Box-fresh? Sandboxes go global

What image does the word ‘sandbox’ conjure up for you? For most people, the answer is likely to be kindergartens, buckets and sandcastles. But for financial services innovators, sandboxes have a different meaning – and, for some projects, pivotal importance.

For organisations looking to launch a product that needs a regulatory licence, a sandbox is a test-space for the company itself (frequently start-ups), and the regulator, to learn how it works – normally for several months – with appropriate safeguards in place.

The UK’s Financial Conduct Authority (FCA) is widely seen as a global sandbox pioneer, having launched a regulatory sandbox in 2016.

The FCA is now in the throes of launching a new sandbox – a digital sandbox, which aims to support earlier-stage innovation and is being run with the City of London Corporation. Separately in the UK, the Information Commissioner’s Office (ICO) has established a sandbox to support organisations creating products and services that use personal data.

‘Key role in helping innovation’

The FCA’s regulatory sandbox has so far accepted six cohorts of projects. The first cohort attracted 69 applications, with 24 accepted; the second saw 77 applications, with 24 accepted (and so on). In total, by City AM’s count, the first six cohorts had 443 applications, with 146 accepted. Applications for the seventh close in a couple of months (31 December).

The FCA has moved towards encouraging propositions on specific topics: for example, cohort six’s focus was on areas such as financial inclusion and responding to climate change; for cohort seven the focus includes propositions aimed at tackling fraud and helping small- and medium-sized enterprises with access to finance.

A 70-page report published this week by the Association for Financial Markets in Europe (AFME) flags the role that sandboxes have played in supporting UK fintech growth.

“Interventions such as the FCA sandbox have played a key role in helping fintech innovation, enabling not just product innovation, but also encouraging close engagement between fintechs and financial institutions,” says Victoria Roberts of Tech Nation. “The next challenge is to refine how best regulators and the wider tech ecosystem can continue to support these high potential firms to scale.”

Establishing ‘collaborative environment’

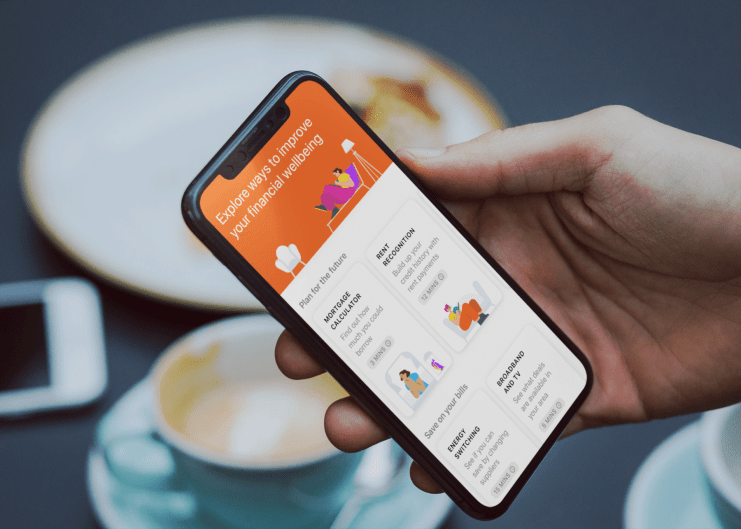

One company that has passed through the FCA sandbox – twice, in fact – is London-based Bud, which launched five years ago. The fintech was in the first cohort testing its own app and in the third alongside First Direct testing an app called ‘artha’.

“I think sandboxes’ utility comes from giving innovators a chance to show how their innovations align with the spirit of the regulations and, for the regulators, in seeing the regulations applied to use-cases that hadn’t been conceived when they were drafted – it sets up that collaborative environment,” Bud’s founder and chief executive Ed Maslaveckas tells City AM.

“In our case, we were talking about using artificial intelligence to identify potentially suitable financial products for people. So obviously there were huge questions to explore around culpability. We wouldn’t have been able to bring that model to market anywhere near as quickly without that close conversation with the regulators,” he says.

Jamie Campbell, former commercial lead at Bud, jokes that he is “probably Britain’s most ‘sandbox-ed’ person’”. He experienced the FCA’s sandbox twice with Bud and is now part of the sandbox’s sixth cohort with Fronted, a start-up with a fintech product designed to help renters finance deposits.

Fronted was accepted into cohort six in February and expects to start its sandbox test shortly. “Sandboxes are very important for the regulator, investors and customers. At Fronted we want to use the sandbox to prove that banking data can be used to determine affordability for our deposit loans,” Campbell says.

‘Technology changes industries rapidly’

The UK’s sandbox experience has resonated internationally – and been highlighted as worth increased overseas promotion amid the grimness of the pandemic’s economic impact and the uncertainty over the Brexit negotiations’ end-game.

‘London Recharged: Our Vision for London in 2025’, a 35-page Corporation of London report published earlier this month, suggests a campaign highlighting the FCA’s sandbox(es) to enable non-UK businesses understand how they can gain access to the capital’s market and consumers.

An increasing number of sandboxes have been created in overseas financial hotspots – from Abu Dhabi to Hong Kong. One established and well-regarded example is the Monetary Authority of Singapore (MAS)’s sandbox, which launched in 2016 – the same year as the FCA’s – and was last year joined by MAS’s ‘Sandbox Express’.

“There’s a reason why the UK is one of only a few countries seen as a good place to launch a financial services-based firm, and that’s down to initiatives such as the FCA’s sandbox,” says Fronted’s Campbell. “Technology changes industries rapidly and countries such as the UK and Singapore have realised that in order to keep up with those changes – and the impact on customers – there needs to be a safe space to test and learn.”

Thinking – and testing – internationally

Campbell’s sentiment is echoed by Iana Vidal, head of policy and government affairs at Innovate Finance. “The UK is a leader in this field but can also learn from what other countries like Singapore are doing with their sandbox programme,” she says.

Looking ahead she sees the new UK digital sandbox as welcome progress. “The regulators have been developing new approaches recently and the launch of the FCA’s digital sandbox is exciting: one of the key features is access to synthetic or ‘fake’ data, which will allow firms to really understand how new products could operate in the market,” she says.

Vidal also emphasises the growing importance of thinking across borders. “It’s important for the regulators to consider testing for the international inter-operability of these solutions and other services, which has better benefits for the customer, and the potential to scale these products globally,” she says.

Time, then, for a global sandbox? The FCA proposed precisely this almost three years ago. The authority chairs the co-ordination group of the Global Financial Innovation Network (GFIN), which launched in January 2019 and ran a cross-border testing pilot last year.

It was announced earlier this week that, through GFIN, 23 regulators (including the FCA) are launching an initiative for firms to test innovative financial products, services, business models or regulatory technology across more than one country or jurisdiction. Applications close on 31 December.

It’s early days, but sandboxes are going global.