UK inflation scales to 41-year high, but analysts bet it has peaked at 11.1 per cent

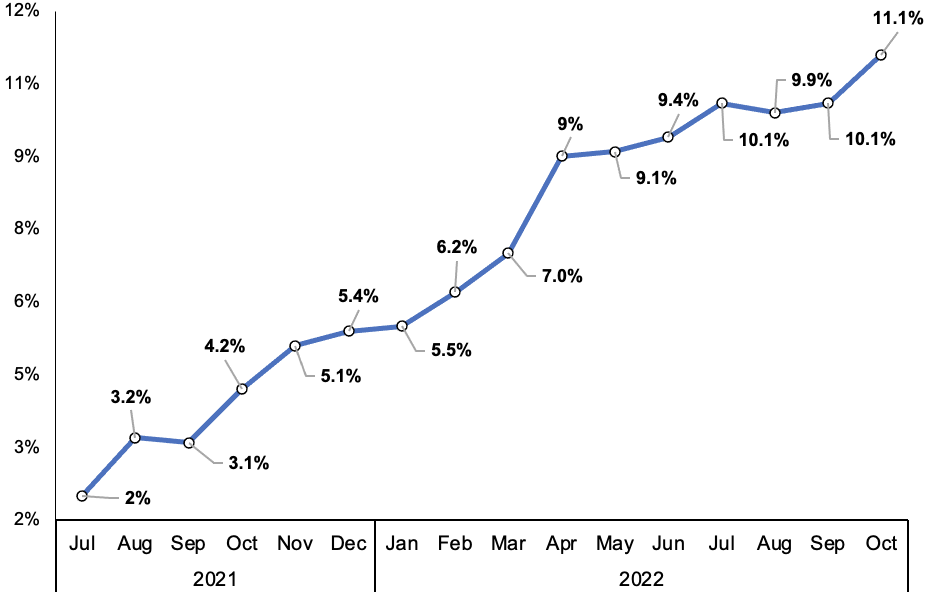

UK inflation has surged above the City and Bank of England’s expectations to reach a new 41 year high, but experts said it may now have peaked, official figures revealed today.

Prices rose 11.1 per cent over the last year, pushing the rate a whole percentage point higher from September, according to the Office for National Statistics (ONS).

The reading topped the Bank and analysts’ expectations of 10.7 per cent.

London’s FTSE 100 jumped 0.2 per cent on the news, while the pound strengthened 0.24 per cent against the US dollar.

The shock rise marks another upward junction in this year’s inflation surge, which was initially driven by a sudden burst in global spending after Covid-19 restrictions but is now being fuelled by higher energy bills sparked by Russia’s invasion of Ukraine.

Inflation has skyrocketed this year…

Energy bills rose to £2,500 in October, while food prices climbed 14.8 per cent, the fastest acceleration since September 1977.

Last January, prices rose 5.5 per cent and inflation has not hit the Bank’s two per cent target since July 2021.

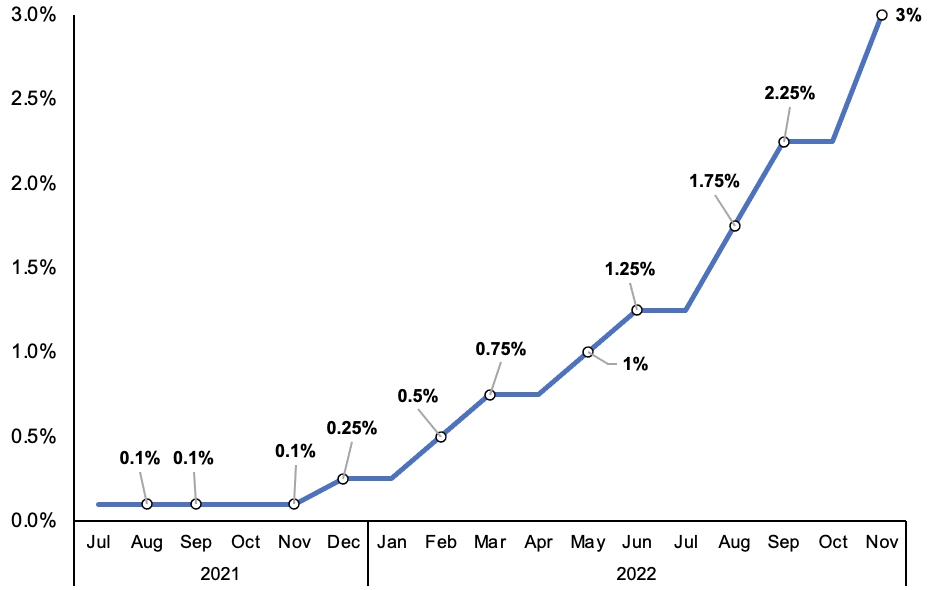

That sustained burst has led Bank governor Andrew Bailey and the rest of the monetary policy committee (MPC) to raise interest rates eight times in a row to three per cent, including the biggest hike in 33 years earlier this month at 75 basis points.

At that MPC meeting, the Bank warned Britain is on course to tumble into the longest recession on record at two years if rates top five per cent. The Bank has signalled it will not do this.

Bailey today defended the Bank’s record at taming inflation at a grilling by the treasury select committee, explaining the central bank could not have prepared for a “sequence” of shocks – the pandemic and Russia’s invasion of Ukraine – that have made the UK poorer.

Inflation is approaching six times the Bank’s target.

The City reckons the Bank will slow its rate hike cycle at its next meeting on 15 December to 50 basis points.

But, there were signs in today’s ONS figures that its tightening campaign has yet to tame the stickiest price rises.

“The real bad news in this report, however, is that the pace of core price rises hasn’t eased yet, despite the recent softening in consumer demand,” Samuel Tombs, chief UK economist at Pantheon Macroeconomics, said.

Core inflation rose to 0.7 per cent over the last month, 0.5 points above its historic trend, Tombs said. Core inflation is a measure of underlying price pressures in the UK economy and is the Bank of England’s preferred measure of inflation.

The looming recession is likely to be steered by consumers and businesses slashing spending in response to their finances being squeezed by higher prices, which should push inflation lower.

“The recession and period of austerity will reduce demand and should feed through into lower core-inflation over the next year,” Thomas Pugh, economist at RSM UK, said.

Chancellor Jeremy Hunt tomorrow is expected to raise taxes and cut government spending by around £55bn to balance the UK’s finances. The moves will heap more pressure on household and company balance sheets, but should ease price rises.

… prompting the Bank of England to raise interest rates steeply

“It is our duty to help the Bank of England in their mission to return inflation to target by acting responsibly with the nation’s finances. That requires some tough but necessary decisions on tax and spending to help balance the books,” he said.

Economists said October’s 11.1 per cent reading is likely inflation’s peak, but said its trajectory is wholly dependent on how the government shapes the energy bill cap going forward.

Currently, typical annual household bills are pegged at £2,500. There are rumours Hunt tomorrow could raise that level to £3,000 from April, sparking a sudden inflation jump that month.

Strong upward wage pressure fuelled by around 900,000 workers leaving the jobs market since the start of the pandemic has also led prices higher.

“Due to the tight labour market and the high price/wage expectations of households and businesses, we think it will be at least a few months before UK core inflation,” Paul Dales, chief UK economist at Capital Economics, said.

The retail price index, an old measure of inflation but is still used to uprate payments on some government debt, climbed to 14.2 per cent from 12.6 per cent.

If that upward trend continues, the UK’s debt servicing bill will likely stay above £100bn each over the Office for Budget Responsibility’s forecasts, published after the chancellor’s statement tomorrow.

Inflation has ripped through the global economy this year, driven by a combination of international energy markets being jolting by the Russia-Ukraine war, rising commodity prices after the pandemic and higher wages.

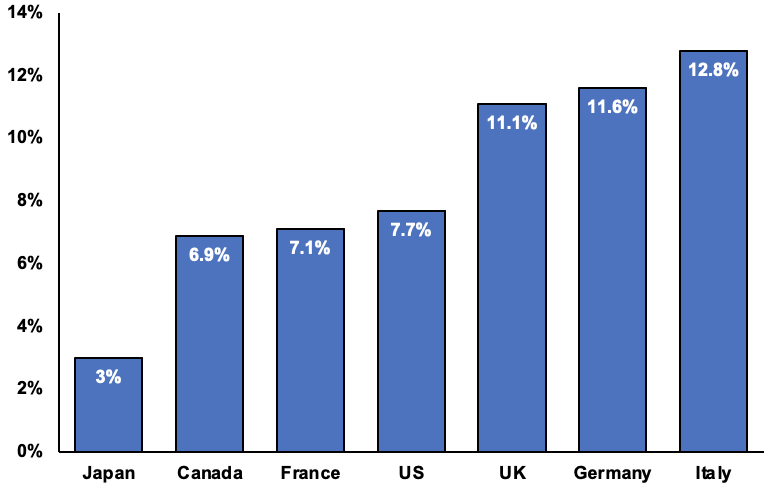

Germany and Italy have higher inflation rates than the UK.

UK has third highest inflation rate in G7