BP follows in rivals’ footsteps with near-record £7bn quarterly profits

BP has unveiled monster profits of $8.5bn (£6.95bn) for the second quarter of this year, powered by soaring oil and gas prices following Russia’s invasion of Ukraine.

This is the energy giant’s highest quarterly profits in 14-years, and is a huge boost on the $6.2bn (£5.07bn) underlying earnings reported for the first three months of trading this year.

Operating cash flow spiked to $10.9bn – despite $1.2bn of Gulf of Mexico oil spill payments – while net debt has been slashed to $22.8bn.

This is the ninth successive quarter net debt has fallen at the company.

The energy giant has now hiked its dividends 10 per cent to just over six cents per share, offering $3.5bn in share buybacks ahead of the third quarter results later this year.

During the second quarter BP executed share buybacks of $2.3bn, and the $2.5bn programme announced with the first-quarter 2022 results was completed on 22 July.

Earlier this year, BP had to write off a post-tax charge of $24.4bn following its decision to exit its 19.75 per cents shareholding in Rosneft and its other businesses operations in Russia.

However, its latest results are free of such heavy write-downs.

Shareholders rewarded vast dividends as households brace for record energy bills this winter

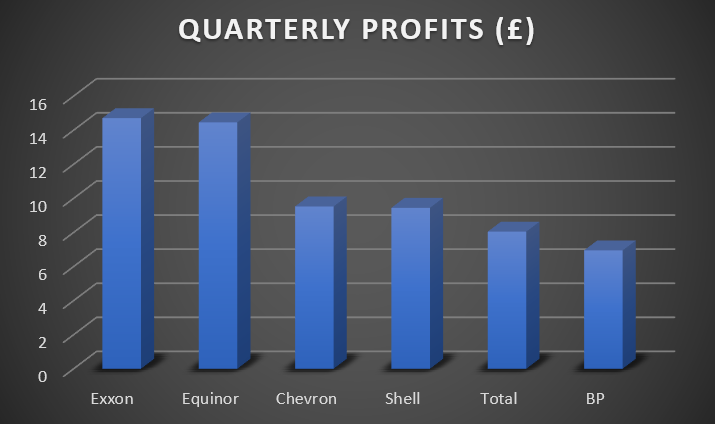

The huge headline earnings follow in the footsteps of peak quarterly profits across the energy sector this month.

Rivals including Shell and Equinor reported huge earnings, while Chevron and ExxonMobil also thrived Stateside.

The heavy profits have been boosted by oil and gas prices.

Both commodities have seen prices spike amid severe supply shortages, driven by booming post-pandemic demand and disruption to gas and oil supplies following Russia’s invasion of Ukraine.

While this is putting immense pressure on households and exacerbating a cost of living crisis, it is allowing energy firms to rake in historic earnings.

Looking ahead, BP expects to have capacity for an annual increase in the dividend per ordinary share of around four per cent through 2025 at around $60 per barrel Brent Crude.

The benchmark is currently trading at just under $100 per barrel.

For 2022, BP remains committed to using 60 per cent of surplus cash flow for share buybacks and intends to allocate the remaining 40 per cent to further strengthen the balance sheet.

It has also committed to spending £18bn on domestic energy generation projects across the UK over the current decade.

This will boost the UK’s supply security over the coming years, as it looks to reduce its reliance on unreliable overseas partners.

However, it has only spent $361m on low carbon energy in the first half of 2022

BP’s operations in the North Sea are within the crosshairs of the Energy Profits Levy, announced earlier this year.

The energy giant estimates the additional 25 per cent tax on profits will cost $800m between now and the sunset clause on 31 December 2025.

As the legislation was enacted after June 2022, this charge will be presented within adjusting items in the third quarter.

Chief executive Bernard Looney said: “Today’s results show that bp continues to perform while transforming. Our people have continued to work hard throughout the quarter, helping to solve the energy trilemma – secure, affordable and lower carbon energy. We do this by providing the oil and gas the world needs today – while, at the same time, investing to accelerate the energy transition.”

BP trades on the London Stock Exchange as a FTSE 100 company.