Bollywood Godfather takes on Hollywood

Anusha Bradley talks to the boss of Eros, the media mogul bent on profiting from the silver screen

It goes without saying: Kishore Lulla loves movies. “Indian or Hollywood, I love watching them all. Whether it’s Spiderman, Harry Potter, Shawshank Redemption, or The Godfather – I love the Godfather – they give me a lot of inspiration and knowledge,” he says excitedly.

But the Bollywood media mogul’s greatest love is making money. “I am completely focused on that. I don’t care about the deal size unless it makes sense on the bottom line. And hence we don’t do many deals, but we do meaningful ones,” he says, suddenly quite seriously.

It’s a strategy that has worked for Lulla, the chief executive and chairman of India’s biggest entertainment company Eros International. Last week the company unveiled record full-year earnings and bumper profits. Group pre-tax profits grew 58 per cent to $63m (£31.5m) on revenues that surged 70 per cent in 2007 to $113m.

Taking on Hollywood

Lulla’s father started Eros in 1977 and built it into a large Indian-only entertainment firm.” I had the vision that I wanted to take the company global and he used to laugh at me. But after 25 years we are in 50 countries and we can now really say we are a global company.”

Now, he wants to take Bollywood to Hollywood to tackle the English speaking market. “In the next five years there will be a new media empire that will rule the world. It will be a cross pollination between the Hollywood and Bollywood. We will be a force to be reckoned with it. And that’s where we are heading towards with our deals and acquisitions.”

Eros has recently signed up a deal with Sony Pictures and the two are working on their first film script, which Lulla describes as “part superhero, part Indian mysticism” set in New York.

Growing Fast

“My wish would be that we make the crouching tiger of India – invest $15-25m and gross $1bn.”

Eros is the largest film and entertainment company in India but it also has its fingers in pies as diverse as Internet on demand video, television, content dubbed into a multiple of languages.

Dubbed content grew 32 per cent last year and Lulla says it is increasingly popular in Europe. “Markets such as Russia, Poland, Germany find Bollywood movies a breath of fresh air because of their family values,” he says. Inspired by Hollywood studios, Eros has invested more than $250m in content and its libraries over the last two years. The Aim-listed company is also considering an additional listing in India to boost its acquisition fund.

Lulla says: “If you look at the Indian entertainment sector, it’s worth about $12bn today, but it’s going to be about $30bn in five years. US film growth has totally plateaued out. The US studios are losing money, but they are making money overall from their library and their international network.

He adds: “TV is also going to see the biggest growth in India. There are 5bn TV sets now, but it’s going to grow to 15bn in the next five years. So we want to be in content and distribution like a Hollywood studio in the US. If you have the content then you will always last forever.”

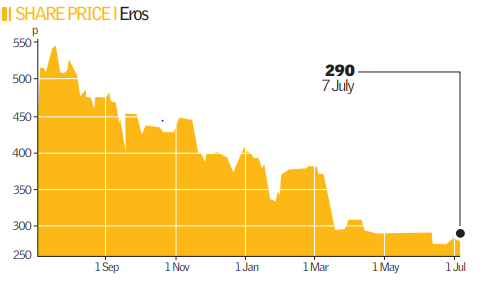

Shares Down

Eros’ 1,900-strong film library produces more than 20 per cent of the group’s revenues at the moment. To add to that, Lulla recently signed a joint venture with US based Lionsgate, the makers of hit satirical cartoon Southpark, allowing them to dub its entire film library and distribute in any format in India.”

“It’s a 50-50 joint venture so whatever comes from that deal will straight away hit our bottom line,” he says. It seems, however, that the market doesn’t share Lulla’s bullish prospects about the future.

Eros’s share price has shed 27 per cent in the last six months, with some investors pulling out of smaller cap media stocks, but that doesn’t faze Lulla. He believes the value of the company will grow “hundreds of percent” over the next five years. “The most important thing about our company is that revenues are still growing. The family owns 71 per cent of the company and we are in no rush to sell out any of those shares.” He adds: “Our mantra is don’t leave any stone unturned. Use every opportunity to generate cash.”