Brits sit pat on Covid-19 savings mountain in sign of tougher recession

Brits are sitting pat on the mountain savings they built up over the course of the Covid-19 crisis during lockdowns, official figures out today reveal.

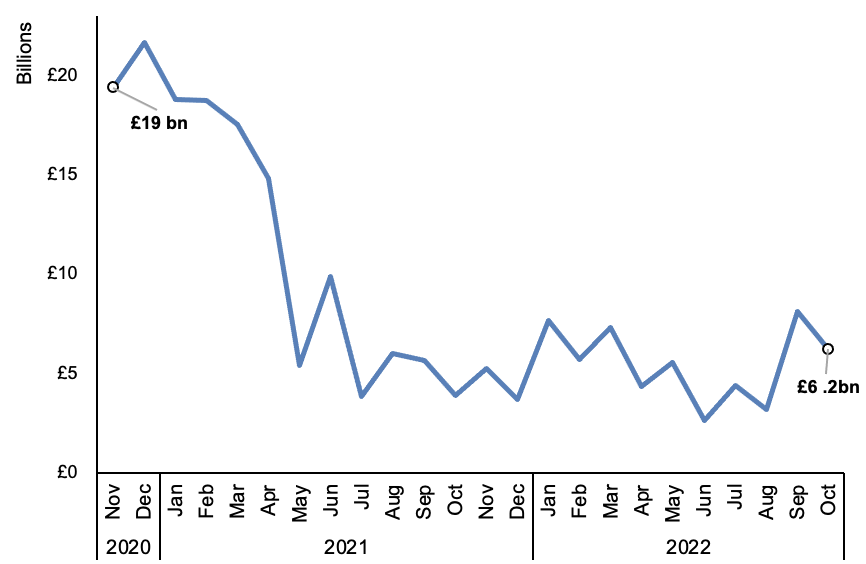

Households set aside £6.4bn in savings last month, £1.6bn higher than the average monthly deposit flow before the pandemic, according to the Bank of England.

The figures illustrate consumers are responding to the cost of living crisis by exercising greater caution with their finances.

Economists have for months been betting people would use their savings to maintain spending as historically high inflation erodes their budgets.

Prices are up 11.1 per cent over the last year, the fastest acceleration in 41 years, outstripping pay growth.

Consumers can either borrow or use savings when inflation outpaces their income.

However, the Bank of England’s data revealed debt fuelled spending is flagging. Brits spent just £400m on credit cards last month.

Monthly flow of savings in UK

Households are seemingly shunning taking on more debt over fears they could be sacked during the coming recession, which is forecast to last at least a year.

“Households have remained unwilling to draw on savings or take on more debt in order to support their level of real expenditure,” Samuel Tombs, chief UK economist at Pantheon Macroeconomics, said.

The UK’s budget watchdog, the Office for Budget Responsibility (OBR), earlier this month alongside the autumn statement forecast the UK economy will grow more than two per cent each year after 2024.

It also said GDP will expand next year, largely based on the assumption the UK’s savings rate will plummet to zero in response to rising living costs.

But, today’s numbers cast “further doubt over the OBR’s view that a sharp fall in households’ saving ratio will ensure the recession is short and the subsequent recovery is swift,” Tombs added.

Brits “clearly are not spending to their fullest. In addition, the muted level of consumer borrowing in October shows that households without savings are not flexing their credit cards,” he said.

The number of home loans tumbled to 58,977 last month from 65,967. Mortgage rates have soared after former prime minister Liz Truss’s mini-budget spooked financial markets by raising the UK’s borrowing trajectory.

Chancellor Jeremy Hunt’s £55bn of tax hikes and spending cuts earlier this month have pushed UK debt costs back down to around three per cent. But, lenders have yet to pass on these reductions in full to customers.

Tombs said house prices could shrink nine per cent next year driven by tighter financial conditions pricing prospective buyers out of the market.