BP’s profits bonanza reignites windfall tax debate with energy bills set for painful spike this winter

BP unveiled bumper profits powered by soaring oil and gas prices yesterday, as households brace for painfully high energy bills this winter.

The energy giant revealed near-record earnings of $8.5bn (£6.95bn) for the second quarter this year, its strongest three-month performance in 14 years.

It is now offering $3.5bn in share buybacks to investors.

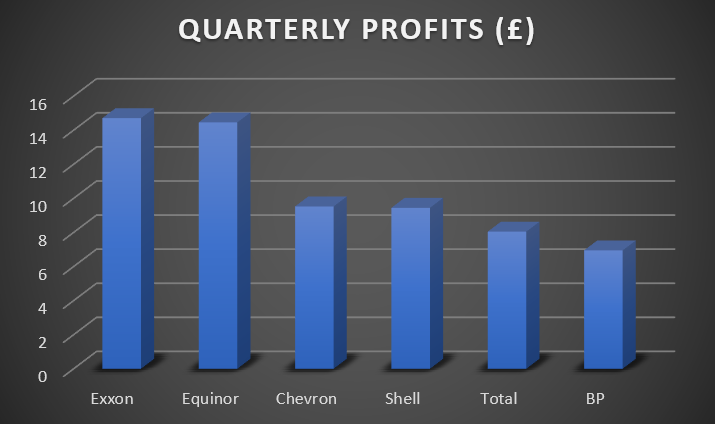

The huge headline earnings follow in the footsteps of its rivals, with Shell and Equinor also reporting huge profits, while Chevron and ExxonMobil also thrived Stateside.

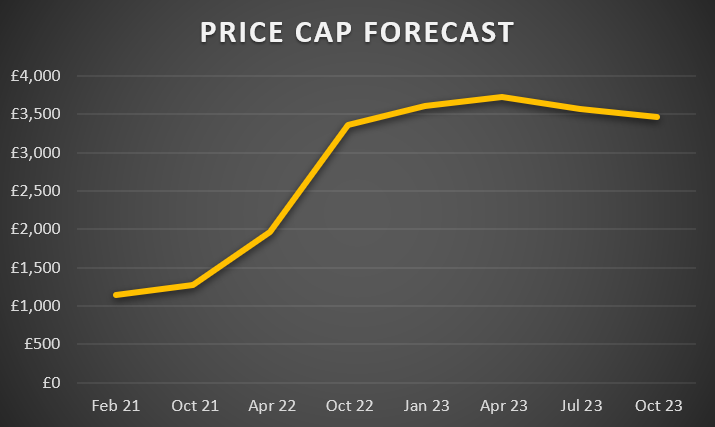

This comes as energy specialist Cornwall Insight revealed forecasts that the consumer price cap – which establishes the average price for energy bills – could close in on £3,500 per year this winter, and peak at £3,729 next Spring.

Prices are expected to remain elevated into 2024 – putting sustained pressure on households.

BP’s profits have infuriated the Labour Party’s, which has called for investment relief within the windfall tax to be scrapped.

Shadow Chancellor Rachel Reeves said: “People are worried sick about energy prices rising again in the autumn, but yet again we see eye-watering profits for oil and gas producers.”

Meanwhile, climate charity Ashden slammed BP’s huge haul as “unsound, unethical and economically disastrous for the country as a whole.”

The Energy Profits Levy, which will help fund a £15bn support package for households this winter, includes 91 per cent tax breaks for companies that invest in domestic projects.

Leading industry body Offshore Energies UK has argued continued investment in the North Sea is vital for ramping up supplies and taming bills.

It said: “Our view is that if the UK wants to protect itself against similar future crises, then it must maintain those offshore resources – and that needs investment.

Jacob Rees-Mogg, the Government’s Brexit opportunities minister, told LBC he was not in favour of windfall taxes.

He said: “The energy industry is enormously cyclical. You need to have a profitable oil sector so it can invest in extracting energy.”

Chief executive Bernard Looney argued BP was “backing Britain” by investing £18bn in the country this decade, to boost generation and drive down bills.

Looney said: “In terms of cost of living we all have to recognise that it’s a very, very difficult place for people, not just, by the way, in the UK but across the world right now.”

In the first six months of the year, BP has invested just $361m in low carbon projects worldwide.