Bitcoin’s Lightning Network capacity hits new high, and crypto lenders investigated

Data from CryptoCompare shows that the price of Bitcoin moved down to $19,000 this week before starting an uptrend that is still ongoing and has seen the flagship cryptocurrency reach $22,250 at the time of writing.

Ethereum’s Ether, the second-largest cryptocurrency by market capitalisation, moved down to test its support at $1,000 before entering an uptrend. It’s now nearing the $1,500 mark after projections suggest it will undergo a significant upgrade in September.

Last week, headlines in the cryptocurrency space focused on embattled cryptocurrency lenders’ operations and on Bitcoin’s continuous growth. CryptoCompare’s latest Asset Report has detailed that while the price of Bitcoin fell 37.4% in June to close the month at $19,908, its Lightning Network – a layer-2 scaling solution designed to make BTC transactions as fast and cheap as possible – saw its capacity grow to stand at 4,96 BTC at the end of June.

Total fees paid for BTC transactions decreased by 28.7% to $11.5 million, with the average transaction fee falling from $2.01 in May to $1.54 last month. The cryptocurrency’s price has notably since increased to now be close to the $21,000 mark.

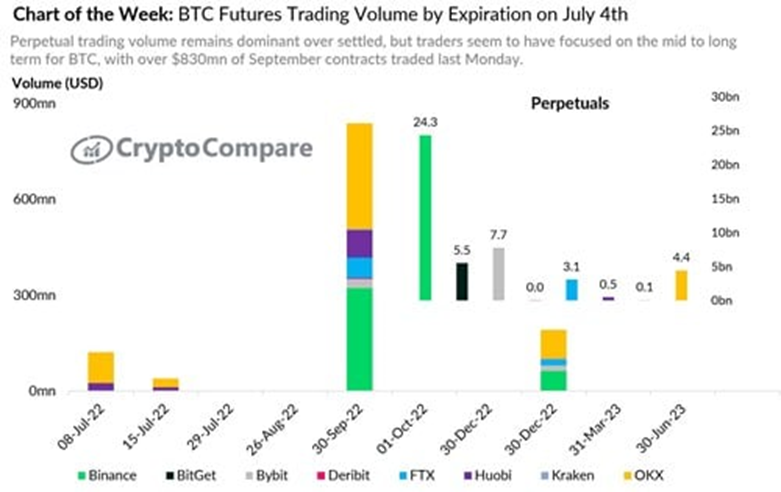

Derivatives trading volumes have been focusing heavily on perpetual futures contracts, with settled contracts seeing massive volumes aimed for the end of September. Traders are seemingly focusing on mid- to long-term for BTC.

Bitcoin’s growth if being supported by growing adoption, with Brazil’s leading digital payments app PicPay set to launch a cryptocurrency trading platform for its 65 million users, as well as a stablecoin tied to the country’s fiat currency, the Brazilian real. The exchange is the fintech firm’s first cryptocurrency-related offering.

Similarly, Brazil’s largest private bank Itaú Unibanco is set to launch an asset tokenisation platform that transforms traditional finance products into tokens and to offer cryptocurrency custody services for its customers.

The bank will launch these services through a new unit called Itaú Digital Assets, which will first be available for institutional clients before a retail version is rolled out by the end of the year. The bank has also said it did not rule out offering cryptocurrency trading services to retail customers in the future.

Over the week, according to JPMorgan analysts, Bitcoin’s production cost has dropped from around $24,000 at the start of June to around $13,000. The drop is associated with a decline in electricity use.

JPMorgan strategists led by Nikolaos Panigirtzoglou wrote that the change is consistent with miners’ efforts to protect their profitability by deploying more efficient mining rigs.

Crypto lenders start being investigated

Embattled cryptocurrency lenders this week started being investigated by the California Department of Financial Protection and Innovation (DFPI) after a series of prominent lending firms indefinitely halted withdrawals and transfers between user accounts.

The department didn’t name the companies under investigation, but it did say it’s eyeing multiple” companies offering customers “interest-bearing crypto asset accounts.” The DFPI is investigating service providers that “may not have adequately disclosed risks customers face when they deposit crypto assets onto [lenders’] platforms.”

Crypto exchange CoinFLEX partially restored user withdrawals this week, allowing them to withdraw up to 10% of their funds. Meanwhile, a filing from crypto lender Celsius has revealed the firm has a $1.2 billion hole in its balance sheet.

A document filed to the US Bankruptcy Court of the Southern District of New York shows that the firm holds $4.3 billion of assets and has $5.5 billion of liabilities. In its list of assets, it claimed it has about $600 million in its CEL token.

The company noted in the filing that the total market cap for CEL as of July 12 was roughly $170.3 million.

DeFi exploits surpass $1.8 billion year-to-date

Hacks against decentralised finance (DeFi) protocols have increased nearly eightfold compared to last year’s first quarter, with over $1.22 billion being stolen or rugged from protocols in the first quarter of the year. Year-to-date exploits have already topped $1.8 billion.

According to DeFi bug bounty platform Immunefi, more than 77% of the first quarter’s $1.22 billion figure stems from the Ronin Network’s $625 million hack and Wormhole’s $326 million exploit.

In the year’s second quarter, DeFi exploits seemingly slowed significantly, with the $100 million theft of Harmony’s cross-chain bridge and algorithmic stablecoin protocol Beanstalk’s $180 million losses being the outliers.

This week, a hacker or group of hackers executed a phishing campaign on a major Uniswap v3 liquidity pool, which allowed them to make off with roughly 3,278 Ether worth of non-fungible token (NFT) positions. The attacker sent 73,399 addresses a malicious token, acting under the false pretence of a UNI airdrop, in a bid to trick investors.

Nearly all of the stolen funds have since been laundered through cryptocurrency mixing service Tornado Cash, according to data of the address belonging to the attacker.

Francisco Memoria is a content creator at CryptoCompare who’s in love with technology and focuses on helping people see the value digital currencies have. His work has been published in numerous reputable industry publications. Francisco holds various cryptocurrencies.

Featured image via Unsplash.