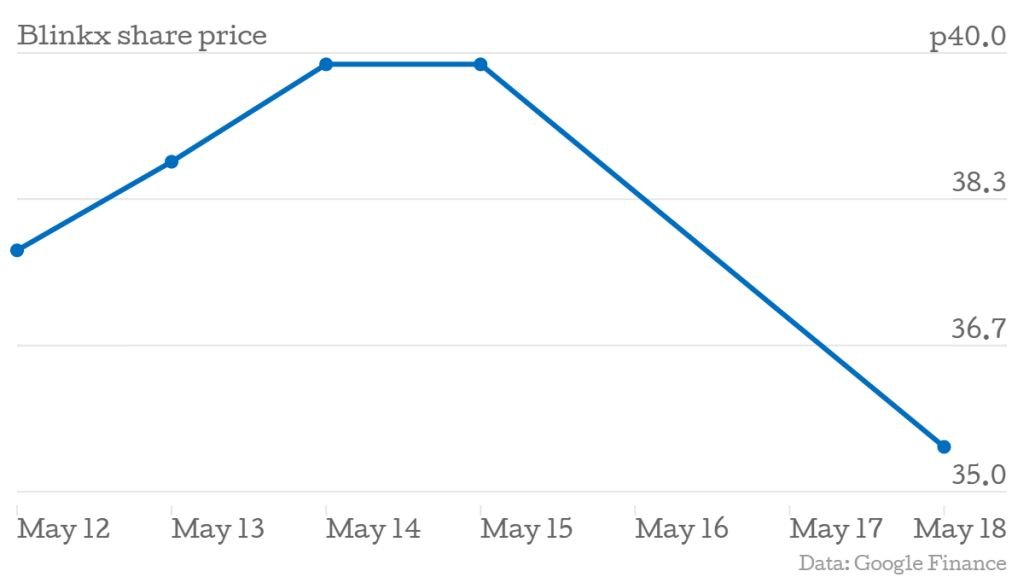

Blinkx share price dives as results show impact of market concerns on ads

Shares in online advertising company Blinkx fell by 10.26 per cent yesterday, after swinging to a pre-tax loss of $25m (£16m) in the year ended 31 March.

The Aim-listed company reported a profit of $18m last year. Revenue also fell, from $247m to $215m.

The poor performance comes as the firm deals with increasing market concerns that ads are not being seen by people, but instead are racking up views from bots.

In order to address this, the firm said it “took a decisive stance in addressing the industry-wide issue of supply quality and brand safety”.

As part of this process, the company said it had increased its “owned-and-operated supply footprint” by buying All Media Network, but also “initiated new and expanded relationships with a number of partner organisations to combat and remove suspicious activity within the supply chain”.

These partners include Nielsen, Integral Ad Science, Forensiq and DoubleVerify.

Blinkx said that while actions like these led to increased costs for the group, they would help the company ensure that its audience quality meets advertisers’ requirements, and said it “expects to see a corresponding increase in price and margins over the long term”.