BP’s profit bonanza reignites calls for tougher windfall tax

BP has unveiled another bumper round of monster profits powered by soaring gas prices, reigniting calls for the windfall tax to be toughened up on North Sea fossil fuel producers.

The British energy giant is the latest firm to revel in Big Oil’s profits bonanza this year, raking in £7.1bn ($8.2bn) in underlying earnings in its third quarter this year between July and September.

Overall, BP’s global profits for the first nine months have jumped to $22.8bn from $8.7bn in the previous year.

This has been driven by historically elevated oil prices – which remain above $90 per barrel despite a recent slide – and record gas prices amid growing concerns of supply shortages following a Russian squeeze on European gas flows.

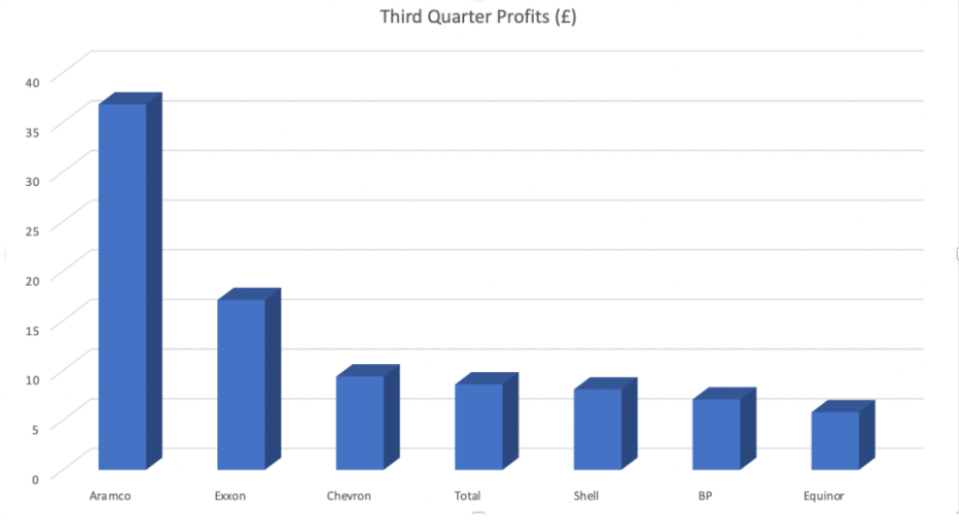

Its latest hefty takings follow in the footsteps of rivals Chevron, Equinor, Exxon, Total and Shell, which have also announced mega profits over the past week.

Leading the pack is Saudi Aramco which has revealed eye-watering profits of £36.8bn ($42.4bn) today – one of the biggest quarterly-trading performances in business history.

Labour pushes Government to strengthen levy

Labour has urged the Government to strengthen the Energy Profits Levy by removing the investment relief and backdating it to January – even though it was announced by the Government in May.

Shadow Climate Change and Net Zero Secretary Ed Miliband argued Tory Prime Minister Rishi Sunak “should be hanging his head in shame that he has left billions of windfall profits in the pockets of oil and gas companies, while the British people face a cost-of-living crisis”.

Meanwhile, industry body Offshore Energies UK (OEUK) has written a letter to the Chancellor seeking an urgent meeting.

It has warned ongoing uncertainty is “driving investment out of the UK” and is also “encouraging some companies to exit the basin.”

Chief executive Deirdre Michie said: “Companies are unable to plan future long-term investments under such uncertain conditions and shareholders, particularly in overseas headquartered companies see an increasing risk premium regarding the future of their operations in the UK.

“There is clear evidence that fiscal stability drives investment into the North Sea and fiscal uncertainty drives investment away from it.”

The Treasury refused to comment on the possibility of expanding the windfall tax, but City A.M. understands no options are off the table.

A spokesperson said: “The Energy Profits Levy – which comes on top of an existing 40 per cent headline rate of tax for the industry – is expected to raise £17bn this year and next to help fund cost of living support for eight million people.

“We also want to see the sector reinvest its profits to support the economy, jobs, and our energy security, which is why the more investment a firm makes into the UK, the less tax they will pay.”

The Government’s projects, published in September’s Growth plan, indicate the levy is expected to raise over £7bn in 2022/23 and around £10bn in 2023/24 based on forecast oil and gas prices.

This is expected contribute to funding for support packages for households and businesses facing record energy bills.

BP expects to pay $800m in windfall taxes this year out of its expected $2.5bn tax outlay in the UK.

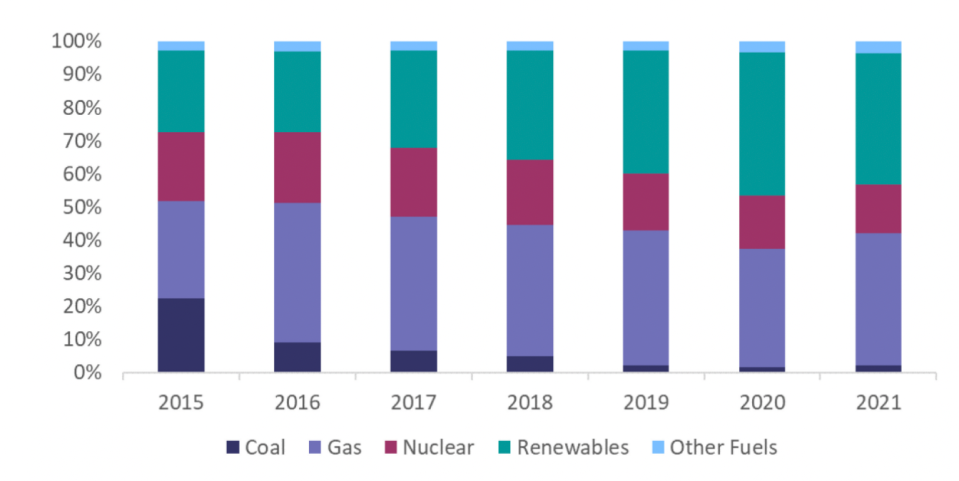

It has also committed to spend £18bn in low and zero carbon energy projects domestically over the current decade.

Think tanks warn against expanding windfall tax

Downing Street is scrambling to raise revenues as its grapples multiple crises, including a ticking clock on record energy bills with the household support packages set to expire in April and a chunky fiscal black hole.

Chancellor Jeremy Hunt is reportedly considering expanding the windfall tax to 2028 and raising the rate of additional taxation from 25 to 30 per cent, according to The Times.

This would be on top of the special 40 per cent corporation tax rate North sea oil and gas operators already pay.

Currently, it makes around 15 per cent of its profits in the UK.

Free market think tanks have raised concerns over expanding the levy, fearing it could deter investment in the UK.

Julian Jessop, fellow at the Institute of Economic Affairs, recognised there are “no good options” if the Government has to press ahead with tax hikes, and that bolstering the windfall tax could be the “least damaging” on the economy in the short term.

However, he argued “haphazard increases in arbitrary windfall taxes will add to the general climate of business uncertainty” and could “deter investment in a crucial sector of the economy.”

Daniel Pryor, head of research at the Adam Smith Institute, said: “A properly designed windfall tax shouldn’t change business behaviour or investment decisions. But calls to expand the scope of the energy profits levy risk undermining its credibility—creating greater uncertainty and lower investment when energy security is a key concern.”