BT share price edges down as Ofcom outlines measures to open fibre networks

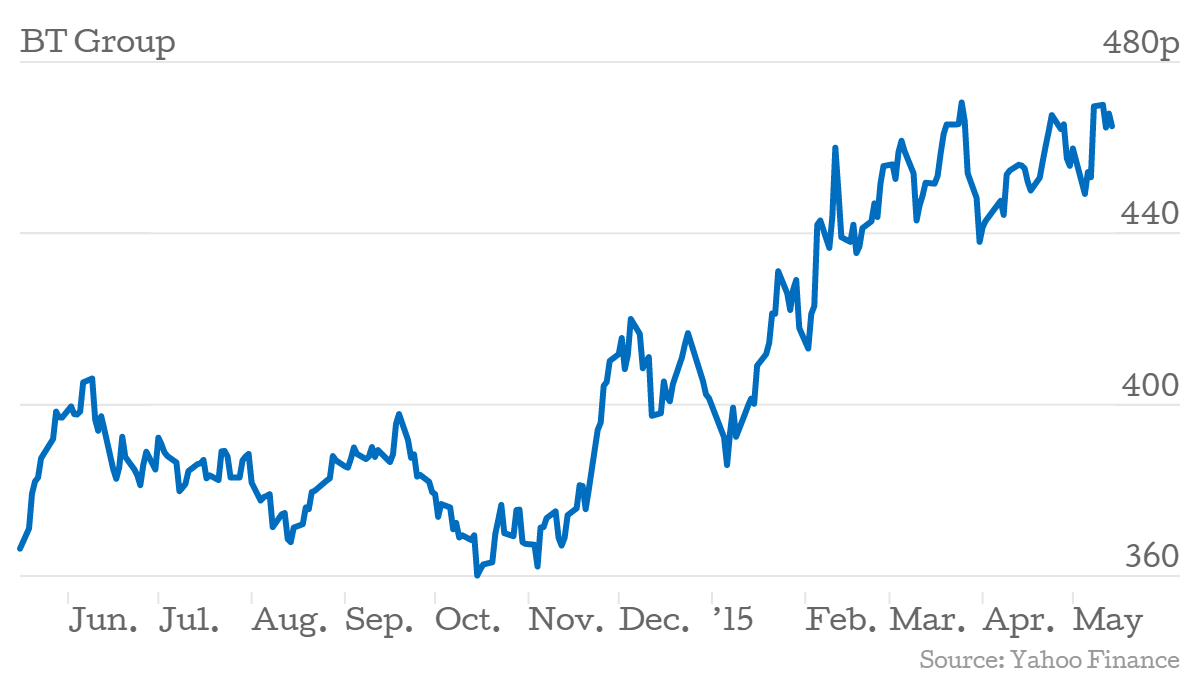

Shares in BT opened almost one per cent lower at 461.65p this morning, after it was revealed regulator Ofcom could force it to open some of its fibre-optic lines to rivals.

However, these falls were later clawed back, with shares trading at 463.9p, 0.24 per cent down, an hour later.

The regulator said the measures would apply to "leased-lines", high-speed lines rented by businesses, schools and public sector organisations, giving BT's rivals access to its fibre-optic cables.

Under the plans, BT will be forced to supply "dark fibre" (so called because it would be those taking control of the cables, rather than BT, which "light" them) to its rivals in areas outside central London.  Ofcom said the measure will "promote competition and innovation in the £2bn market".

Ofcom said the measure will "promote competition and innovation in the £2bn market".

The plans, subject to a consultation which closes on 31 July, are part of Ofcom's Business Connectivity Market Review. The review also proposes a "new, minimum quality of service performance requirements" on Openreach, the arm of BT which installs and maintains connections to BT's network on behalf of rivals.

"Ofcom is concerned that Openreach often takes too long to install leased lines, and too often changes the date on which it promises to deliver services," it said.