UK house prices: Britain’s property millionaires are set to triple by 2030 – as one in four London homes hit £1m

Worried about how exactly to become a millionaire after the Adam Smith Institute's predictions this week that we will all be hitting the millionaire milestone by 2050?

Not to fear – your property will do most of the work for you, according to new research out today that forecasts that the number UK properties worth at least £1m are set to triple over the next 15 years.

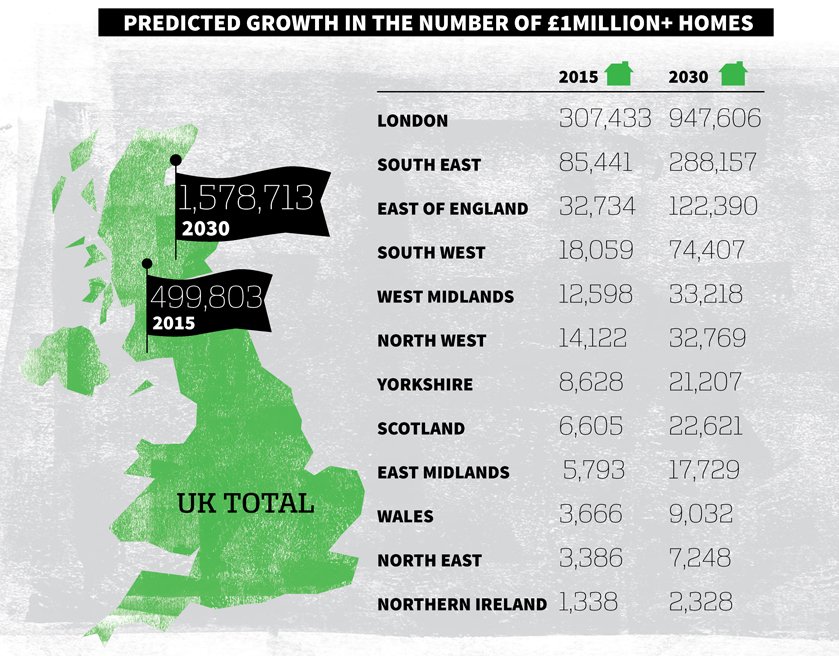

Today, less than half a million properties in Britain are worth £1m or more, of which 62 per cent are based in capital. However, this is set to rise to over 1.6m by 2030 as homes remain in short supply and prices continue to soar, Santander Mortgages' report showed.

In London alone, more than a quarter of properties will have broken the £1m-mark by 2030 compared with nearly one in ten properties today.

The average price of a property in the capital will jump from £534,000 to £1.27m. For the UK overall, prices are expected to double from £283,565 to £557,444 by 2030.

This is good news for people already on the property ladder. But for aspiring homeowners, buying a property will only become more challenging as wages fail to keep up the pace with property price inflation.

“By 2030 the divide between housing haves at the top and the have-nots at the bottom will be even wider than it is now," Professor Paul Cheshire, LSE Professor of Economic Geography, who co-authored the report, said.

Read More: Two thirds of Londoners will be renting by 2025

At present in the UK, the average property price is 7.9 times the average income, but by 2030, this is expected to hit a multiple of 9.7. This is even higher for London, where prices are currently 11.5 times the average income, rising to an eye-watering 16.5 by 2030.

"Property price inflation is beneficial for existing owners who will see their net-wealth increase, but it will make entering the market more difficult still for new buyers, further highlighting the importance of the right timing, advice, support and financial planning; and not just having a mum and dad who bought a house but a grandparent too," Cheshire said.

The graphic below shows the current number property millionaires across the country compared with 2030.