Bitcoin wallet address milestone is something to smile about

The week in review

with Jason Deane

Good morning from Bitcoin Miami!

That’s the line I wrote last year while basking in the sun at Miami 2022! Sadly, I’m giving it a miss this year as my travel and work commitments are off the charts right now, so I’m sitting at my desk somewhere in Berkshire, England, quietly going green with envy. Yes, the inevitable FOMO has started to creep into my very being as my Twitter feed fills with smiling images of all my favourite Bitcoiners, buddies and work colleagues all seemingly having the best time ever.

And maybe they should be smiling because even while it’s happening Bitcoin keeps marching on and quietly setting new milestones.

Yesterday’s Bitcoin difficulty adjustment reached yet another new high as miners continue to deploy around the world. Now sitting at 49.55T with an average epoch hashrate of 354.55 EH/s, it’s a far cry from when I put my first miner in place way back in 2017 when we were sitting at 3.74 Eh/s and wondering if we could really go much higher.

At the same time, the number of wallet addresses that hold at least one Bitcoin finally crossed the million mark this week and was picked up and commented on by the legend that is Adam Back. This sparked a whole debate as people started to realise while looking at the data that it’s entirely possible this number won’t go up that much more. After all, with only 21 million ever available and around 4 million lost forever, the theoretical limit is below 17 million. But, since many of these addresses own more than one Bitcoin that’s not probable either.

The fact is that while it doesn’t always feel like it, Bitcoin is getting scarcer by the day and with the halving now less than a year away, it’s about to “get real”, as the kids say.

Meanwhile the usual debt ceiling dance is unfolding in the USA as the “x-date” of June 1 approaches and the Democrats and Republicans argue about it until they inevitably take another step towards the death of the dollar by raising it again to avoid the entire nation defaulting and causing a global catastrophe.

This is one of those things that health and safety people would class as “low likelihood/high impact” but it does give you an insight into just how little control we little people actually have over our financial situation in fiat terms.

Make no mistake, a default would be devastating for the world and while Bitcoin remains a viable alternative to instantly move to, it doesn’t have the global presence it needs to make that transition easy. Yet.

Elsewhere in the world as Russia’s economy starts to feel the effects of sanctions and a diminishing workforce, the nation is still, almost eight months later, trying to take the small town of Bahkmut in Ukraine.

Let me just drive that point home; the “second best army” in the world has taken the best part of a year to take a town the same size as Bognor Regis, at least in terms of population. Worse, according to estimates issued by the Ministry of Defence of Ukraine, Russia has now expended over 200,000 lives just on its OWN side to get as far as it has.

For those of you who haven’t done the maths in your head, that’s almost three times the size of the population of the town to start with.

That’s an incredibly sobering thought.

Have a great weekend!

New to Bitcoin? Learn all about it here with the Bitcoin Pioneers!

Yesterday’s Crypto AM Daily

In the Markets

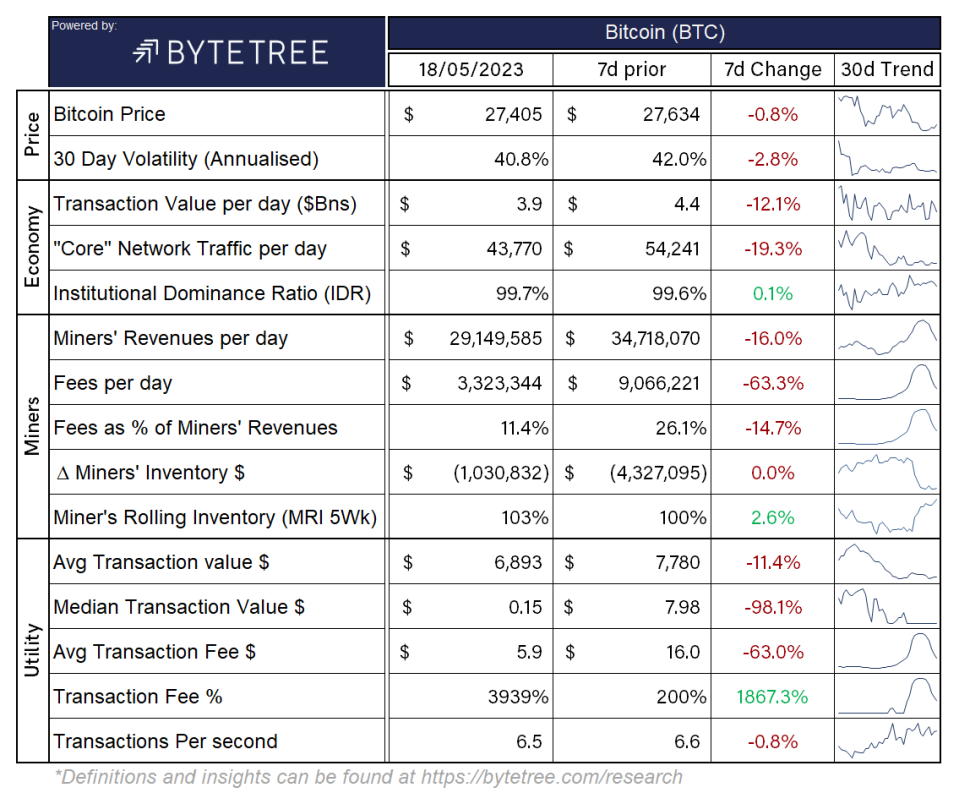

The Bitcoin Economy

*Data can be found at https://terminal.bytetree.com/

Total crypto market cap

The total capitalisation of the entire cryptocurrency market this morning was $1.125 billion.

What Bitcoin did yesterday

We closed yesterday, May 18, at a price of $26,832. The daily high yesterday was $27,466, and the daily low was $26,415.

Bitcoin market capitalisation

Bitcoin’s market capitalisation this morning was $522.335 billion. To put it into context, the market cap of gold is $12.999 trillion and Tesla is $560.65 billion.

Bitcoin volume

The total spot trading volume reported by all exchanges over the last 24 hours was $$14.807 billion.

Fear and Greed Index

Market sentiment today is 48, in Neutral.

Bitcoin’s market dominance

Bitcoin’s market dominance today is 47.85. Its lowest ever recorded dominance was 37.09 on January 1 2018.

Relative Strength Index (RSI)

The daily RSI is currently 42.13. Values of 70 or above indicate that an asset is becoming overbought and may be primed for a trend reversal or experience a correction in price – an RSI reading of 30 or below indicates an oversold or undervalued condition.

Soundbite of the day

I’ve decided to dedicate the rest of my life in building on #Bitcoin and specifically on Lightning.

PayPal’s former president David Marcus

What they said yesterday

👀

📊

🧪

Would you like to help spread the adoption and education of Bitcoin in the UK and even stack some Sats while you’re doing it? Well, now you can!

The Bitcoin Pioneers community, backed by Barry Silbert’s Digital Currency Group, was created to introduce Bitcoin to a mainstream audience in a meaningful way and now has members right across the UK.

We share tips, stories and ideas on how to encourage others to try Bitcoin for the first time. And, thanks to support from Luno, each Pioneer gets £500 of Bitcoin a month to share with beginners, helping them get started.

So, if you’re passionate about Bitcoin, why not join today? Click here to find out more!

All feedback on Crypto AM Daily in association with Luno is welcome via email to James.Bowater@cityam.com 🙏🏻

Crypto AM: Editor’s picks

ChatGPT urges crypto conference panel not to become over-reliant on AI

Mt. Gox customers will have to wait until November to recover lost Bitcoin funds

Sam Bankman-Fried: A tissue of lies soaked with fake tears?

Three-in-four wealth managers are gearing up for more cryptocurrency exposure

Crypto.com granted FCA licence to operate in UK

Q&A with Duncan Coutts, Principal Technical Architect at IO Global

Jamie Bartlett – on the trail of the missing ‘Cryptoqueen’

MPs are falling silent over potential of cryptocurrency

Erica’s ‘Crypto Wars’ handed honours in Business Book Awards

‘Let people invest’: Matt Hancock makes case for liberal crypto rules

Crypto AM: Features

Crypto AM: Founders Series

Crypto AM: Industry Voices

Crypto AM: Contributors

Crypto AM: In Conversation with James Bowater

Crypto AM: Tomorrow’s Money with Gavin S Brown

Crypto AM: Mixing in the Metaverse with Dr Chris Kacher

Crypto AM: Visions of the Future, Past & Present with Alex Lightman

Crypto AM: Tiptoe through the Crypto with Monty Munford

Crypto AM: Taking a Byte out of Digital Assets with Jonny Fry

Crypto on the catwalk

Crypto AM: Events

Cautionary Notes

It’s definitely tempting to get swept up in the excitement, but please heed these words of caution: Do your own research, only invest what you can afford, and make good decisions. The indicators contained in this article will hopefully help in this. Remember though, the content of this article is for information purposes only and is not investment advice or any form of recommendation or invitation. City AM, Crypto AM and Luno always advise you to obtain your own independent financial advice before investing or trading in cryptocurrency.