Brits ‘batten down hatches’ ahead of bleak winter

Brits are “battening down the hatches” ahead of an exceptionally tough winter marred by sky-high energy bills, economists warned today.

Households are cooling spending on credit cards and putting money aside in savings accounts to keep their finances intact to withstand a historic shock to their living standards.

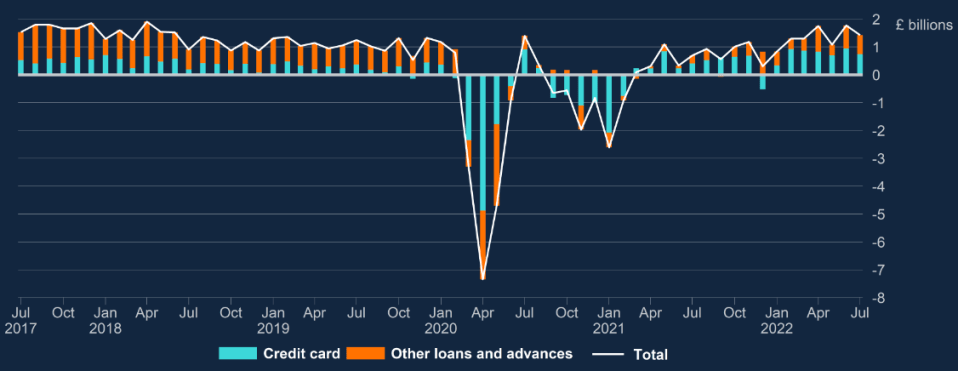

Brits spent £700m on credit cards last month, down from the £900m spent in June, according to data released by the Bank of England today.

UK consumer borrowing has cooled ahead of a tough winter

Overall consumer borrowing climbed £1.4bn over the last month.

Annually, consumers spent 13 per cent more on their credit cards, the fastest rise since 2005, partly driven by high inflation boosting the Bank of England’s data, which is measured in cash terms.

Consumers are seemingly diverting money that could have been used for non-essential spending to their savings accounts.

Household savings swelled £4.3bn over the last month, sending the total stock of savings in the UK up 0.2 per cent over the same period.

Interest rates have climbed to 1.75 per cent, a 14-year high, strengthening incentives for consumers to save instead of spend.

Thomas Pugh, economist at consultancy RSM UK, said: ‘The reduction in borrowing and rise in saving in July, suggests that consumers are already battening down the hatches against what will almost certainly be an exceptionally tough winter.”

Soaring inflation fuelled by historic rises in wholesale gas prices pushing energy bills higher is set to erode UK living standards at the fastest pace on record this year.

Inflation is already running at a 40-year high of 10.1 per cent, but it could near 20 per cent later this year if global gas prices keep climbing.

Last week, energy regulator Ofgem announced bills will jump 80 per cent in October.

However, the huge build up of savings in Britain since the Covid-19 crisis indicates households may be able to cope with the historic shock to their spending power.

“Households’ balance sheets are still exceptionally strong, so we expect consumers to reduce their saving over the winter to offset some of the impact of the 80 per cent jump in energy prices that will take effect in October,” Pugh added.