BlueBay gets a boost as managed assets grow

Fixed income hedge fund manager BlueBay received a boost yesterday, after its shares rose on the back of an announcement that assets under its management had grown significantly.

Funds handled by the firm grew by 12 per cent to £10.5bn at the end of June, up from £9.35bn at the end of March, the firm said.

The money manager also earned £5.2m in performance related fees in the past six months, significantly higher than market expectations.

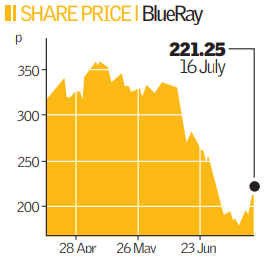

The news will provide some much-needed respite for the firm, whose shares plummeted by 14 per cent last month, after chief executive Hugh Willis warned the City that profits for the year would be lower than analysts expected.

Long-only assets rose the most to £10.8bn from £7.55bn at the start of the year, after BlueBay added two new funds, including one which focuses on corporate bonds in emerging markets.

The amount the company runs in hedge funds also rose slightly from £2.8bn to £2.9bn, although the proportion of assets managed as hedge funds dropped to about a quarter of total assets from about a third at the end of 2007.

“Credit market conditions have been and remain difficult. It is gratifying that, over the fiscal year, BlueBay has seen $7.1bn (£3.55bn) of net inflows into its funds – equal to more than half of the starting assets for the period,” said Willis.

“There was a slight over-reaction after the June warning and they’re recovering some of that. Clients are reading into the long-term structure of the company, which looks good,” said Gurjit Kambo, analyst at Numis securities.