BP weathers storm havoc

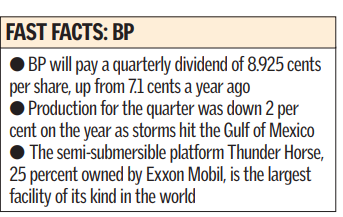

Oil giant BP’s third-quarter rise in underlying profit was largely unaffected by summer hurricane damage in America, leaping 27.5 per cent, the company revealed yesterday.

The company’s underlying profit, driven by high barrel prices and strong refining margins, rose to $5.33bn (£2.98bn).

The company said it owed its strong underlying performance to “high but volatile” oil and gas prices.

Chief executive Lord Browne said: “In recent weeks the temporary loss of Gulf Coast refining capacity and signs of weaker consumption have caused crude prices to drift downward.”

But he added: “Nonetheless, prices are expected to be well supported into the winter.”

In comparison to its profits hurricane damage costs were minimal.

The cost of repairing its Thunder Horse platform, which was left listing after Hurricane Dennis in July, was £107m. Production on the Gulf of Mexico rig is unlikely to restart before the second half of 2006.

BP’s underlying profit strips out $921m of one-off items, but most of this relates to an accounting write down related to the recent sale of BP’s petrochemical unit Innovene.

Keith Morris, an analyst at Evolution Securities, said: “The only thing BP has to worry about at the moment is if demand from China dies down, or if Chancellor Gordon Brown decides to impose higher taxes on it in his November budget.”

BP said that crude oil prices averaged $61.63 a barrel over the last three months, which is $10 more than in the second quarter, and $20 more than the third quarter last year. During the last quarter crude oil reached an all-time high of $70.85.

Lord Browne said oil capacity was now “adequate”, but added that a particularly cold winter would put pressure on stocks.