Brits swap pub for nights in as inflation deals heavy blow to finances

Brits are responding to the cost of living crunch by ditching the pub for nights in to save money, a survey published today revealed.

Consumer spending grew at the slowest rate since February 2021 over the last month, jumping 1.8 per cent over the year to September, Barclaycard said.

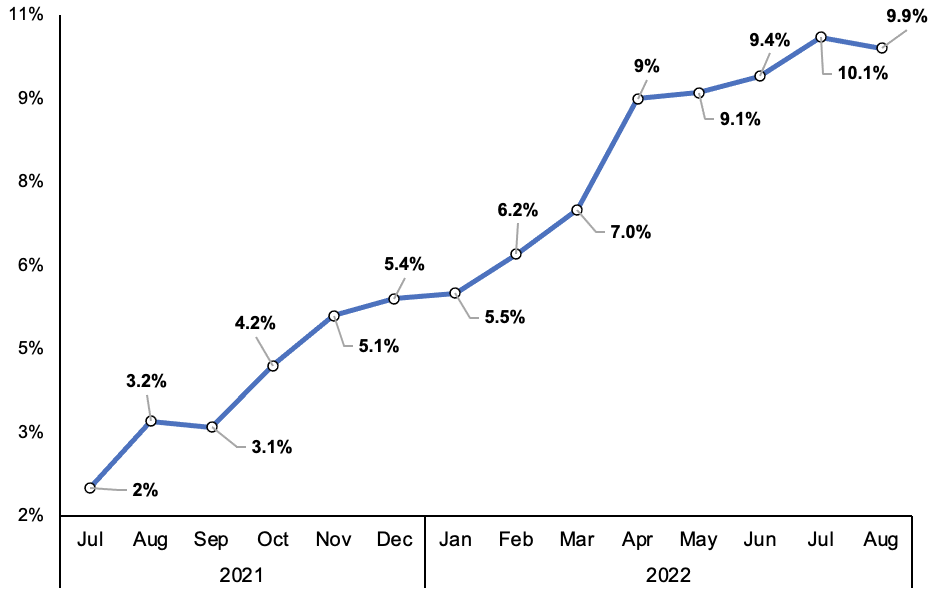

Inflation has hovered around a 40-year high for the past few months and is currently running at 9.9 per cent, putting consumers’ finances under intense strain, forcing them to trim discretionary spending.

Annual UK CPI inflation

Purchases of non-essential items such as clothes jumped one per cent over the last year, the limpest growth since the last Covid-19 lockdown at the beginning of 2021.

Barclaycard’s data chimes with official Office for National Statistics figures that reveal retail sales fell 1.4 per cent in August.

“Brits are… looking for ways to enjoy themselves at home while saving money, which has led to growth across “insperience” categories such as digital subscriptions and takeaways,” Esme Harwood, director at Barclaycard, said.

Separate data revealed high street stores are struggling due to consumers exercising greater caution.

September saw another month of falling sales volumes while footfall across the UK’s high streets also plunged.

Consumers “shopped cautiously,” avoiding purchases of big-ticket items including computers, TVs and furniture, Helen Dickinson, chief executive British Retail Consortium, said.

While retail sales crept up 2.2 per cent in September, the subtle increase masked a much larger drop in volumes after historic inflation levels were taken into account, the BRC said.

Footfall declined by 0.2 per cent last week across all retail destinations, Springboard said yesterday.