Bitcoin now more correlated to stocks and still has value in traditional portfolios

Bitcoin remains a valuable addition to a traditional asset portfolio, according to research by a leading investment manager.

Switzerland-based Tyr Capital, has found that, despite market volatility, portfolio managers across the globe were still allocating the flagship cryptocurrency.

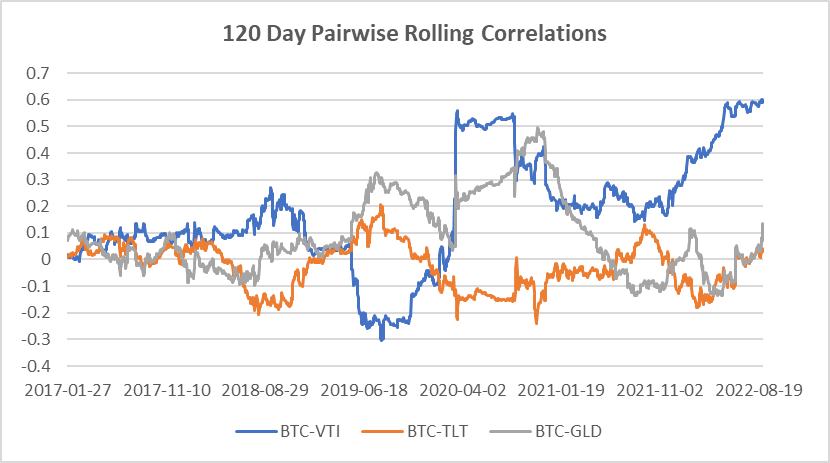

By revisiting the company’s 2020 research using market data from 2016-2022, researchers also found that, while Bitcoin remains uncorrelated to gold and US government bonds, the relationship between Bitcoin and US stocks has changed.

Bitcoin is now more correlated to US stocks, particularly since the Covid-19 pandemic – something analysts attribute to being treated as a ‘tech play’ or a ‘risk-on’ asset.

Tyr examined 120-day rolling correlations to determine the relationships between Bitcoin and other assets. The research findings show the benefit of adding Bitcoin to a traditional portfolio, as it is still largely uncorrelated with most other traditional assets.

“These insights help us better understand the likely future diversification effect of Bitcoin, as well as what a sensible approach will be when deciding whether to include it in a portfolio,” said Nick Metzidakis, Tyr’s Chief Technology Officer.

“A Bitcoin allocation can be seen here as a risk management exercise where the investor can learn more about that specific market whilst also dealing in markets they know well. Bitcoin remains relatively uncorrelated to most other asset classes.”

Ed Hindi, Chief Investment Officer at Tyr Capital, explained how the attraction of a small amount of crypto was about diversifying a portfolio.

“In a traditional portfolio, the role of Bitcoin is one of a diversifier, making the portfolio more attractive and more likely to produce superior returns,” he said.

“The standard risk has not changed in two years; therefore, investors can be confident using Bitcoin as part of a newer portfolio.”

Tyr’s research suggested annualised returns of a traditional portfolio increased significantly when only a two per cent allocation into Bitcoin was added. Increases of 37 per cent and 28 per cent in annualised returns were seen in the two benchmark portfolios (Portfolio’s 3&4) when a 2% allocation of Bitcoin was made (Portfolio 3 allocation: 39% US stocks, 59% US Bonds, 2% BTC & Portfolio 4 allocation: 39% US Stocks, 30% US Bonds, 29% GLD, 2% BTC); compared to portfolio 1 containing 40% US Stocks & 60% Bonds and portfolio 2 containing 40% US Stocks, 30% US Bonds plus the addition of a 30% Gold allocation.

This information highlights Bitcoin’s effect as a diversifier in the set. Throughout the pandemic, Bitcoin also remained a positive addition to traditional portfolios.