Boomtime for Credit Suisse

Credit Suisse became the latest big bank to report soaring profits on the back of stronger financial markets.

The Swiss bank reported a 42 per cent rise in third quarter profits to Sfr1.92bn (£846m) thanks to growth across its investment banking, private banking and asset management divisions.

Oswald Grübel, chief executive, called the results “satisfactory”. They set the scene for continued growth as Credit Suisse predicted the global economy would remain “robust”. Growth in Europe and Asia will offset higher energy costs and interest rates facing American consumers, it said.

Credit Suisse is the latest bank to report a surge in profits from business in the third quarter. The most spectacular came when Goldman Sachs revealed stunning third quarter profits up 83 per cent.

Last month Merrill Lynch revealed its best ever quarterly profits at $1.4bn, a rise of 49 per cent.

Citigroup, JP Morgan, Lehman Brothers and Deutsche Bank have enjoyed similar success, fuelling talk of a bonanza in City bonuses this year. UBS, the closest rival to Credit Suisse, followed the long line of banks recording stellar results this week.

Analysts at Dresdner Kleinwort Wasserstein said Credit Suisse’s private banking had performed 21 per cent ahead of its expectations and 16 per cent ahead of the market consensus.

“The results show that Credit Suisse can benefit from the environment in a very similar way to UBS, both in the growth and cost dynamics of private banking, but also in investment baking,” the broker said.

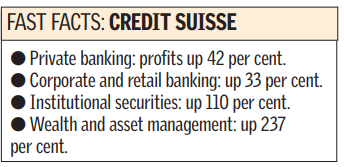

Private banking registered a net income of Sfr728m in the third quarter of 2005, an increase of 42% over the same period of 2004 and of 25% up on the second quarter of 2005. Corporate and retail banking improved by 33 per cent to Sfr264m.