Budget 2021: Government to review further changes to pension schemes charge cap

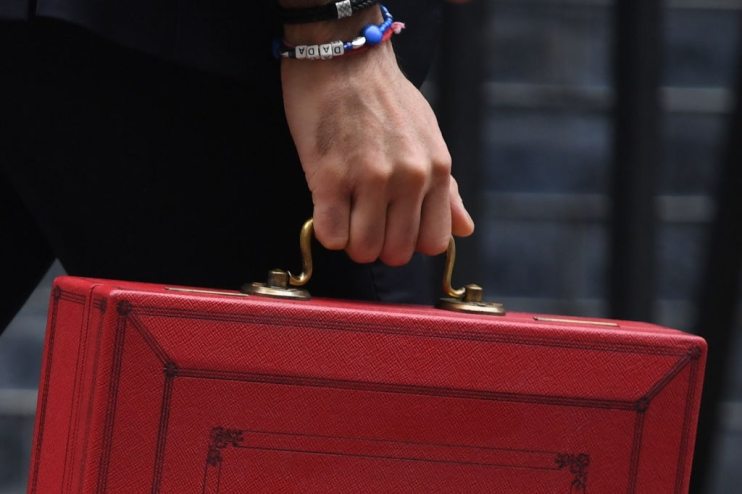

As part of his Autumn budget reveal today, Chancellor Rishi Sunak announced that the government will further review the pension schemes charge gap, as a way to encourage schemes to invest in high-growth UK businesses.

Under the plans announced today, the government will consider options to amend the scope of the charge cap so that it can “better accommodate well-designed performance fees” to ensure savers can benefit from higher return investments, whilst also opening up capital for the UK’s tech innovation and the government’s “levelling up” agenda.

The government said this was part of its ongoing wider policy work to “understand and remove various barriers to illiquid investment.”

He said: “We will consult on further changes to the regulatory charge cap for pension schemes, unlocking institutional investment whilst protecting savers,” Sunak said.

It comes after the government’s work and pensions department opened a consultation in Spring into whether the charge cap prevents schemes from investing in alternative investments, including venture capital, illiquids and growth assets.

The higher fees associated with non-standard investments have traditionally prevented pension fund managers from investing in these sectors, and by loosening the annual charge cap, the government intends to unlock institutional investment into homegrown high-growth businesses.

“The charge cap has been effective in driving down costs for DC savers, but has made it hard for pension providers to offer their members illiquid or alternative investments that, while they cost more to acquire and hold, can deliver greater returns in the long run,” said Jason Whyte, Associate Partner in EY’s Life & Pensions practice.

Unlocking the large pool of long term investment money in these schemes is also in line with the recommendations from the Bank of England’s Productive Finance Working Group, Whyte pointed out.

Stephen Welton, Executive Chairman of BGF, said a potential cap change would benefit “both the scheme members who are currently missing out, and the many companies in need of investment.”

“This is the right time to unlock the immense potential of private capital led by the major pension funds that can boost the growth of businesses up and down the country that will fuel the green recovery in the long run,” Welton said.