Brits spent £7.5bn on moving house last year: That’s £23,000 in stamp duty, surveyors and other fees if you live in London

The average cost of moving house in London shot up to £23,000 last year – that's higher than the average (median) UK annual wage.

The figures

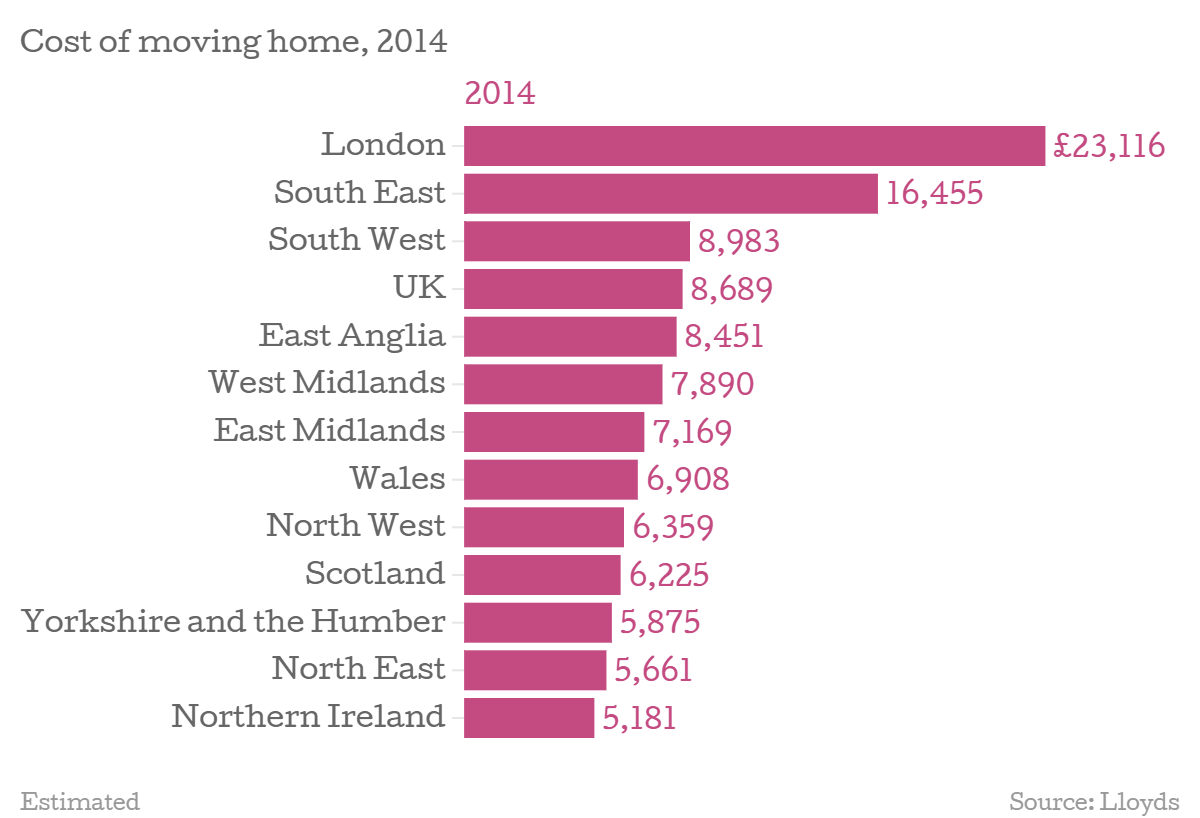

The price of moving house in the UK rose by £431 last year, bringing the average total figure to £8,698 in 2014, up from £8,258 in 2013 and £7,552 in 2004, research by Lloyds has found.

This rise, and a rise in the number of homes sold in 2014, means the UK spent around £7.5bn on moving home last year – a full £1bn more than in 2013.

The costs of moving house include stamp duty, fees for estate agents, surveyors, home removals, and conveyancing.

According to the report:

The rising cost of moving is driven by a per cent (or £266) increase in estate agency fees and surveyors costs growing by over a fifth (22 per cent) to £665 in the final quarter of 2014 compared to the same period a year earlier.

Over the same period, conveyancing fees increased by 7 per cent (or £74) to £1,074. The average stamp duty paid fell marginally by 1 per cent (or £28) to £1,973.

Many of these costs have increased as a result of higher house prices in 2014 compared to the year earlier.

[infographic id="50"]

It’s worth noting Lloyds looked at the fourth quarter of 2014, which covers two months under old stamp duty rules, and one month under new ones introduced by the chancellor during the Autumn Statement, which imposed higher rates on some of the most expensive homes.

The total cost of moving house varies depending on where in the country you live. London is the most expensive region by far: at £23,116 it dwarfs the average of £8,689.

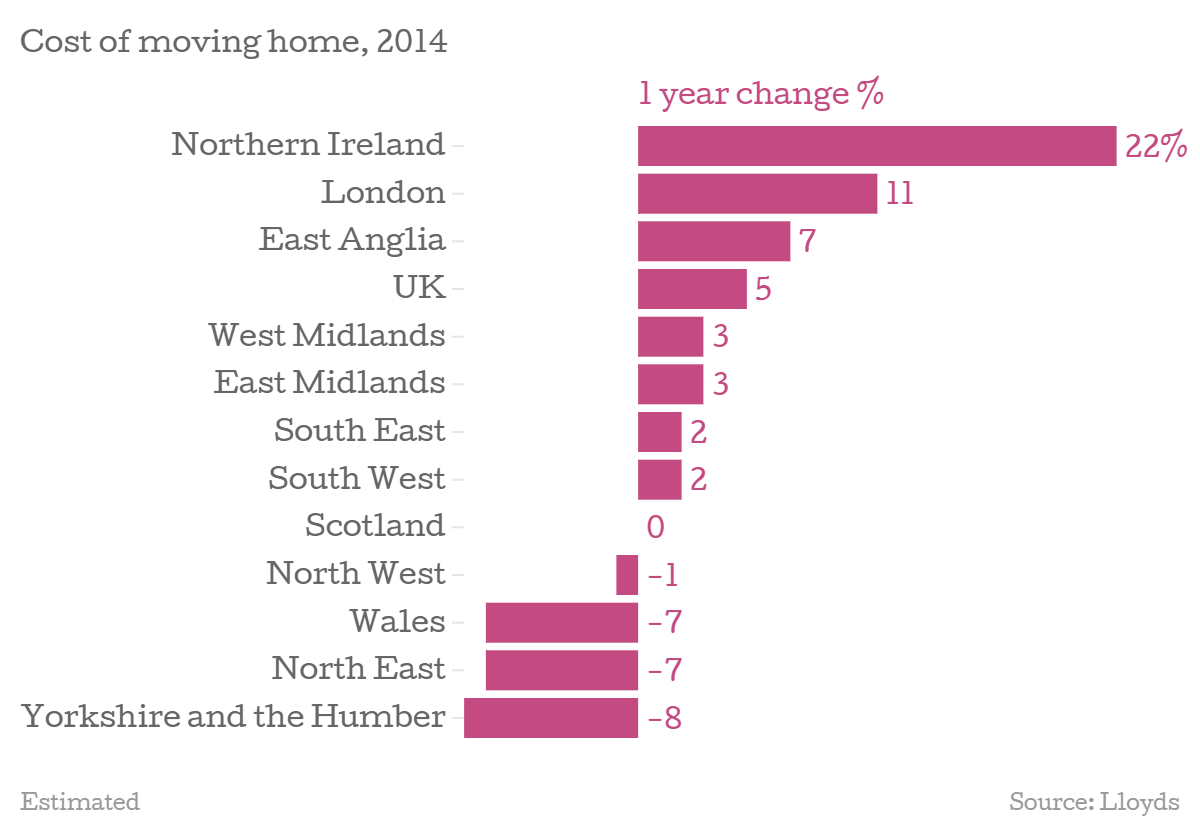

Although it’s cheapest to move house in Northern Ireland, the region has the highest increase in costs at a huge 22 per cent – twice that of London (11 per cent). In four of 12 regions it cost less to move house in 2014 than 2013 with the north east and Wales (7 per cent) reporting the highest drops.

Why it’s interesting

House prices have shot up to record highs recently, and, despite moderating their growth of late, are pricing many people out of the market. When fees are added in too, moving house is an even more daunting prospect.

Over the past 10 years, fees have risen by 15 per cent while wages have risen by 16 per cent meaning the average home mover spends 26 per cent of his or her earnings on moving, compared with 28 per cent a decade ago. That just highlights how big some of this year's changes are, and homeowners will be hoping the rate of increase won't be sustained.

What Lloyds said

Andy Hulme, mortgages director at Lloyds Bank, commented:

With the cost of moving at its highest level since 2007, people struggling to cover the costs should look to make savings wherever they can. The recent changes in stamp duty should help buyers reduce their overall cost of moving, which can be a significant boost.

In short

London continues to be both the most expensive place to buy for both outright cost and associated taxes and fees. These two factors aren't discrete however, especially as stamp duty is higher on more expensive homes. If house price inflation continues to cool through 2015, the change in the cost of moving house could be lest shocking in 12 months time. As always with the housing market, there are no guarantees.