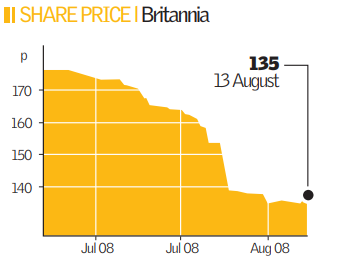

Britannia hit by bad debts on mortgages

Mutual building society Britannia yesterday posted a 40 per cent drop in interim profits, after the cost of bad debts hammered its mortgage book.

Britannia said the percentage of its home loans that were three or more months in arrears rose by just over 1.7 per cent in the first six months of the year – above the industry average of 1.3 per cent, and up from 1.25 per cent a year ago.

Bad debts were fuelled by arrears on specialist lending, including loans for new housing in the centre of London – a sector which has been battered by the credit crunch.

Acquired mortgage books, which have felt the impact of falling property prices and a drop in consumer confidence, were also particularly badly hit. Gross mortgage lending for the group fell to £1.9bn from £3.7bn a year ago as the group tightened its criteria in the face of an impending recession. Pre-tax profit for the first six months fell to £50.5m from £81.7m a year ago.

“The bulk of the arrears are arising on eight per cent of our book. It is a small percentage of our total book that is incurring the arrears – it is contained and manageable,” said chief executive Neville Richardson.

Richardson said the group did not expect significant losses from the arrears, as the average loan-to-value on its book is 42 per cent. The loan-to-value on new lending this year dropped to 54 per cent from 61 per cent a year ago.

“We never loaned above 100 per cent loan-to-value and very little above 95 per cent, at a time when competitors were lending 100 percent,” he added.