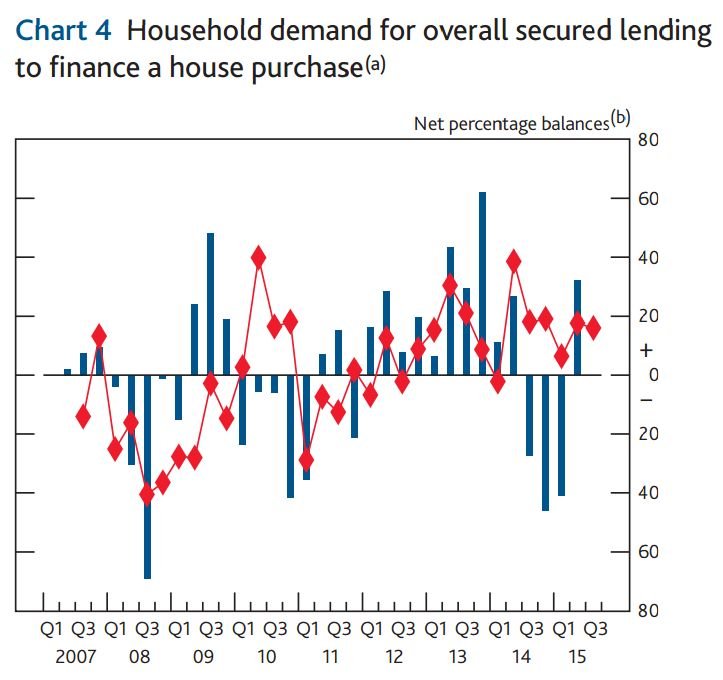

BoE says mortgage demand rose “significantly” in the second quarter

The Bank of England's credit conditions survey, released today, has shown mortgage demand rose "significantly" in the second quarter, having fallen in the three previous quarters, and is set to rise again in the third quarter.

The survey also showed demand for loans to big and small companies increased in the three months to mid-June 2015, and is expected to rise again in the next quarter. Demand for credit card lending remained unchanged while other unsecured lending products, such as personal loans, increased slightly.

Meanwhile mortgage availability increased slightly during this period, as corporate loan availability remained unchanged from the previous quarter. Economists were pleased to see credit availability to small businesses increased in the second quarter, which suggests it's becoming easier for them to borrow.

The availability of secured credit increased slightly during this period while the availability of unsecured credit was unchanged.

(Source: Bank of England)

"The Bank of England’s credit conditions survey for the second quarter points to broadly healthy economic activity, with increased demand for credit from small businesses, higher demand for mortgages and relatively elevated demand for unsecured consumer credit," Howard Archer, chief economist at IHS, said.

"It is also encouraging to see that default rates fell across all sectors in the second quarter – on mortgage borrowing, unsecured consumer credit and on corporate lending, especially for small businesses. This is clearly a reflection of recent sustained healthy UK growth as well as the help to consumer finances coming from negligible inflation, rising earnings growth and higher employment. Low interest rates are also clearly a help."

“It’s heartening to see that demand for lending from small businesses has increased significantly as this is a clear, positive sign that firms have the confidence to take on borrowing to invest and expand," Richard Woolhouse, chief economist at the BBA, said.

"At the same time we’re seeing demand for mortgages increase, as consumers take advantage of some of the extremely competitive mortgage deals that are available from banks at the moment. This – coupled with the increase in demand for personal loans – shows that people are starting to feel more financially secure and ready to commit to making bigger purchases."