Bitcoin soars to over $35,000 for first time

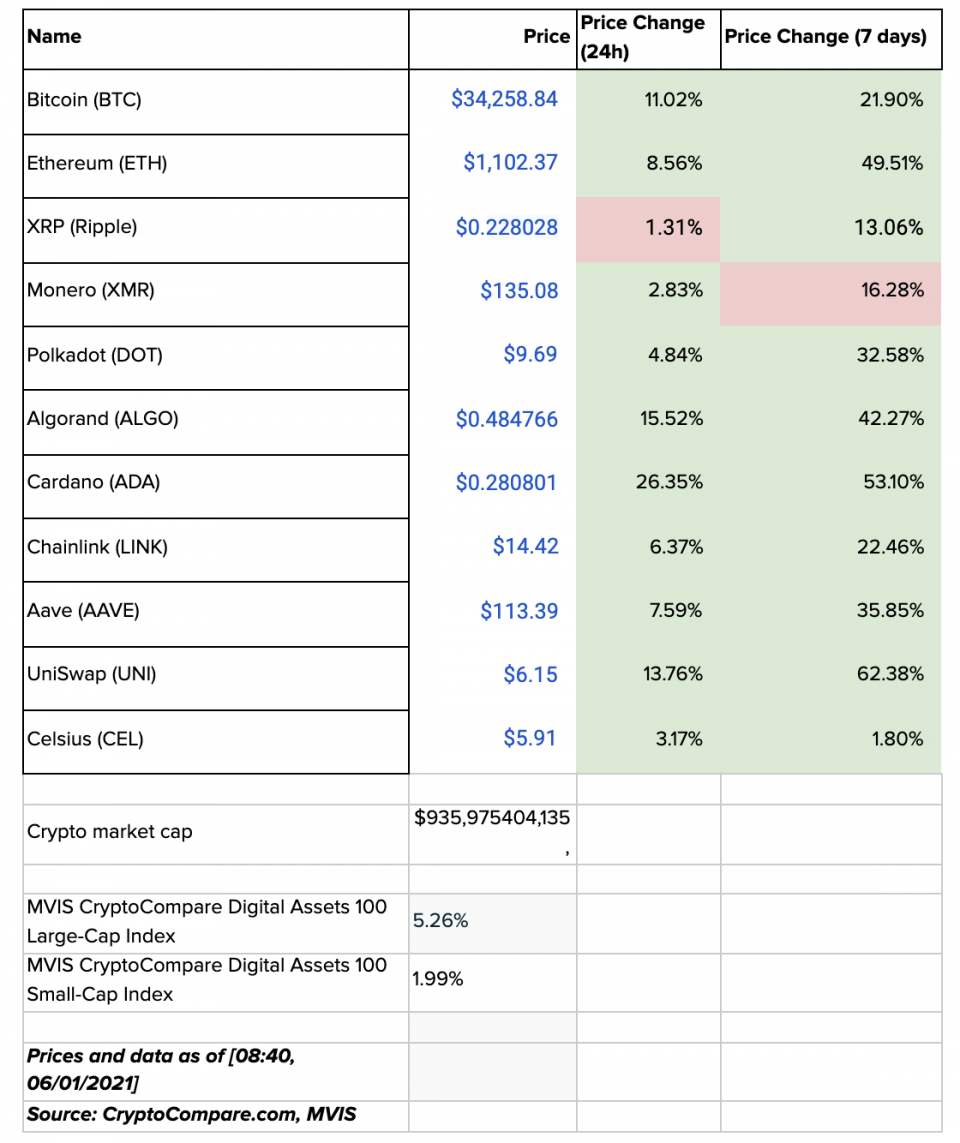

Crypto at a Glance

If you thought the dip at the beginning of this week spelled the end of the bull market, you, my friends, were very much mistaken. This morning saw Bitcoin storm back to another new all-time high of over $35,000, charging through resistance like tanks through milk. This puts Bitcoin among the top 10 assets by market capitalization, above the likes of Alibaba and Samsung. Tesla – you’re next.

Bitcoin wasn’t the only one tearing it up, though. Ether is still going strong, coasting just above the $1,100 mark. It seems like there’s opportunities everywhere at the moment. Cardano this morning flipped Polkadot, having leapt up by more than 50% over the past week. UniSwap is also up more than 60% over the past week, while Algorand is up by more than 40%. It might be ‘lockdown’ in society, but crypto is very much open for business. Enjoy the ride. Enjoy it carefully, that is – still make good decisions, don’t go too crazy.

In the Markets

What bitcoin did yesterday

We closed yesterday, 5 January, 2020, at a price of $33,992.43 – up from $31,971.91 the day before. That’s the highest daily closing price in Bitcoin’s young but magnificent history. It’s the fourth day in a row that bitcoin has closed over $30,000.

The daily high yesterday was $34,437.59 and the daily low was $30,221.19.

This time last year, the price of bitcoin closed the day at $7,411.32 and in 2019 it was $3,845.19.

As of today, buying bitcoin has been profitable for…

99.9% of all days since 2013-04-28.

Market capitalisation

Bitcoin’s market capitalisation is currently $643,541,344,617 – up from $577,566,819,840 yesterday. This is good enough to make BTC the ninth-most-valuable asset in the world, according to Asset Dash. It puts it above the likes of Samsung, Berkshire Hathaway, and even Alibaba, which currently has a market cap of $622.54 billion.

Bitcoin is also considerably outshining other global financial networks, with VISA’s market cap sitting at a lowly $472.86 billion and Mastercard’s at $346.35 billion.

Bitcoin volume

The volume traded over the last 24 hours was $217,961,292,482,754 – up from $82,030,775,649 yesterday. This is up there with the highest 24 hour trading volumes on record for Bitcoin. High volumes can indicate that a significant price movement has stronger support and is more likely to be sustained.

Volatility

The price volatility of bitcoin over the last 30 days is 69.66%.

Fear and Greed Index

Unsurprisingly, the sentiment remains in Extreme Greed territory and is back up to 95, up from 94 yesterday. The last time the sentiment was not in Extreme Greed was 5 November, 2020. The price of one bitcoin on that day was $15,706.40.

Bitcoin’s market dominance

Bitcoin’s market dominance stands at 69.39. Its lowest recorded dominance was 37.09 on 8 January, 2018.

Relative Strength Index (RSI)

The daily RSI is currently 83.70. Values of 70 or above indicate that an asset is becoming overbought and may be primed for a trend reversal or experience a correction in price – an RSI reading of 30 or below indicates an oversold or undervalued condition.

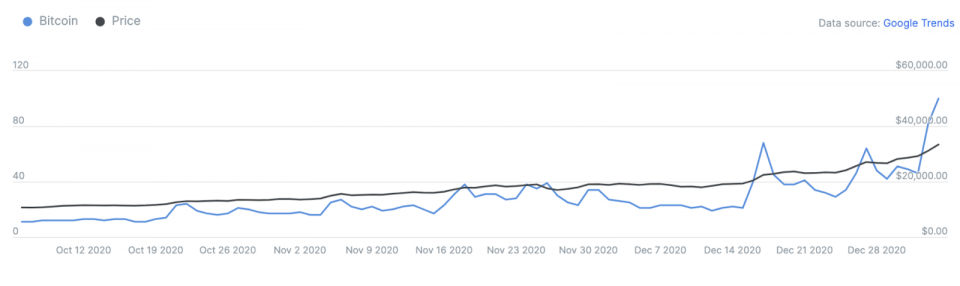

Google trends

The trend in Google searches over the last 90 days. Google shows this chart on a relative basis with a max score of 100 on the day that had the most Google searches for that keyword. The latest score is 100 – taken from 3 January.

Convince your Nan: Soundbite of the day

Today, there is significantly more demand for bitcoin than there is supply. About 900 new bitcoin are mined daily, and three market participants alone — PayPal, Square, and Grayscale Bitcoin Trust — purchase considerably more than 900 bitcoin a day because of high investor demand. If this dynamic continues, and we believe it will, much higher prices lie ahead for the dominant cryptocurrency.

– Anthony Scaramucci and Brett Messing

What they said yesterday…

Mark Cuban’s run for president on a Bitcoin platform is… bullish news?

“First they ignore you, then they laugh at you, then they fight you, then you win”

The bulls have Tesla in their sights…

The celebrities are coming…

Crypto AM: Longer Reads

Crypto AM: In conversation with James Bowater

Crypto AM: Market View in association with Ziglu

Crypto AM: Technically Speaking in association with with Zumo

Crypto AM: Talking Legal in association with INX

Crypto AM: Focusing on Regulation

Crypto AM: Deeper Dives with Liam Roche

Crypto AM: A Trader’s View with TMG

Crypto AM: Definitively DeFi

Crypto AM: Founders Series

Crypto AM: Industry Voices

Crypto AM shines its Spotlight on EdenBase & its ‘Cognitive Revolution’

Cautionary Notes

It’s definitely tempting to get swept up in the excitement, but please heed these words of caution: Do your own research, only invest what you can afford, and make good decisions. The indicators contained in this article will hopefully help in this. Remember though, the content of this article is for information purposes only and is not investment advice or any form of recommendation or invitation. City AM, Crypto AM and Luno always advise you to obtain your own independent financial advice before investing or trading in cryptocurrency.

All information is correct as of 08:30am GMT.

Crypto AM Daily in association with Luno