British Gas owner Centrica predicts eightfold profit hike after energy price surge

British Gas owner Centrica has predicted a near eightfold increase in its full-year profits, powered by soaring energy prices last year following Russia’s invasion of Ukraine.

The energy giant now anticipates earnings of 30p per share, way above analyst expectations of 22p per share compiled by Bloomberg.

Centrica attributed its strong uptick in performance to robust trading across its electricity generation assets alongside gas production from fields in the North Sea.

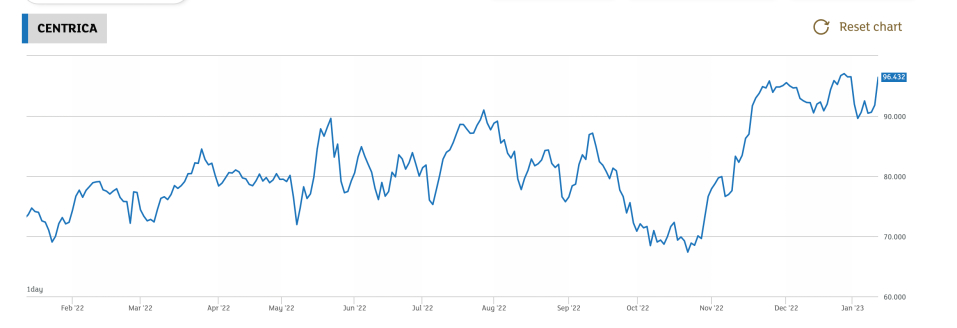

Investors have responded positively to the bullish update, with shares up 5.12 per cent on the FTSE 100 in this morning’s trading – rising to levels not seen since May 2019.

This also makes it the fastest riser on London’s premier index and follows Centrica’s shares gaining 53 per cent during 2022

Centrica’s anticipated mega earnings reflect a sharp turnaround in performance since the pandemic.

Alongside rival energy firms, it suffered billions in losses in 2020 when the pandemic struck – which left raw energy prices at lows not seen in modern times, with oil dipping below $0 per barrel.

It showed signs of recovery the following year, as the energy firm generated earnings of four pence per share and a pre-tax profit of £761m in 2021.

The company now predicts closing net cash for 2022 to be above £1bn and said that it had “continued to deliver strong operational performance” since its last trading update in November.

Last November, Centrica launched a £250m share buyback – its first since 2014, cementing its return to conventional operations.

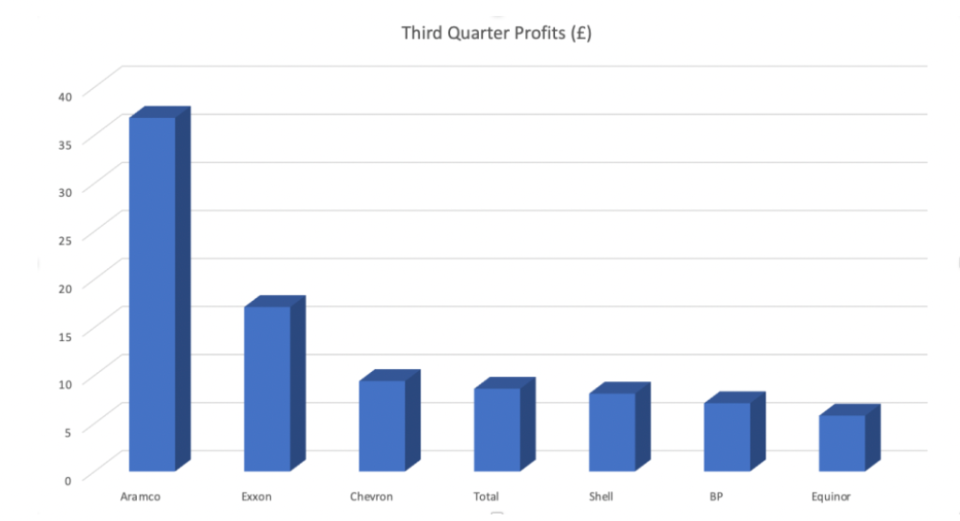

This reflects soaring oil and gas prices following Russia’s invasion of Ukraine, amid a Kremlin-backed supply squeeze on the continent alongside shortages driven by Western sanctions on Moscow.

Prices have since eased but remain historically elevated compared to pre-crisis levels.

British Gas struggles remain amid industry crisis

While Centrica’s energy production has powered bumper earnings, its retail energy arm British Gas has not been raking in profits – with margins still tight amid record wholesale costs over the past 12 months.

The retail arm has suffered from the rise in wholesale costs, and Centrica’s business supplying homes with gas and electricity is widely expected to make a loss in the second half of the year.

British Gas last year revealed it would donate 10 per cent of its profits to help its poorer customers manage rising gas and electricity bills for the “duration of the energy crisis”.

Centrica does face key headwinds this year, such as a 45 per cent levy on electricity generators which began this month.

This levy will hit both its green energy projects and its 20 per cent stake in Britain’s nuclear fleet.

It also has now sold its Norwegian oil and gas assets to Spirit Energy and will no longer be able to raise revenues from assets it has previously banked on.

Centrica is set to unveil its fourth quarter and full-year results next month.