Brits to face record £4,400 energy bills as gas prices refuse to come down

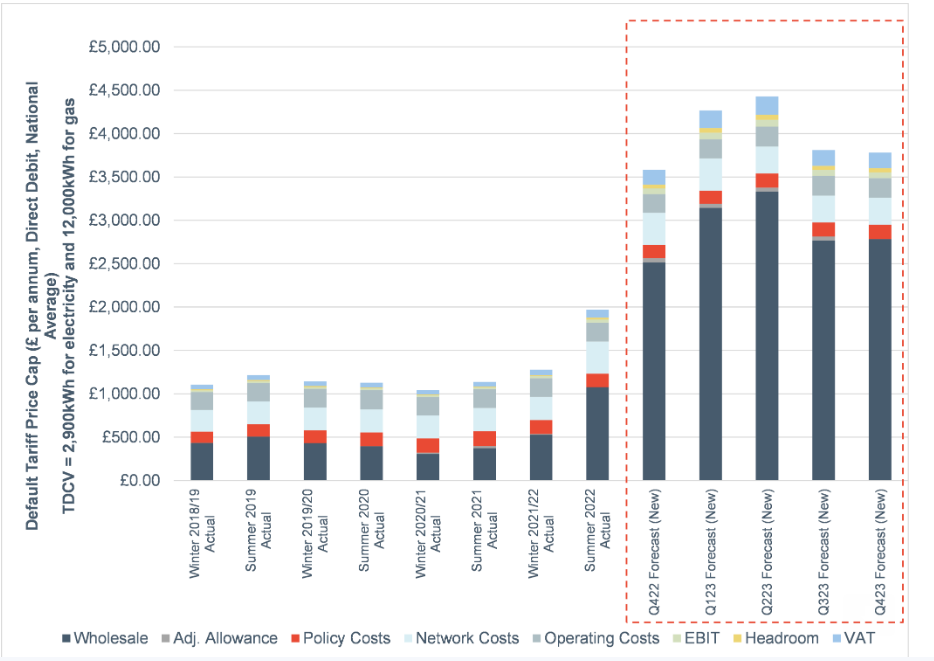

Cornwall Insight has hiked its price cap forecasts to over £4,000 next year, attributing the hike to Ofgem’s decision to shift to a quarterly model.

The energy specialist has raised its estimates for October and January to £3,582 per year and £4,266 per year respectively, in the coldest period of the year when demand is at its peak.

It also expects the price cap to peak to £4,426 per year next Spring, and for prices to remain elevated into 2024.

Such a hike would condemn millions of Brits to fuel poverty, with vulnerable households exposed to difficult choices over heating and eating.

With UK median household income currently £31,400 per year, this will meaning the average family will now be spending about £82 per week on their energy needs.

This is about how much they would’ve spent on petrol, housing and energy combined in 2021.

The increases reflect both a spike wholesale prices, and also the costs associated with Ofgem shifting to a quarterly model.

In consultation documents published last week, Ofgem confirmed suppliers costs associated with wholesale market hedging would now be recoverable over a six-month period – resulting in higher bills than previously forecast for the crucial January cap.

The application and structure of these additional backwardation costs reflect the suppliers’ wholesale energy trading requirements.

Cornwall Insight argues the recovery of these is essential to help avoid more supplier failures.

However, it argued the new forecasts for the January to March 2023 quarter further underline the need for support for households who will struggle to pay their energy bills this winter.

Dr Craig Lowrey, Principal Consultant at Cornwall Insight: “While our price cap forecasts have been steadily rising since the summer 2022 cap was set in April, an increase of over £650 in the January predictions comes as a fresh shock. The cost-of-living crisis was already top of the news agenda as more and more people face fuel poverty, this will only compound the concerns.”

The energy expert recognised that Ofgem was likely to attract criticism for changing its hedging formula, which has contributed to Cornwall Insight’s predicted hike in bills alongside Russia cutting gas flows into Europe.

However, he argued that many energy suppliers remain under severe financial pressure, with some currently making a loss – and that without updating the cap, a further crisis could happen within the energy sector.

He said: “Maintaining the current timeframe for suppliers to recover their hedging costs could risk a repeat of the sizable exodus seen in 2021. Given that the costs of supplier failure are ultimately met by consumers through their energy bills, a change which means that this is less likely is welcome, even if the timing of it may well not be. “

Instead, he suggested it might be be time to consider the cap’s place in the energy sector, which was initially drawn up to prevent customers who don’t switch from being overcharged, rather than limiting the price consumers can be charged.

Dr Lowrey concluded: “After all, if it is not controlling consumer prices, and is damaging suppliers’ business models, we must wonder if it is fit for purpose – especially in these times of unprecedented energy market conditions.”