British Land warns politics a risk to recovery

BRITISH Land warned that upcoming political events such as the general election posed “increasing risks” for the property market as the FTSE 100 landlord posted a jump in profits.

Chief executive Chris Grigg said yesterday that uncertainty over the outcome of the 2015 elections could put off businesses and investors from investing in the sector.

“We remain positive about the outlook for our markets, although you could argue that political risks, both at home and abroad, are greater than they were a year ago and these may have an impact,” Grigg said.

His comments came as the comp-any posted an 8.4 per cent rise in underlying pre-tax profits to £297m in the year to 31 March, buoyed by a recovery in the UK’s property market.

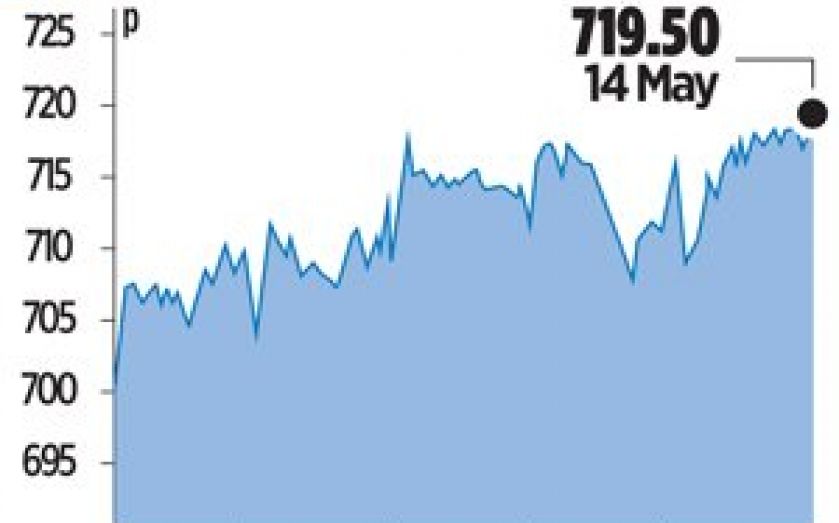

British Land’s net asset value rose by 15.4 per cent to 688p, fuelled by an 8.3 per cent jump in the value of its properties to £12bn. Retail rose by 4.4 per cent in value while offices and residential increased by 14.5 per cent.

The company has been taking advantage of the recovery and increased interest from international investors piling into the sector to offload some of its older assets an begin work on new developments.

The group said it had invested £1.3bn in acquisitions and development schemes during the year in London and the south east.