Bitcoin sets new all-time-high as corporate adoption grows

CryptoCompare data shows the price of Bitcoin (BTC) started the week at about $50,000 and moved steadily up throughout it until it hit a new all-time high of $61,820, before enduring a correction that saw it drop below $56,000.

Ether (ETH) – the second-largest cryptocurrency by market capitalisation – moved within the $1,700 and $1,900 territory throughout the week, failing to breach the $2,000 to set a new high above it, even as BTC’s price climbed.

The week was marked by growing corporate adoption, as more firms followed the footsteps of MicroStrategy, Tesla, and Square and invested part of their funds into bitcoin to hedge against potential hyperinflation and currency debasement.

Hong Kong-listed firm Meitu, which makes image and video processing software, purchased $22 million of Ether and $17.9 million of Bitcoin, in a move that made it the first publicly-traded company to disclose a major purchase of Ether for its treasury. In total, it acquired 15,000 ETH and 379.1 BTC in open market transactions.

One day later, Oslo stock exchange-listed Aker ASA set up a new company dedicated to investing in Bitcoin projects and other companies called Seetee. The new company will “keep all its liquid investable assets in Bitcoin” and is “initially capitalised with NOK 500 million ($58.3 million)”.

Seetee will focus on “investing in and owning Bitcoin,” and “joining the Bitcoin and broader blockchain community and establishing partnerships with leading players”. It also plans on launching “Bitcoin verification operations”. It has already partnered with Canada’s Blockstream to work on Bitcoin mining and sidechain projects, and purchased 1,170 BTC.

This week, Israeli asset manager Altshuler Shaham also revealed it invested $100 million into the Grayscale Bitcoin Trust (GBTC) last year, when the price of Bitcoin was at around $21,000. The firm is said to have made a $100 million profit before selling a third of its holdings. It still holds BTC to this day.

Rising customer demand

Growing institutional demand for cryptocurrencies was highlighted by Goldman Sachs’ Chief Operating Officer John Waldron, who said the bank was exploring ways to meet rising customer demand to invest in the space while complying with current regulations.

He said: “Client demand is rising. We are regulated on what we can do. We continue to evaluate it… and engage on it.”

Goldman Sachs has recently restarted its cryptocurrency trading desk, and started trading Bitcoin futures and non-deliverable forwards on behalf of its clients. It’s also said to be exploring a Bitcoin exchange-traded fund.

JPMorgan Private Bank distributed an educational deck to clients this week, to help them better understand bitcoin and cryptocurrencies. The deck covered major topics to help investors better understand digital assets. It included information on Bitcoin basics as well as the implications of holding BTC in a portfolio. The report was distributed “for informational purposes only”.

It’s worth noting JPMorgan Private Bank requires a minimum balance of $10 million to open an account. JPMorgan also announced the launch of debt linked to cryptocurrency-focused companies.

Called the ‘J.P. Morgan Cryptocurrency Exposure Basket’, the debt instrument is long on companies with exposure to the cryptocurrency industry, including MicroStrategy, Square, Riot Blockchain, and NVIDIA.

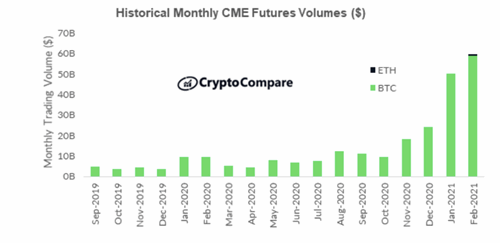

Institutional adoption could also be looked at through the trading volume of cryptocurrency futures contracts offered by the Chicago Mercantile Exchange (CME), which reached $59.6 billion last month. BTC futures made up the lion’s share of the trading volume, with ETH futures only reaching $1 billion, according to CryptoCompare’s February 2021 Exchange Review.

Over the week, digital asset manager CoinShares officially started trading on the Nasdaq Nordic exchange after going public in an “oversubscribed” initial public offering (IPO). CoinShares is trading on the Nasdaq First North Growth Market, an alternative stock exchange for small and medium-sized growth companies in Europe.

Ethereum could scale ‘100x’ through rollups

Ethereum co-founder Vitalik Buterin has predicted that Optimism will release its layer-two scaling solution, which he believes could help the network scale by a factor of 100, in the coming weeks.

Rollups are a second-layer scaling solution. Through them, data is processed and stored on a designated sidechain, before batches of transactions are bundled together onto the Ethereum main chain.

Ethereum 2.0, on the other hand, will use sharding to ensure scalability. To Buterin, rollups will be enough to lower ETH’s surging transaction fees as the network will be able to process “somewhere between 1,000 and 4,000 transactions a second”.

Transaction fees on the ETH network have surged over the last few months as the network’s utilization is now above 98%. The rising transaction fees have seen critics claim small investors are being priced out of the network.

Francisco Memoria is a content creator at CryptoCompare who’s in love with technology and focuses on helping people see the value digital currencies have. His work has been published in numerous reputable industry publications. Francisco holds various cryptocurrencies but has no bias in his writing.

Featured image via Unsplash.