Brexit deal defeat triggers huge uncertainty: what next?

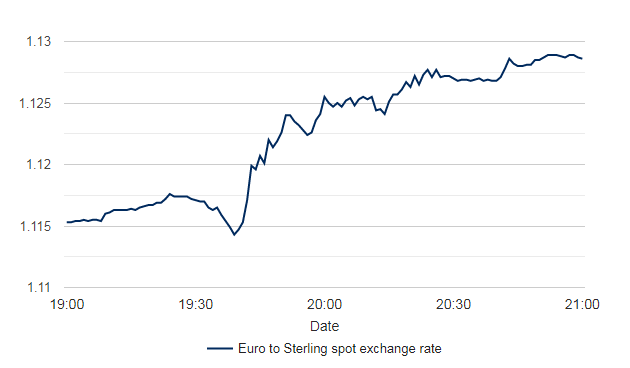

- Sterling rose in vote aftermath from €1.115 to €1.128; FTSE 100 fell more than 40 points in early trading

- In event of no deal, Schroders forecasts 2019 UK recession

- Market expectations that soft Brexit is now more likely seem premature

Azad Zangana, Senior European Economist & Strategist, says:

As had been widely expected, parliament has voted against the ratification of the UK’s Withdrawal Agreement with the European Union. Opposition to the agreement was overwhelming, with 432 members of parliament (MPs) voting against, versus 202 for. It is worth noting that 118 Conservative Party MPs voted against their own prime minister (PM), while only four opposition Labour Party members rebelled and backed the deal.

In reaction to the defeat, Prime Minister Theresa May offered parliamentary time to debate whether the government still enjoyed the support of the House of Commons. Labour Party leader Jeremy Corbyn promptly confirmed that his party has tabled a motion of no confidence to the house, and so the debate will commence today (Wednesday 16 January) followed by the vote of no confidence in the government at around 7pm this evening. Assuming MPs vote in line with their parties and the Democratic Unionists Party (DUP) of Northern Ireland backs its coalition partner (as it has suggested), then the government is highly likely to win the vote.

What next?

Assuming the government survives, Theresa May stated that the next step would be to consult cross-party MPs that opposed the deal, to see what changes would be necessary in order to secure their support. The government then plans to put those proposed changes to Brussels in the hope of augmenting the current Withdrawal Agreement.

In order for the EU to be willing to re-open the current agreement, the government must demonstrate that there is sufficient support for the proposed amendments to win a new vote in parliament. Given the multiple issues that parliament is divided on, it seems unlikely that the government can come up with a set of proposals that can change the minds of at least 116 MPs.

If the government persuades parliament to ratify the current or augmented agreement, then the UK will proceed to leave the EU on 29 March, and enter a transition period. During this period, the future relationship including trade, customs arrangements and regulatory alignment should be finalised.

UK recession likely if no deal is reached

In the absence of a deal being ratified, the UK will be leaving the EU without a transition period, and is likely to face significant trade tariffs in accordance with World Trade Organisation (WTO) rules, along with full customs checks, and a number of other important memberships/associations with EU institutions lapsing. Given the fragile state of the UK economy, we would then forecast a recession over 2019.

A delay to Brexit is possible. The UK could request a temporary delay (say three months), but this would require unanimous backing from the 27 EU member states. If the UK has not made progress in securing a majority for a deal, then the EU is unlikely to support a delay without a clear mechanism to break the deadlock in the UK’s parliament. This could come in the form of a second referendum or a general election. As European Parliamentary elections are due in May, the EU is keen not to have the UK’s membership spill over into the new term, unless the UK decides to remain permanently.

If the EU does not grant an extension to the Brexit deadline, then the UK could unilaterally revoke Article 50, only to restart the process again at a later point. This is unlikely and would certainly anger the EU and the public in the UK, especially as it would technically restarts the two-year negotiation process.

High chance of cliff-edge Brexit

In our view, the risk of a “no-deal” or “cliff-edge” Brexit is probably as high as it has ever been. At the same time, the need for a general election or a second referendum to break the deadlock in parliament seems more apparent than ever. Based on the last ten opinion polls of voting intentions, the Conservative Party looks set to retain its position as the single biggest minority party in a general election. However, the Conservatives are projected to lose seats and would therefore need both the DUP and the Liberal Democrats to form a coalition (assuming that both a coalition with Labour and the Scottish National Party is untenable). Moreover, it is worth remembering that opinion polls could shift during a campaign, and we doubt recent events will garner support for the government, even if Theresa May steps down and is replaced by another candidate.

The outlook if a second referendum is called is complicated by the many options possible for such a plebiscite. However, opinion polls that have offered three outcomes: “remain”, “deal” and “no deal” have consistently found that the support for Brexit is split between the latter two, leaving “remain” as the most supported option by a big margin.

Soft Brexit still seems unlikely

We believe that the possibility of a remain result following a second referendum and the prospect of a delay to Brexit have helped boost the pound in recent days against the US dollar and the euro. Markets seem to be pricing in a greater probability of a “soft Brexit”. However, we believe that investors are getting ahead of themselves.

The main uncertainty now is how the Labour party will react if they fail in their bid to trigger a general election. Will Corbyn work constructively with the government to end the deadlock, or will he continue to obstruct the process? The Labour Party’s six tests for Brexit focus on the future relationship, which are irrelevant at this stage of the negotiation. Though not the official position, many in the Labour Party including Shadow Brexit Secretary Keir Starmer and Deputy Leader Tom Watson believe that a second referendum should be the next option.

How sterling reacted during the UK parliament Brexit deal vote

Please remember that past performance is not a guide to future performance and may not be repeated.

Source: Schroders. Refinitiv data for Euro Sterling exhange rate between 1900 and 2100 GMT on 15 January 2018 correct as at 16 January 2018.

View from a fund manager

Remi Olu-Pitan, Multi-asset fund manager, says:

You would be forgiven for assuming that financial markets care little for Brexit and the UK political chaos this morning with Asian markets little changed and sterling recovering strongly from yesterday’s close.

This indicates that the defeat came as no surprise and the market expects that the motion of a no confidence vote will fail. The market has moved on to Plan B assigning a much lower probability to a "no deal" outcome. While the plethora of options will keep the pound and UK assets vulnerable to headline risk in both directions, the pound and UK assets are already reflecting a significant Brexit premium.

The immediate reaction by EU member states is critical, support for the PM and scope for concessions and a potential extension of A50 will be supportive for the pound and UK assets

Beyond the near-term volatility, the outlook for UK’s trade relations with the EU remains unclear, this will do nothing to alleviate the risk premium embedded in UK assets.

Important Information: This communication is marketing material. The views and opinions contained herein are those of the author(s) on this page, and may not necessarily represent views expressed or reflected in other Schroders communications, strategies or funds. This material is intended to be for information purposes only and is not intended as promotional material in any respect. The material is not intended as an offer or solicitation for the purchase or sale of any financial instrument. It is not intended to provide and should not be relied on for accounting, legal or tax advice, or investment recommendations. Reliance should not be placed on the views and information in this document when taking individual investment and/or strategic decisions. Past performance is not a reliable indicator of future results. The value of an investment can go down as well as up and is not guaranteed. All investments involve risks including the risk of possible loss of principal. Information herein is believed to be reliable but Schroders does not warrant its completeness or accuracy. Some information quoted was obtained from external sources we consider to be reliable. No responsibility can be accepted for errors of fact obtained from third parties, and this data may change with market conditions. This does not exclude any duty or liability that Schroders has to its customers under any regulatory system. Regions/ sectors shown for illustrative purposes only and should not be viewed as a recommendation to buy/sell. The opinions in this material include some forecasted views. We believe we are basing our expectations and beliefs on reasonable assumptions within the bounds of what we currently know. However, there is no guarantee than any forecasts or opinions will be realised. These views and opinions may change. To the extent that you are in North America, this content is issued by Schroder Investment Management North America Inc., an indirect wholly owned subsidiary of Schroders plc and SEC registered adviser providing asset management products and services to clients in the US and Canada. For all other users, this content is issued by Schroder Investment Management Limited, 1 London Wall Place, London EC2Y 5AU. Registered No. 1893220 England. Authorised and regulated by the Financial Conduct Authority.