Bitcoin Retests $10,000 Mark as Trading Volumes Keep Rising

This week the price of Bitcoin (BTC) once again moved up to test a rally above the $10,000 mark, hitting a high close to $10,200 before dropping back to $9,500. The cryptocurrency has since been trading within this range, as trading volumes keep growing.

Ether (ETH), the second-largest cryptocurrency by market capitalization, saw a similar pattern this week, hitting a $253 high before dropping to $233, and trading within a specific range since. Despite the mild price performances, trading volumes in the cryptocurrency space have been on the rise.

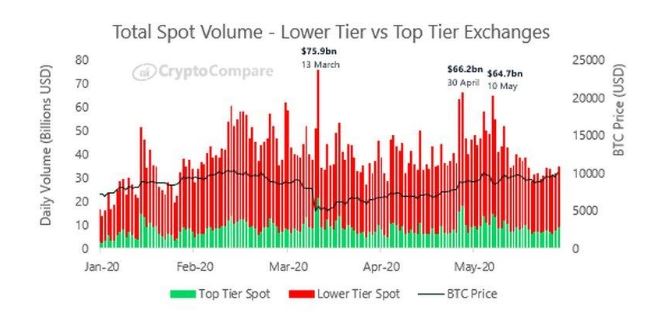

In its May 2020 Exchange Review report, CryptoCompare found that a total of $64.7 billion worth of cryptocurrency was traded on May 10, the day the price of Bitcoin flash crashed 12% in only 15 minutes. It saw the third-largest volume in the market’s history, behind a volume of $66.2 billion on April 30, and of $75.9 billion on March 13.

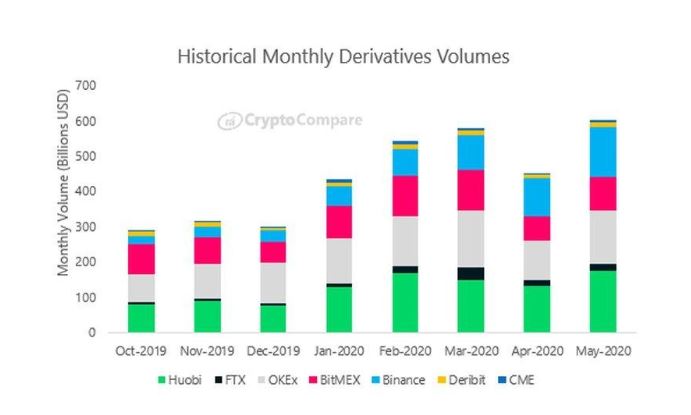

Most of the trading volume, however, was based on lower-tier cryptocurrency exchanges, based on CryptoCompare’s Exchange Benchmark. CryptoCompare’s report also found, however, that cryptocurrency derivatives volumes hit a $602 billion all-time high in May.

According to the report, cryptocurrency derivatives are gaining market share, as total spot volumes in May increased 5% to $1.27 trillion, which means derivatives represented 32% of the market, compared to 27% in April.

Most of the cryptocurrency derivatives trading came in leading, top-tier exchanges in the space: BitMEX, Binance, OKEx, and Huobi. The latter was the largest exchange by derivatives trading volume, as it traded a total of $176 billion in May, after seeing its trading volumes rise 29% compared to April.

These increasing trading volumes may be a result of growing institutional interest in the cryptocurrency space. This week crypto investment firm Grayscale Investments, a wholly-owned subsidiary of the Digital Currency Group, revealed its assets under management (AUM) have reached $4 billion after increasing 8.1% from last week, and nearly doubling since May 2019.

Grayscale is the sponsor of nine single-asset investment products, including the Grayscale Bitcoin Trust (GBTC) and the Grayscale Ethereum Trust (ETHE). Its investment funds give institutional investors exposure to top cryptocurrency, including BTC, ETH, ETC, BCH, XRP, LTC, XLM, and ZEC.

Grayscale manages the funds for a fee, and investors are saved from the complications of managing private keys or digital wallets, but still gain exposure to the underlying cryptocurrencies. Its two most popular investment products are the Bitcoin and Ethereum trusts.

Despite the growing interest and trading volumes, not everyone is sold on cryptocurrencies and their potential appreciation. John Bollinger, the creator of the popular technical analysis tool Bollinger Bands, has made it clear on social media he believes it’s time to be “cautious or short” on the price of bitcoin, as he believes the move past $10,000 this week was a head-fake.

Bitcoin Fundamentals Show Improvements

Looking away from the price, underlying blockchain data shows Bitcoin’s fundamentals have been improving throughout the week. After the block reward halving last month, that saw miners’ rewards for finding blocks drop from 12.5 BTC to 6.25 BTC per block, its hashrate plummeted, but over time it has been recovering.

Bitcoin’s hashrate is used to measure the processing power of the network, as to find new blocks – and mint new BTC – intensive mathematical operations are made. These calculations make the network more secure. In other words, the higher the hashrate, the safer the network.

Square Crypto, the cryptocurrency development arm of payments firm Square, has this week issued a grant to the Eye of Satoshi, a Lightning Network watchtower that monitors blockchain transactions to protect users. The Lightning Network is an off-chain scaling solution that, to be securely used, requires users to be connected to the internet to monitor the underlying blockchain.

If a user is disconnected on the Lightning Network, a third party is needed to watch the transaction for them, to prevent other parties from stealing their funds by abusing payment channels. The grant is expected to increase security on the Lightning Network.

It’s worth pointing out that the underlying Bitcoin blockchain doesn’t need users to be online to monitor transactions on the blockchain, nor is it possible for others to steal funds from their wallets if they are not online.