BP’s profit slump points to falling gas prices, but does not explain sluggish shares

BP missed analyst expectations in its third-quarter earnings, with a 60 per cent year-on-year decline in profits for the three months to October, blaming the underwhelming performance on poor gas trading.

European inventories are well-stocked ahead of winter, slashing the earnings of commodities traders and making fossil fuel trading less lucrative.

This has fuelled underwhelming trading across the industry, and BP ‘s downturn in earnings follows sharp third-quarter declines posted over the past week from rivals including Chevron, Equinor, Exxon, and Total.

Although the energy giant has benefitted from rallying oil prices in recent months, there is no doubt commodity markets have calmed since last year’s bumper rallies fuelled by Russia’s invasion of Ukraine.

Gas prices have tumbled this year, sliding from last summer’s all time high of nearly £8 per therm to £1.38 per therm in this morning’s trading.

Gas prices have tumbled this year – eating into the hefty profits of commodity traders

BP has sought to placate investors, assuring them its focus is in strengthening shareholder value. as it pushes to become an “integrated energy company,” with oil and gas trading sustained alongside investment in electric vehicles, hydrogen, and wind power.

It has announced a fresh £1.2bn shareholder buyback scheme, and estimates from Global Witness suggest it has paid out dividends of £6.5bn since January 2022, and repurchased shares worth £13.6bn – a more than £20bn handout to investors.

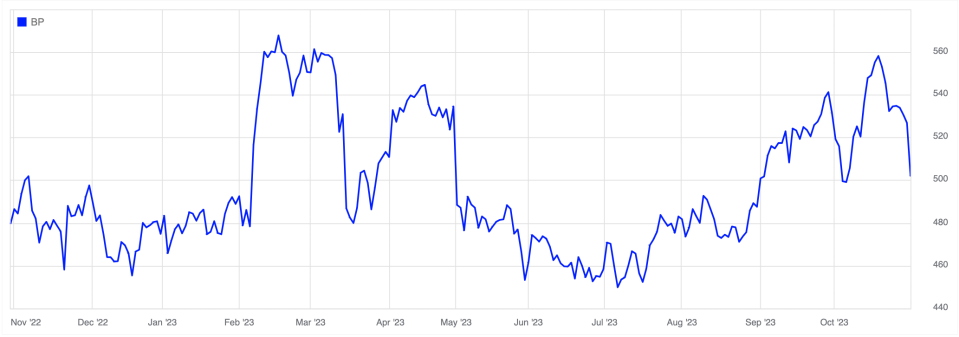

Despite these moves, the company’s share price has not benefitted from such handouts.

Following today’s results, the BP’s shares slid as much as 5.2 per cent in morning trade at 499.7p per share on the FTSE 100.

For context, rival Shell trades at 2,667p per share on the same index.

Investors took money off the table as the firm failed to perform in line with expectations — with its £2.7bn third quarter earnings below estimates from London Stock Exchange Group analysts of £3.4bn over the three months of trading.

Today’s tumble bolsters existing questions questions over why its share price is so low compared to its rivals.

Third quarter profits have tumbled year-on-year across major oil and gas giants

Shareholders wary of BP’s green push

There is no doubt BP has suffered from instability at the top, following former chief executive Bernard Looney’s dramatic departure in September, but the reality remains that the company’s share price performance has been sluggish for a long time.

During Looney’s three-and-a-half year stint at the helm, shares in BP rose just seven per cent — compared with a 25 per cent climb for Shell, a 51 per cent spike for Chevron, and a 87 per cent gain for Exxon, according to calculations from the Wall Street Journal.

Michael Hewson, chief market analyst at CMC Markets argued that alongside boardroom uncertainty, investors are wary over its transition plans, with BP adopting a more aggressive approach to the energy transition compared to its competitors.

“That’s down to management and it rather begs the question as to whether any new chief executive will persevere with the ‘Performing while Transforming’ of Bernard Looney, because while it is clear that BP is transforming, it certainly isn’t performing, with the shares sharply lower, after missing on third quarter profits in its numbers released today,” he said.

BP’s share price has endured a rocky journey on the London Stock Exchange this year

Under new boss Wael Sawan, Shell has backed oil and gas for decades to come while also slashing its short-term oil and gas reduction pledges – with the chief executive describing radical reductions as “dangerous and irresponsible.”

This has seemingly reassured investors that these oil and gas producers are still committed to their primary operations.

While BP has hardly been a green champion, its rhetoric has spooked investors compared to the bullish stances of its contenders towards oil and gas.

In one of his final interviews at the helm, Looney confirmed there would be no further rolling back of climate pledges and that BP would “hold its nerve” over renewables.

While politicians and environment campaigners slam energy giants for not transitioning to net zero fast enough, and for raking in heavy profits from commodity rallies, shareholders are seemingly much less receptive to the plans of oil and gas giants to go green.

At the same time, it has not managed to win over clean tech investors put off by its continued fossil fuel trading, creating a painful situation where it is caught between two stalls.

If it wants to give its shares a boost in line with the industry, it will have to do more to prove it can keep up with its peers.