Bitcoin Tests $12,000 Mark as Decentralized Finance Surpasses $4 Billion

This week the price of Bitcoin (BTC) went from about $10,200 to a near $12,000 high, but it was met with resistance and crashed to less than $11,000 within 6 minutes. At press time, it’s trading at $11,200 as it steadily recovers.

Ether (ETH), the second-largest cryptocurrency by market capitalization, started the week at $355 but moved steadily up throughout it. Once BTC was rejected at $12,000 a crypto market-wide drop ensued, bringing ETH back to $370. At press time it already climbed back up to $385.

Bitcoin’s test of the $12,000 mark came as investors are turning increasingly bullish on the flagship cryptocurrency. Earlier this week a report published by analytics firm Glassnode revealed that the number of millionaire addresses holding BTC rose to 18,000 thanks to the cryptocurrency’s move into five-figure territory.

The number of millionaire addresses does not necessarily reflect the number of bitcoin millionaires, as some BTC holders may own several addresses that combined make up $1 million worth of bitcoin, while others may have several addresses with over $1 million in them each.

Ari Wald, head of technical analysis at Oppenheimer, revealed that bitcoin’s move past $10,000 last week showed it was reversing a long-term downtrend that has been influencing it since December 2017. Speaking during CNBC’s “Trading Nation,” Wald argued gold is a high momentum commodity above all others, but noted bitcoin “isn’t as extended,” and could be an interesting asset given the Federal Reserve’s recent balance sheet expansion.

While bitcoin is still far from its near $20,000 all-time high seen in December 2017, reversing a two-year-long bearish trend is seen s a major sign for investors. BTC holders proved enthusiastic with the move, so much so transaction fees on the network rose 500% as transactions started competing for limited blockspace.

Bakkt, the Intercontinental Exchange’s (ICEs) cryptocurrency venture, recorded a new all-time high in single-day trading volumes for its physically-settled monthly bitcoin futures contract this week, trading a total of 11,509 BTC, worth over $124 million, the day BTC hit $11,000.

Bakkt’s record-setting day represented an increase of 85% from the previous one, which occurred in December 2019. The trading platform was initially criticized for having a slow start in the space, trading less than $6 million worth of BTC futures contracts in its first week.

Adoption is also growing, as Amazon-owned livestreaming platform Twitch doubled down on cryptocurrencies this week, giving subscribers a 10% discount if they pay for their subscriptions using crypto. The firm uses BitPay to process the payments.

This week also saw authorities arrested a 17-year-old who they say was the “mastermind” behind the Twitter hack that hijacked dozens of high-profile accounts to promote a fake bitcoin giveaway. Two others allegedly involved in the hack were also arrested, the New York Times reports.

Chinese authorities have reportedly arrested all 27 key executives allegedly running the massive PlusToken cryptocurrency Ponzi scheme. The operation that led to their arrest was led by the country’s top police agency, the Ministry of Public Security, and also led to the arrest of 82 core members of the scheme.

PlusToken was a crypto Ponzi scheme that is believed to have had over 3,000 layers and affected two million investors. In total, $5.7 billion were lost in it, with the founders leaving the message “sorry we have to run” after stealing the funds.

Decentralized Finance Hits $4 Billion Market Cap

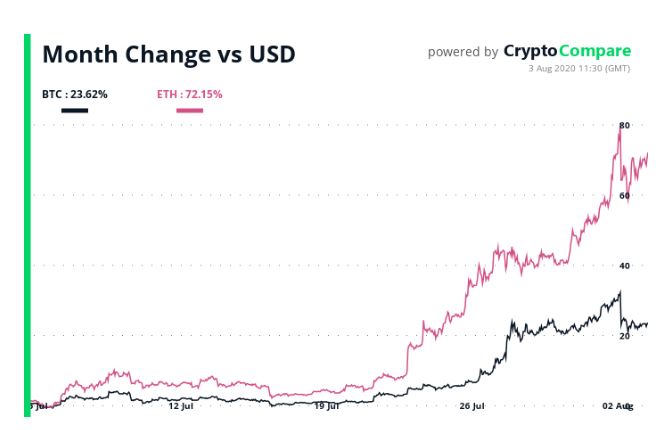

The decentralized finance (DeFi) space has kept on growing throughout July, and there are now over $4 billion worth of cryptoassets locked in it, with most being on protocols that let users either earn interest on their holdings by lending them, or taking out loans in crypto.Most of these protocols are on the Ethereum network, and have helped ether’s price and trading volumes grow. So much so that ETH preceded BTC’s move past the $10,000 mark and has been leading the crypto market, CryptoCompare data shows.

Leading the DeFi space is MakerDAO, the non-custodial lending protocol that lets users issue the DAI stablecoin. It surpassed $1 billion in total value locked this week. It’s followed by Compound and Synthethix, while major lending protocols like Aave and Balancer are within the top 10.

Crypto AM: Market View in association with