UK economy: Borrowing overshoots expectations as interest bill spikes

Government borrowing overshot expectations last month, new figures show, as ministers promised to take a hard line to tackle government “waste”.

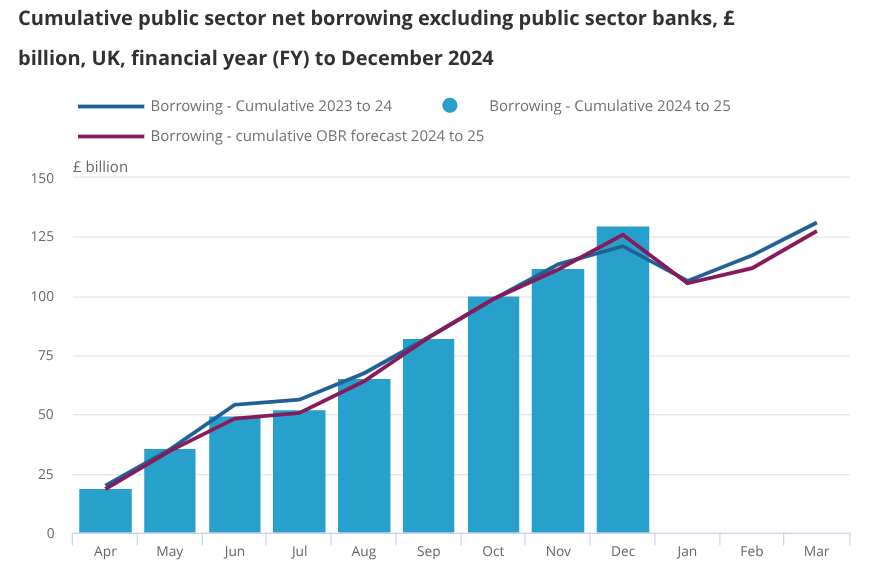

According to figures from the Office for National Statistics (ONS), the government borrowed £17.8bn in December, well ahead of the £14.6bn expected by the Office for Budget Responsibility (OBR).

This was the third highest December figure on record, behind 2009 and 2020, and the highest in four years, the figures showed.

“Compared with December 2023, spending on public services, benefits, debt interest and capital transfers were all up, while an increase in tax receipts was partially offset by a reduction in National Insurance contributions, following the rate cuts earlier in 2024,” ONS Deputy Director for Public Sector Finances Jessica Barnaby said.

The interest payable on central government debt was £8.3bn in December, nearly £4bn higher than last year and the third highest December figures since January 1997. This figure does not include the effect of January’s spike in gilt yields.

In the first nine months of the financial year, government borrowing has totalled £129.9bn, exceeding the OBR’s forecasts for the same period by £4.1bn.

This put borrowing in the year-to-date as at its second highest level since records began in 1993.

Public sector net financial liabilities (PSNFL) was estimated at 84.5 per cent of GDP, which was 1.9 percentage points higher a year earlier, while public sector net debt stood at 97.2 per cent of GDP.

Alex Kerr, UK economist at Capital Economics, said the figures were “disappointing” and “underline the challenges that face the Chancellor”.

The government’s fiscal position attracted renewed scrutiny at the turn of the year following jitters in the gilt market.

A surge in borrowing costs in early January looked like it could wipe out the Chancellor’s headroom against her key fiscal rule, which requires tax receipts to meet day-to-day spending.

Yields have recovered almost all of the ground lost earlier in January, but Reeves is still in a precarious fiscal position.

Capital Economics estimates that the Chancellor’s headroom has been reduced from £10bn to just £2bn, as gilt yields are still higher than they were at the time of the Budget.

Following this morning’s figures, Darren Jones, chief secretary to the Treasury, said that the fiscal rules were “non-negotiable” and promised to cut back on unnecessary government spending.

“Through our Spending Review we will interrogate every line of government spending for the first time in 17 years. We’ll root out waste to ensure every penny of taxpayer’s money is spent productively and helps deliver our Plan for Change,” he said.

The spending review, which will determine the details of departmental budgets for the rest of the decade, will conclude in June.

Departments will not receive any funding for new projects unless they meet the Treasury’s demand to reduce spending by five per cent, Jones said in a speech yesterday.