Workers’ real pay erodes at historic pace despite huge wage rises

Workers’ pay is still being eroded at a historic pace by rampant inflation despite employers hiking wages by one of the greatest amounts since records began, official figures revealed today.

When taking off the Office for National Statistics’ (ONS) preferred measure of inflation, pay excluding bonuses dropped 2.7 per cent over the last three months, one of the biggest falls since the organisaiton started tracking the data in 2001.

The sharp fall came despite employers hiking pay 5.7 per cent over the three months to September, the biggest rise outside of the Covid-19 crisis, which muddied the numbers.

The new figures underscore how badly households are being squeezed by rising prices. On some measures, wages have now trailed inflation for 11 months.

Economists and the Bank of England have predicted the UK economy is on course to plunge into the longest recession on record, at two years, driven by consumers and businesses cutting spending in response to high inflation.

The Bank reckons the economy could contract nearly three per cent over the course of the slump, but only if interest rates top five per cent.

They are currently three per cent after eight successive rises to tame rising inflation, which is running at a 40 year high of 10.1 per cent.

The Bank has been lifting interest rates to curb future price rises caused by workers demanding pay rises to protect their spending power and businesses hiking prices to maintain margins.

Analysts cast doubt over whether such an inflationary spiral is building in the UK economy.

Martin Beck, chief economic advisor to the EY Item Club, said: “Workers’ bargaining power… still looks a long way from being able to generate a sustainable wage-price spiral. The odds of that happening are also expected to recede as the weak economy cuts demand for workers.”

But, others highlighted the 6.6 per cent pay growth in the private sector risks keeping inflation above the Bank’s two per cent target.

Thomas Pugh, economist at RSM UK, said wage expansion needs to hover around three per cent to ensure Threadneedle Street hits its target.

Chancellor Jeremy Hunt, who on Thursday is likely to announce £55bn of spending cuts and tax hikes, said curbing inflation is his “absolute priority”. Tightening fiscal policy will help ease inflation by cooling demand, but will likely worsen a recession.

New cost of living figures out tomorrow are expected to climb to around 11 per cent.

Joblessness fell over the last quarter, but mainly driven by workers pouring out of the labour market altogether, likely fuelled by long-term sickness caused by Covid-19 and people retiring early.

The unemployment rate fell to 3.6 per cent, down from 3.8 per cent. But, the number of people without a job and not looking for one climbed over 100,000 over the same period.

The ONS does not include economically inactive people in its unemployment estimate, meaning when more people stop looking for a job, it can push down the jobless rate.

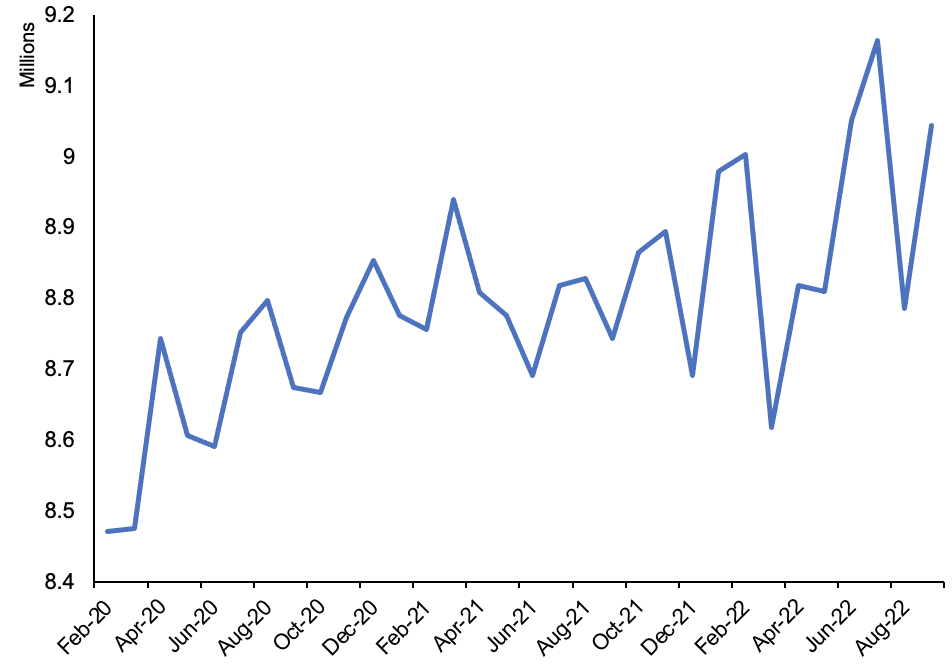

Economic inactivity has soared since the start of the pandemic

Unemployment has held low despite the economy wilting under the weight of high inflation, worker shortages and rising borrowing costs.

However, the ONS’s figures showed vacancies dropped over the last quarter, indicating employers are bracing for the coming recession by mothballing hiring.