BP scales back climate ambitions as outcry over £23bn earnings ignites call for tougher windfall tax

BP has scaled back its climate ambitions, easing plans to slash the amount of oil and gas it produces over the current decade to meet global demand.

The energy giant had previously promised its emissions would be 35-40 per cent lower by the end of this decade.

It is now targeting a 20-30 per cent cut, and plans a greater production of oil and gas over the next seven years compared with previous targets.

This is a definitive pivot in policy from BP, which was one of the first fossil fuel producers to commit to net zero carbon emissions by 2050.

The company has also increased its payout to shareholders by 10 per cent – spending a further £2.3bn ($2.75bn) buying back its own shares.

In total, BP handed back more than £11.7bn ($14bn) to shareholders in 2022 – £3.7bn ($4.4bn) in dividends and £8.4bn ($10bn) in share buybacks.

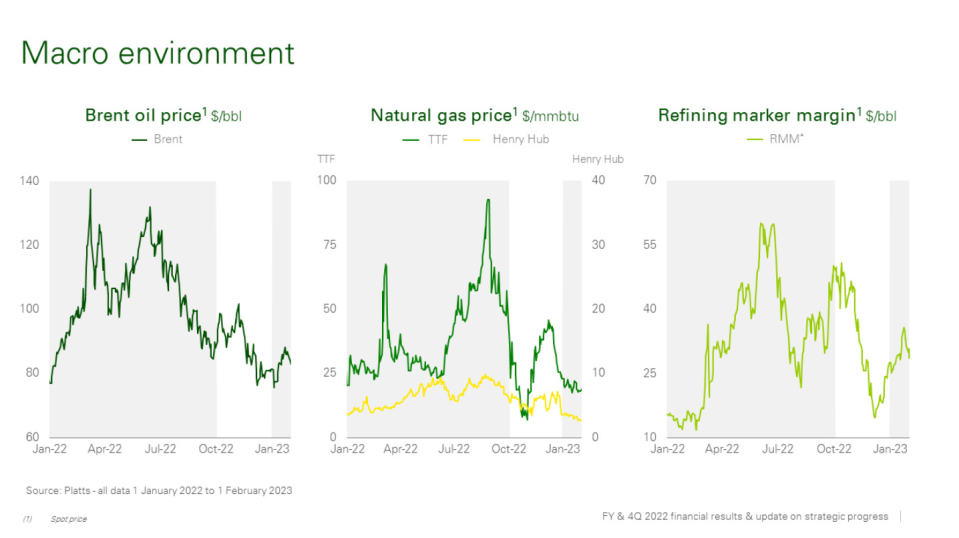

This follows a historic year of trading for the energy giant, which announced record profits powered by soaring oil and gas prices following the pandemic and Russia’s invasion of Ukraine.

BP’s earnings for the full year than doubled to £23bn ($27.7bn) in 2022 in line with record gas prices and 14-year peaks in the cost of oil.

This is more than double last year’s takings of £10.6bn ($12.8bn), in line with resurgent earnings across the energy industry.

The fossil fuel titan’s bumper profits were powered by another quarter of booming trading, with BP capping off the year with a three-month earnings window of just under £9bn ($10.8bn)

Shares in the company were up 5.7 per cent in early afternoon trading on the FTSE 100 following the results, trading at 505p per share.

It follows Shell’s bumper £32.2bn ($39.9bn) profits for the full-year, alongside massive earnings reported by energy giants operating Stateside such as Chevron and Exxon Mobil.

Total and Equinor are expected to unveil their own results tomorrow, with Aramco scheduled for next month.

Labour: Scrap investment relief from EPL

The latest wave in mega earnings has triggered familiar calls for the windfall tax to be toughened up with Labour calling for the investment relief to be ditched from the Energy Profits Levy (EPL).

Ed Miliband, Labour’s Shadow Climate Change and Net Zero Secretary, said: “It’s yet another day of enormous profits at an energy giant, the windfalls of war, coming directly out of the pockets of the British people. What is so outrageous is that as fossil fuel companies rake in these enormous sums, [the Prime minister] Rishi Sunak still refuses to bring in a proper windfall tax that would make them pay their fair share.”

Last November, Jeremy Hunt hiked the EPL from 25 to 35 per cent – which has been imposed on North Sea oil and gas profits to harness record profits for support packages to ease energy bills for households and businesses.

This was on top of the special 40 per cent corporation tax the fossil fuel industry already pay.

However, the EPL also included a 91p in the pound relief rate companies investing domestically in the UK.

Labour has labelled this a “fossil fuel investment loophole” and forecasts £13bn in takings from scrapping the relief scheme, and backdating the tax from the start of 2022.

Industry trade group Offshore Energies UK opposed calls for a toughened windfall tax, arguing that it was wrong to offer false resolutions to consumers.

Mike Tholen, OEUK’s director of sustainability, said: “These calls for an increase in the UK windfall tax, linked to the global profits of energy producers, are deliberately misleading. The UK is subject to global tax agreements which say that it cannot tax profits made by companies outside of the country. That means such a tax could never be implemented. It is irresponsible to pretend otherwise.”

He noted that the windfall tax was already having an effect on the industry with Harbour Energy recently pulling out of the licensing round for further projects while Total has pulled out of £100m investment plans in North Sea.

These calls for an increase in the UK windfall tax, linked to the global profits of energy producers, are deliberately misleading

Mike Tholen, OEUK’s director of sutstainability

Meanwhile, Shell is rowing back its pledge to spend £25bn in the UK over the current decade, and will now assess projects on a “case by case basis.”

As it stands, BP’s UK operations accounts for less than 10 per cent of its global profits.

It is expected pay around cough up £880m ($1.06bn) towards the Energy Profits Levy in the fourth quarter and £1.52bn for the full year ($1.83bn).

BP has committed £18bn in UK investments over the current decade, including 75 per cent in low and zero carbon.