Blow for George Osborne’s deficit plans as public borrowing climbs in August

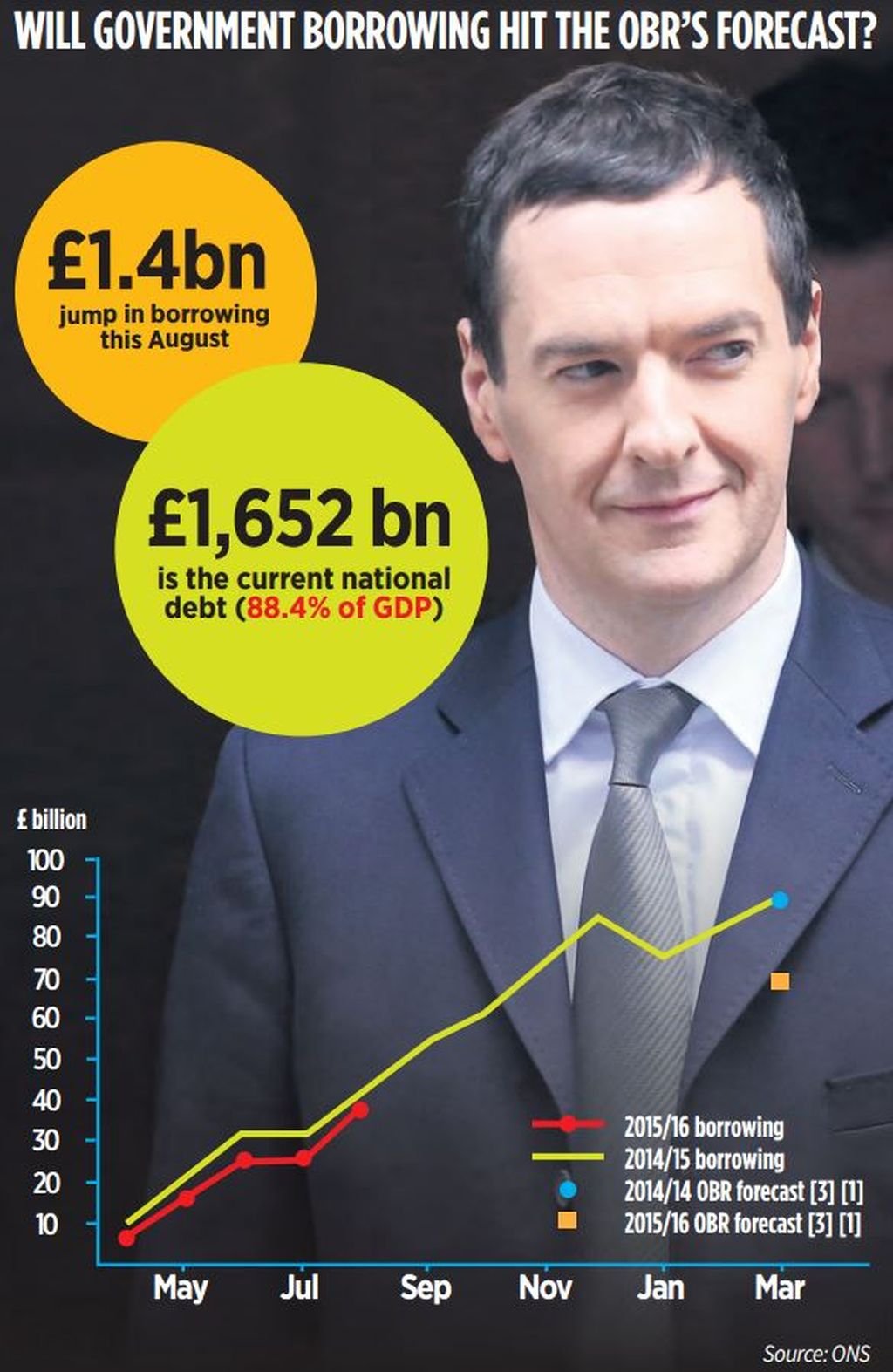

Government borrowing jumped in August, ending a positive run of results for chancellor George Osborne this year.

Public sector borrowing excluding state-owned banks was £12.1bn in August, up £1.4bn on the same month last year, according to figures released this morning by the Office for National Statistics. This was the biggest August deficit since 2012.

Despite the rise, borrowing since April is down £38.4bn, a £4.4bn compared with the same period last year.

“The main reason for the disappointment was a 3.5 per cent annual drop in income tax receipts, reflecting a drop in self-assessment payments,” said Vicky Redwood from Capital Economics.

“On the face of it, this leaves borrowing for 2015-16 as a whole set to undershoot last year’s borrowing total of £90bn by only £10bn or so, rather than the £20bn drop that the OBR forecast in its July’s Budget.”

“That said, we would not read too much into one set of figures, given that the trend had previously improving for several months. Indeed, we expect growth of tax receipts to recover quickly given that the recent strength of the economic recovery should be feeding through.”

Total government debt is now £1,652bn, equivalent to 88.4 per cent of GDP.