British factories yanked into recession by inflation, energy costs and wilting demand

British factories are being yanked into recession by inflation, swelling costs and stumbling demand in a further sign the country is now in the early stages of a tough slump, a closely watched survey out today reveals.

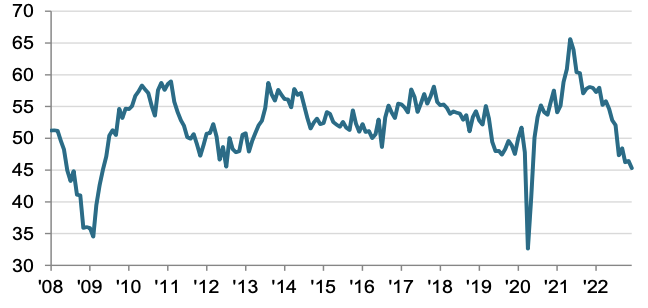

S&P Global and the Chartered Institute of Procurement and Supply’s (CIPS) final purchasing managers’ index (PMI) for the British manufacturing industry came in at 45.3 last month, the lowest reading since the early stages of the pandemic and down from 46.5 in November.

But, the reading was bumped up from an initial estimate of 44.7. It was still far below the 50 point threshold that separates growth and contraction.

Higher energy costs sparked by a combination of Russia’s invasion of Ukraine and resurgence in global demand after the end of Covid-19 restrictions has forced factories to scale back unprofitable activity.

A shallower jobs force in Britain since the pandemic and workers demanding inflation busting pay rises has added to factories’ costs.

UK factories are being hobbled by stalling demand

Rob Dobson, director at S&P Global Market Intelligence, said: “The UK manufacturing downturn took a further turn for the worse at the end of the year.”

“Output contracted at one of the quickest rates during the past 14 years, as new order inflows weakened and supply chain issues continued to bite,” he added.

The PMI is the first major piece of data out in a year that is likely to be tough for the UK economy.

‘SLOW-BURN’ RECESSION

Consumer spending is expected to be hobbled by households’ purchasing power being eroded by high inflation, the Bank of England’s nine successive interest rate rises passing through the economy and tax hikes.

Inflation dropped to 10.7 per cent in November from 11.1 per cent, prompting experts to bet the rate of price growth has now passed its peak. However, pay increases are still likely to lag inflation in 2023.

Most economists reckon the country is in the early stages of a recession that will last between a year or two years.

Figures out from the Office for National Statistics last month unveiled GDP dropped a deeper than first calculated 0.3 per cent. The economy did grow 0.5 per cent in October on a monthly basis, although output was boosted by the lost working day in September for The Queen’s funeral.

Expectations of a reduction in consumer spending in response to worsening finances are prompting businesses to rein in capital goods purchases, products supplied by manufacturers.

“The decline in new business was worryingly steep, as weak domestic demand was accompanied by a further marked drop in new orders from overseas,” Dobson added.

“Demand for industrial goods likely will be hit again in Q2, as real incomes are squeezed by the watering down of government support for energy bills and higher unemployment, as businesses are forced to consolidate costs,” Gabriella Dickens, senior UK economist at Pantheon Macroeconomics, said.

Factories last month shed workers to rein in expenditure ahead of a reduction in spending. The PMI employment index dropped to 45.5, its lowest level since August 2020.

Output price inflation slowed markedly last month due to firms expecting customers to shun higher prices amid a tight real income crunch.