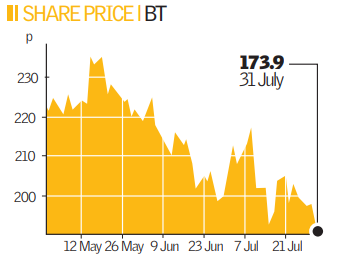

BT stock falls on profit slip

Telecoms giant BT fell the most in more than eight years yesterday, after reporting its fourth consecutive quarterly decline in profit and warning that margins at its global services unit may drop.

Its shares fell 12 per cent, the sharpest fall since February 2000, closing at 173.9p. The firm’s share price has lost 28 per cent in the last 12 months.

Lower profitability at its global services division – which provides internet services to businesses – unnerved investors as did a deficit in the company’s pension fund. The firm also warned that its margins would be lower due to increasing inflation and rocketing energy costs.

BT is under pressure to counter falling sales in its wholesale business, after Ofcom forced it to make the network of copper lines that it inherited when it was privatised available at regulated prices to competitors through BT Openreach.

Net income for the group dropped to £397m from £607m in the same period last year, although sales were up by 2.9 per cent at £5.18bn.

Cash flow also worried investors, with outflow of £734m exceeding inflow, partly because of higher debt interest payments and share buybacks. Net debt was £106bn at the end of the year compared to £8.6bn a year earlier.

Chief finance officer Hanif Lalani told CityA.M. that the company was planning a further round of cost cutting measures amounting to £100m, which will allow it to make savings of around £800m before the end of the fiscal year.

Analyst Views: Just how bad were BT’s results yesterday?

Tom Gidley-Kitchin (Charles Stanley): “Probably not as bad as the market seems to think. It’s true that the performance of its global services business was disappointing, but the fall in its wholesale business should have been expected.”

Christian Maher (MD, Oakley Capital): “My view is that the reaction is overdone. It’s a big liquid stock which gets sold on a nervous day, but the worries about its margins are nothing new while pensions is also an ongoing issue.”

Umesh Patel (reasearchoracle.com): “We feel the decline has created a positive investment opportunity and are optimistic regarding BT’s long term transformation into a software-driven communications services company.”