Bitcoin’s fluctuations appear robust despite narrative of Ukraine crisis

Data from CryptoCompare shows that the price of Bitcoin fluctuated throughout last week, starting it out with a move to the $39,000 mark and quickly plunging to $34,000 after Russian President Vladimir Putin announced a “special military operation” in Ukraine, effectively launching an invasion. BTC has since recovered and is now trading at $38,000.

Ethereum’s Ether, the second-largest cryptocurrency by market capitalization, moved in a similar way, starting the week with a push to the $2,700 mark before plunging to $2,300. The cryptocurrency is now trading at $2,600 after recovering from news of the war.

Headlines this week were dominated by Russia’s move, which started after President Putin gave a televised speech announcing military operations. In it, Putin warned the United States and NATO against getting involved, saying that anyone who “tries to interfere with us, or even more so, to create threats for our country and our people, must know that Russia’s response will be immediate and will lead you to such consequences as you have never before experienced in your history”.

Cryptocurrency prices, along with equities markets and other risk assets, crashed shortly after reports of what was happening started coming. Russia’s MOEX Index plunged up to 45% at one point.

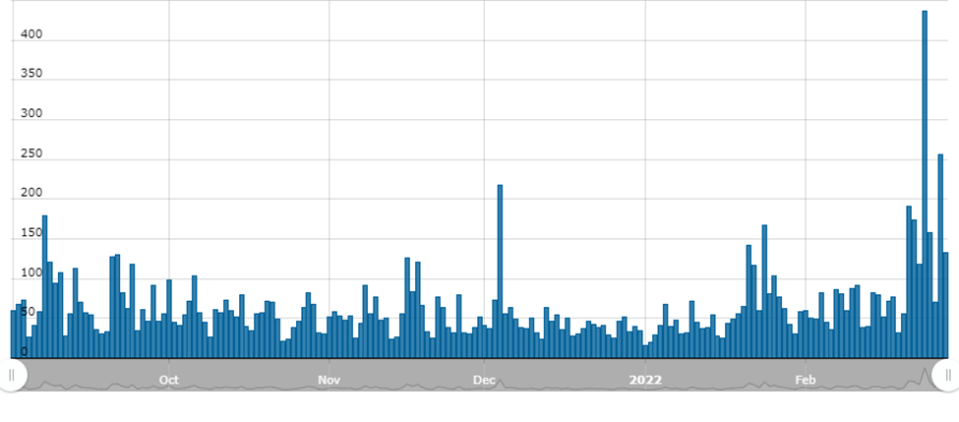

Bitcoin trading volumes denominated in the Russian ruble, the country’s fiat currency, exploded as operations started and economic sanctions began affecting Russia’s economy.

CryptoCompare’s data shows that RUB denominated Bitcoin volume jumped to 1.3 billion RUB on February 24, the day Russia’s military operations started, while a similar trend was seen on USDT – RUB trading volumes.

The spike in ruble-based cryptocurrency trading volumes came as economic sanctions hit Russia and the value of its fiat currency plunged more than 40% against the U.S. dollar, its biggest drop since 1998.

Similarly, Ukrainian cryptocurrency exchange Kuna saw its trading volume explode after Russia’s invasion was launched. On average the exchange’s trading volume was hovering around 45 million Ukrainian hryvnias (UAH) per day. On the day Russian forces entered Ukraine, its trading volume exploded to 150 million UAH, equivalent to around $5 million.

The Ukrainian government itself has raised over $10 million in cryptocurrency after it started accepting donations in crypto amidst an ongoing war with Russia. According to Ukraine’s official Twitter account, it has been accepting donations in BTC, ETH, and the USDT stablecoin.

Blockchain data shows the Ukrainian government has already received over $5 million in ETH, over $1.7 million in USDT across the Ethereum and TRON networks, and over $4.4 million in BTC.

Before Ukraine’s government started accepting cryptocurrency donations, users had donated BTC, ETH, and other assets to NGOs supporting the country’s population and defensive efforts.

Hacker behind 3.6 million ETH theft in 2016 may have been found

The hacker behind one of the most significant incidents in cryptocurrency history, that has gone unsolved for nearly six years, may have been found. Journalist Laura Shin has said she may have discovered the person who siphoned 3.6 million ether (ETH) worth over $9 billion at current prices, from The DAO.

To stop the attacker from getting away with the hack, Ethereum’s developer ended up splitting the chain in two through a hard fork that resulted in the creation of Ethereum Classic (ETC), which the hacker was left holding.

Shin detailed that blockchain transactions showed the hacker moved ETC to ShapeShift, which at the time did not impose know-your-customer checks, to trade some funds for BTC, which was then mixed through a CoinJoin wallet to hide its trail in the blockchain.

In her report, Shin claims blockchain analytics firm Chainalysis was able to de-mix the transactions and trace the BTC to centralised cryptocurrency exchanges, which had accounts registered with the email of the alleged hacker. Chainalysis confirmed it “helped trace the funds despite the attacker’s attempts to cover his tracks w/ mixers”.

Meanwhile, stablecoin issuer Tether revealed it has reduced its commercial paper holdings by $6.2 billion over the last quarter of 2021. The firm now has $24.2 billion in commercial paper, down from $30.5 billion in the period ending in September.

In South Korea, the country’s largest bank by net assets, Kookmin Bank, revealed it is planning to launch cryptocurrency investment products targeted at retail investors. The move comes after it formed a Digital Asset Management Committee to create crypto exchange-traded funds (ETFs) and futures products once South Korea’s regulations allow it to do so. Hong-Gom Kim, head of Kookmin Bank’s index quant management division, was quoted saying:

Francisco Memoria is a content creator at CryptoCompare who’s in love with technology and focuses on helping people see the value digital currencies have. His work has been published in numerous reputable industry publications. Francisco holds various cryptocurrencies.

Featured image via Unsplash.