Bitcoin: is it still worth it?

Since I wrote my previous article about Bitcoin for CityAM, a lot has happened. The price of Bitcoin is down approximately 50 per cent, the mainstream media has changed their narrative from “invest every penny you have in NFTs” to “Bitcoin is an energy hog that eats babies”. Obviously when you have a complete shift in narrative there will be price impact and that price impact will cause many new people to lose money and leave the market.

There has suddenly been a lot of talk about Bitcoin’s electricity consumption and the impact on the environment caused by mining Bitcoin. But it seems that many people do not understand that Bitcoin has always used electricity; literally nothing has changed other than the narrative. It seems many news outlets around the world do very little research before posting an article, instead recycling a newswire which they all copy and paste because ultimately news is not about news, it is about clicks on a web page to gain advertising revenue.

The media has contributed heavily to the Bitcoin crash. The media knows that fear sells. During the first crash that Bitcoin recently had from $64,000 to $29,000, every single day for two weeks we were bombarded by negative stories about Elon Musk and Tesla no longer accepting Bitcoin among many things. As someone who has been invested in Bitcoin since 2013, I am baffled that Tesla should have such a market impact as the company sold barely any cars with Bitcoin. This whole narrative about Bitcoin being bad for the environment is utterly ridiculous and peddled by hypocrites.

For some reason, western developed countries jump on anything that uses a lot of electricity and call it “bad” especially if it is something that most people do not understand. Electric transportation is an industry heralded by the powers-that-be to be the future of eco-friendly transportation. But are electric cars really saving the world? No, of course not: Lithium is mined in poor countries, is shipped around the world on huge container ships and goes through a very power intensive process to be converted into batteries that power cars made exclusively out of fossil fuels and a finite supply of raw materials dug out of the earth.

Kicking the can down the road

The idea that driving an electric car saves the environment is ridiculous. You burn more energy making the car than the car will ever save in most cases. And yet our government calls this a green initiative because it doesn’t pollute here in the UK, it pollutes in areas of the world that we Brits will never have to see. The word “green” is a placeholder for “kicking the can down the road”. There is no such thing as “green”. Everything humans have on earth is derived from in some way exploiting and destroying the planet. So the idea that Bitcoin is somehow single-handedly the worst thing to happen to the earth all of a sudden is hilarious given that I am writing this article on a computer made from various mined metals and oil-based plastics.

So now it is time to debunk the whole “Bitcoin bad” nonsense.

All fossil fuels are bad for the environment; nobody in cryptocurrency disputes this. Bitcoin miners, if plugged into the national grid, would also be bad for the environment given that the national grid (which powers virtually every electric car in the UK) is comprised of 46.5 per cent fossil fuels – and that is not the full picture because the UK also imports energy from overseas. The renewable energy we produce in the UK makes up 23 per cent of the national grid however when incorporating all electricity consumed in the UK only six per cent in total is from renewable sources. So when you plug your “green” electric car into the grid, approximately 90 per cent of the energy being put into the car is generated by fossil fuels because the UK imports so much energy from overseas.

So how does this relate to Bitcoin? Well, the banking industry runs 100 per cent off of the national grid and fossil fuels; ATMs, commuting employees, even just keeping the lights on in the huge glass tower blocks in Canary Wharf use a tremendous and incalculable amount of energy. So when calling Bitcoin a resource hog, you must first put it in context of what it is competing against, namely the banking industry. Banking as an industry worldwide is estimated to use more than 260 Twh per year (Terawatt-hours). This is only taking into account four elements of the banking industry: bank data centres, bank branches, ATMs and card networks. This does not include commuter travel or any other energy usage.

How much energy is Bitcoin really using?

So now we have that figure for context, how much energy is Bitcoin using? The answer is very simple to find out. All Bitcoin figures are publicly verifiable and transparent, something that is definitely not the case in the banking industry that laundered over $2 Trillion dollars in the past 12 months (more than double the value of Bitcoin’s market cap). 113.89 Twh per year is the exact amount of energy used by the Bitcoin network over the previous 12 months – less than half the amount of energy used by the banking system.

Bitcoin differs from the banking industry greatly as it is virtually impossible to mine Bitcoin for a profit just by plugging into the national grid unless you have a special contract with a power plant to use their excess electricity for a big discount (the UK like many other countries overproduces electricity to avoid power outages however much of that energy goes to waste), or alternatively you use some form of renewable energy.

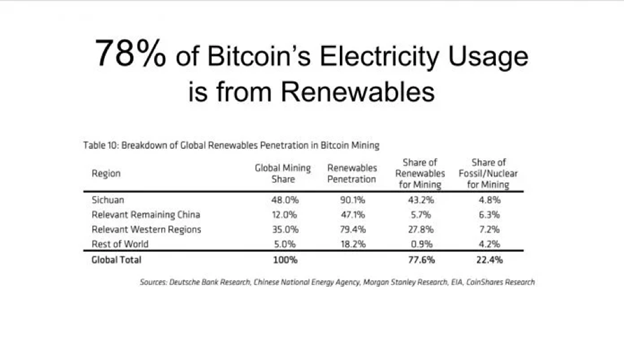

Many of the world’s Bitcoin mines are located in cold areas of the world next to rivers, geysers, anywhere that has a natural energy source. The 2020 third Global Cryptoasset Benchmarking Study by the University of Cambridge indicates that 76 per cent of digital currency miners use renewable power sources. Backing up this data is a report from Deutsche Bank Research, the Chinese National Energy Agency, Morgan Stanley, and Coinshares. The report from these four organisations highlights that “78 per cent of Bitcoin’s electricity usage is from renewables”.

So, directly comparing Bitcoin with the banking industry, 78 per cent of 113.89 Twh is generated by renewable sources. This means 22 per cent is non-renewable, so overall Bitcoin uses 25.05 Twh per year from non-renewable sources. The banking industry gets approximately 90 per cent of its energy from non renewable sources and therefore impacts the world nearly ten times more than Bitcoin, sucking approximately 234 Twh per year from non renewable energy sources.

And with China’s recent Bitcoin mining crackdown and El Salvador hooking up a Bitcoin mine to their volcano, Bitcoin will only get greener with time as the dirty, dinosaur juice-sucking banking industry continues to destroy the planet and launder Trillions of dollars for the world’s elites.

Scaremongering

Bitcoin provides a lifeline to people in countries that have no economic infrastructure. All this energy scaremongering does is mess with the lives of innocent, normal people living in poor nations that rely on Bitcoin for their lifeline because their local currency is far too volatile.

So what comes next for Bitcoin? I imagine society will take a long time to understand exactly how much impact Bitcoin is having on the world with entire nations beginning to adopt it as a national currency to scare away the criminals within their system. Take El Salvador for example, a country known for mainly two things – Cocaine production and trafficking, and money laundering. El Salvador is the blueprint for poor nations that have huge criminal organisations operating within to slowly start tracking and taking down criminal gangs using Bitcoin. Bitcoin is the most transparent asset on earth. The cash that is gained from the trade of illicit substances has to go through a bank before it can ever get to Bitcoin. Adopting Bitcoin as the surveillance money for criminal gangs is a huge step and will help the nation greatly to track down assets.

It is such a commonly peddled story in the media that Bitcoin is only used by criminals but this could not be further from the truth. This is a line parroted by governments and the media to scare people away from Bitcoin so that everyone can continue as normal without having to change; governments can still take cash bribes and people will continue to get shafted. The only way to break free of the current system is to adopt a new system, a better system. Bitcoin might use a lot of energy, but it empowers millions of people worldwide giving them more power than any bank can.

So in conclusion, Bitcoin will recover. It is currently the victim of false narratives perpetuated by desperate governments trying to get people to hold onto the ever depreciating currency they keep printing more and more of at an increasing pace. Over time people will wake up to the lies they have been fed. I’m not a conspiracy theorist, I don’t subscribe to most of the lunacy you see on the internet but when it comes to Bitcoin, there is a financial war going on. The 10 year Bitcoin charts suggests we might be winning.

TMG ‘That Martini Guy’ is a British cryptocurrency trader & YouTuber who publishes daily Bitcoin and crypto videos on YouTube. In the crypto space since 2013 he has vast experience in both bull and bear markets having experienced nearly every single one in the history of Bitcoin!

Twitter: https://twitter.com/MartiniGuyYT

YouTube: https://www.youtube.com/c/ThatMartiniGuy?sub_confirmation=1