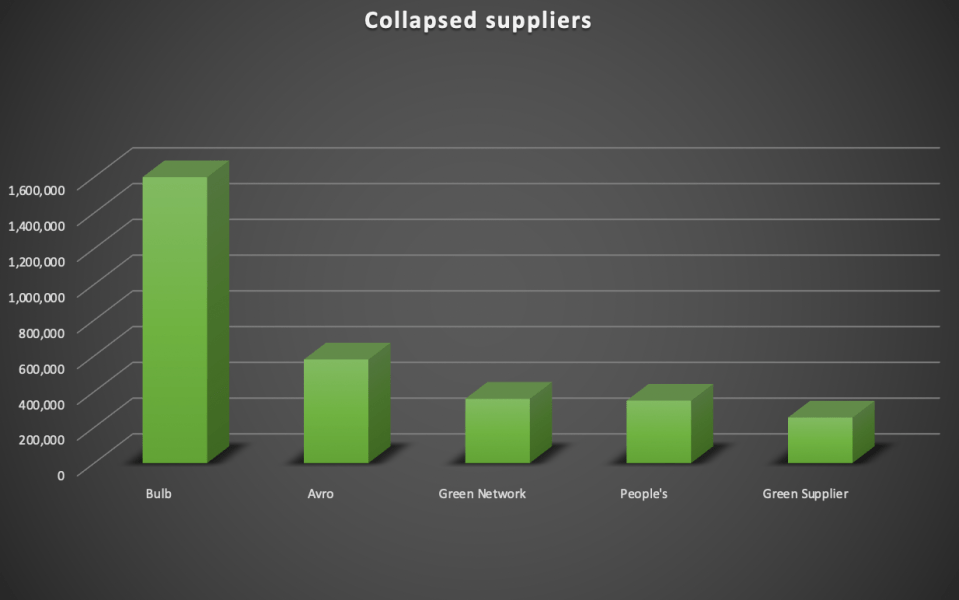

Octopus’ consumption of Bulb and its 1.6m customers could signal the start of that process, with established suppliers consolidating their positions with bigger customer books to ease concerns of future volatility.

City A.M. recounts Bulb’s dramatic collapse and the firm’s increasingly heated bidding process as Big Five rivals grappled over the supplier’s future.

Bulb blows: Lights out for challenger supplier

Bulb dropped into special administration last November, exposed by an insufficient hedging strategy and the constraints of an energy price cap.

It was the 22nd supplier to crumble amid such challenging conditions, but the first to enter the special administration regime – where it was kept on life support with regular transfusions of public funds in the biggest state bailout since RBS.

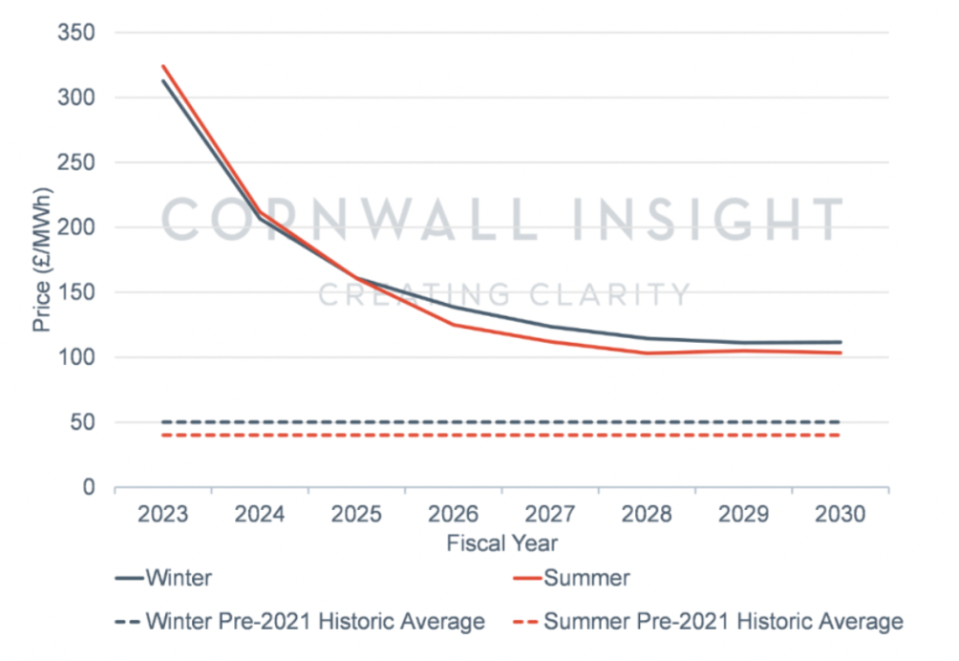

Wholesale prices first spiked to eye-watering peaks last year, driven by rebounding post pandemic demand and gas supply shortages.

This meant Bulb – when it crumbled – could only charge customers 70p per therm for energy, when it cost as much as £4 per therm to meet their needs.

Prior to its fall from grace, concerns over Bulb’s financial position had been mounting and the renewable challenger supplier hired US investment group Lazard to drum up funds from third parties, and potentially find a seller for the supplier.

Bulb’s status as an exciting challenger had been established, with its 1.6m customers making it the UK’s seventh biggest energy firm.

However, it also had liabilities totalling over £585m – including scores of creditors such as Sequoia Infrastructure Fund, which it owed £55m.

This deterred suppliers from making a firm bid for Bulb at a time when every company was bracing for a difficult winter and struggling with hefty losses supplying their customers.

Bulb’s bill hits £4bn as gas prices spike

After Bulb’s fall from grace, Teneo was named the supplier’s administrator while its parent company was overseen by Interpath Advisory after Sequoia swooped in to stop Alix Partners taking on the role, concerned it would be unable to claw back the funds owed by the company.

In February, Russia’s invasion of Ukraine caused gas prices to soar to all new highs of £8-plus per therm, driving up the costs of managing Bulb to eye-watering levels.

The supplier had not been allowed to hedge in administration and was buying gas at spot prices to meet customer needs – eventually costing £4bn, which is being spread across energy billpayers rather than taxpayers.

Energy companies took another look at Bulb once it was in administration – Ovo Energy reportedly first made a play for the company late last year, before withdrawing their offer.

Octopus’ boss Greg Jackson refused to rule out making a bid for the supplier’s customers.

At the time, he told City A.M. it was “critically important we get good value for taxpayers” with any deal for Bulb, and that there had to be a “transparent process.”

There was also plenty of criticism thrown Bulb’s way, with other suppliers questioning its former vaunted status – which had seen it win industry awards while boosting its customer base from 15,000 in January 2017 to over a million within two years without buying another firm.

Instead, it had been luring customers with the promise of green energy at special rates in an industry that peaked with 80 suppliers chasing households with ultra-cheap deals – a key factor in the collapse of both Bulb and the carnage across the energy sector.

Nigel Pocklington, boss of established renewable firm Good Energy, dismissed Bulb as “greenwashers.”

Contrasting Good Energy’s approach with Bulb’s, he told City A.M.: “We have an up-to-18-months-out approach to hedging. We said when we were coming into winter 2021 that we were 100 per cent hedged. That’s one of the reasons we’re still here. Now have we grown like Bulb did? No. But nor have I cost the Treasury or the bill-payer any billions of pounds to rescue me.”

Meanwhile, another eight suppliers fell over the turn of the year and into spring – taking the tally to 30 in just 12 months.

Bidding war for Bulb heats up

Despite the costs involved in managing Bulb’s bloated stint in administration, three potential suitors emerged for Bulb’s customers in June: British Gas owner Centrica, UAE renewable specialist Masdar Energy and eventual winners Octopus – as first reported by the Financial Times.

Centrica pulled out later that month, reportedly concerned about the costs of taking on their customers and further liabilities with financial support from the Government. Masdar then also pulled out without making a final offer.

This left Octopus seemingly as the last supplier standing – submitting a final offer to Teneo.

The firm eventually closed in on a deal with the Government that involved a nine-figure lump sum of £100m-plus, a profit share agreement for Bulb’s 1.6m customers and £1bn in hedging support.

As proceedings seemingly drew to a close, Ovo stunned the industry – returning to the fray with an eleventh-hour bid.

Stephen Fitzpatrick, Ovo’s chief executive, wrote to Teneo to confirm their renewed interest and to pledge a deal without the need for £1bn in public funds, as first reported by Sky News.

Its statement of intent was quite the Lazarus-like revival for a supplier which had reportedly been placed on Ofgem’s nationalisation list, and only months before had raised concerns over its own future before the Government unveiled support packages.

Scottish Power chief executive Keith Anderson, a highly respected voice in the energy sector, called for the process to be reopened and for Bulb’s customers to be potentially sold off in packages.

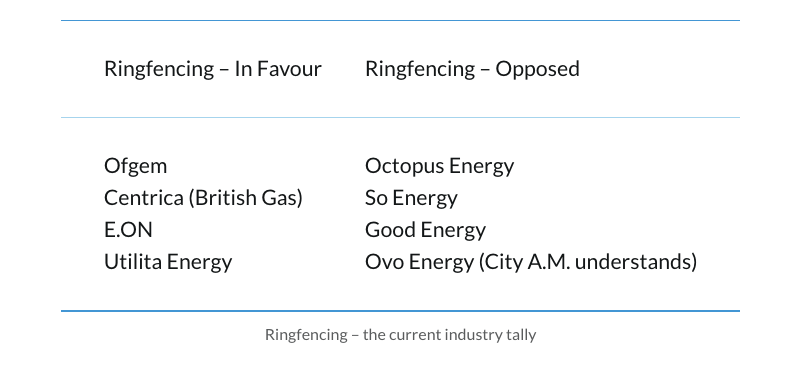

Another big five rival supplier told City A.M. Octopus and Ovo should be made to commit to fully ringfencing Bulb’s 1.6m customers.

Ringfencing refers to requirements proposed by Ofgem for energy firms to hold the credit balance of customers in a different account to their day-to-day operations – and for the money to be spent only on procuring energy for consumers.

However, these challenges to Octopus’ bid were ultimately fruitless, with the supplier concluding the biggest acquisition in its history this weekend.

Octopus cements leading position with Bulb deal

The sale is expected to be implemented through the Energy Transfer Scheme, and will be approved by BEIS Secretary Grant Shapps next month.

The Government has confirmed it will provide financial support for setting up Bulb’s customers with hedging support, in exchange for a profit-share deal, which will be paid back over time.

Bulb’s brand and technology will be used for a transitionary period, and the entity will be separated from Octopus until funding is paid back to the Government.

This means payments to shareholders or the wider Octopus group will be restricted for the foreseeable future.

Nevertheless, the acquisition is quite the statement from Octopus, which has substantially increased its customer base in the crisis while other suppliers have faltered

The deal will also place the firm in the crosshairs of its rivals, determined to compete with the supplier in a market shifting back towards larger firms.

Ringfencing, could be the next point of contention for Octopus, as some of the country’s biggest energy firms including British Gas, EON UK, and Scottish Power are in favour of the concept.

Octopus is concerned ringfencing requirements will force suppliers to charge customers more for their energy bills – with Ofgem currently engaging in an industry consultation over the issue.

Ofgem is yet to impose any ringfencing commitments – but is favour in principle as part of its sweep up of the energy sector.

A decision is expected in the coming months, which could present new headwinds for the energy giant, as it takes on its increasingly prominent role in the domestic energy market.