Britain likely to exit deflation next week

Economists have said that official data due to be released next week will likely show Britain escaped from a brief period of technical deflation last month.

They think that prices could have risen slightly in May due to higher fuel prices, alongside increases in the cost of air/sea transport, and holiday prices.

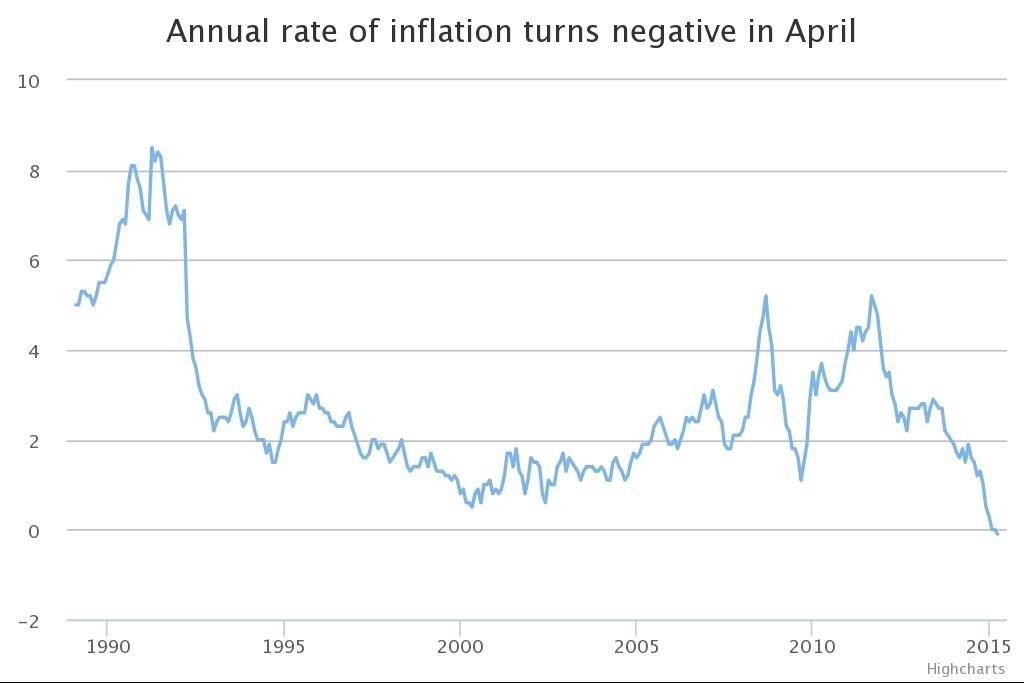

Inflation turned fell by 0.1 per cent in April – taking it into negative territory for first time since the 1960s – as the price of air and sea fares slipped due to the timing of Easter. At the time, economists said they thought this would be temporary.

Read more: Inflation turns negative for the first time in over 50 years – but it should only be a blip

It came after prices remained the same in both March and February.

Howard Archer, chief economist at IHS, said: "The UK is likely to have exited deflation in May with consumer prices edging up 0.1 per cent year-on-year after a dip of 0.1 per cent in April".

"This is expected to be largely due to a rise in petrol prices during May and a move back up in air/sea transport prices and some holiday prices after these were dragged down year-on-year in April by the earlier Easter in 2015 compared to 2014."

Sam Hill, senior UK economist at RBC capital markets, said: "RBC forecasts that UK … inflation for May will be 0.2 per cent".

The Bank of England expects inflation will stay close to zero before rising "notably" towards the end of this year as the effects of oil and food prices, as well as the strong pound, begin to fade.

Earlier this week Monetary Policy Committee member Ian McCafferty said the time for an interest rate hike is nearing, with the factors keeping a lid on inflation expected to fade "as we move into next year".

He said inflation will return to around 1.5 per cent by this time next year, and to 1.7 per cent by the end of 2016.

Read more: Ian McCafferty says time for interest rate rise nearing