Bitcoin: Five Factors; One Conclusion, Three Parts

Bitcoin (BTC) has been labeled as an “uncorrelated asset” since BTC is not directly connected to global GDP, company, revenues, profits (P/E ratios), dividends, and instead, relies on the network effect. For those reasons, the million dollar question is…

What are the factors that impact Bitcoin’s price the most and why?

The answer to this question would be a combination of the five following players with completely different behaviours that directly impact Bitcoin’s price:

1) Institutional Activity (Hedge funds, VC firms, & asset managers)

2) Bitcoin Whales

3) Miners

4) Crypto Enthusiasts / Holders and of course…

5) The Masses

Institutional Activity on futures markets and derivatives are the single most important category in terms of affecting Bitcoin’s price. Derivatives were the trigger for the 2 largest corrections since 2018. On average, the derivatives market is 10 to 15X the size of the spot market when counting Bitmex, OKEx, Binance, Bybit, CME and other major players… In the most recent COVID-19 triggered correction and on Bitmex alone, over US$700 million were liquidated leading to a trickle-down effect of stop losses going off and crashing the entire market on what became known as Black Thursday.

- For those reasons, some savvy traders are using the following metrics to be ready for these gigantic swings: A) daily trading volume in futures markets, the expiration dates of derivatives contracts, the CME gaps and of course the longs vs. shorts ratio.

Bitcoin Whales are the second critical factor by virtue of their activity which existed well before any substantive institutional activity kicked off. Whales are wallets owning between 1,000 and 100,000 BTC with over a ¼ of the total Bitcoin supply being in their hands having a strong impact on the price of Bitcoin.

Whales use both futures and spot markets and as a matter of fact, Bitcoin Whales were the ones shorting BTC yesterday affecting over-leveraged buyers in the futures to get trapped in their positions which crashed the Bitcoin price from the 10K zone to 8.2K USD. Thanks to onchain data which is fully transparent, BTC whale transactions are quite easy to track allowing for savvy traders to “front-run” trades.

Miners have a tremendous impact on bitcoin’s price as they often have to liquidate their block rewards to pay for equipment and running costs. One of the major metrics in 2020 was the halving, as the block rewards for miners are cut in half, decreasing the amount of bitcoin that miners can dump on the market. Although in the short-term, the halving is mostly speculative, a gradual decrease in new bitcoin supply creates a scarcity effect on Bitcoin. Simple mathematics, if the newly created bitcoin supply decreases while demand remains steady or even better, increases, bitcoin’s price will be largely affected. That being said, the halving event itself was clearly over-hyped and the volatility will remain strong in the days to come.

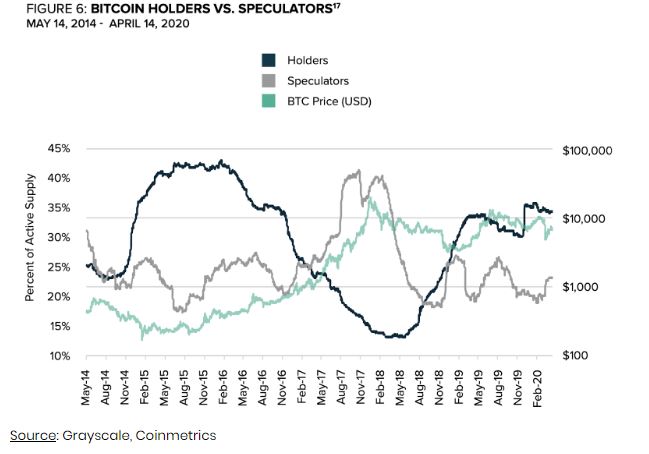

Crypto Enthusiasts are usually the HODL’ers as they do not trade often but tend to measure their gains in BTC or satoshis rather than fiat currency. This segment tends to accumulate when there are brutal down swings. Although the metrics are difficult to track, onchain data shows a surge of bitcoin wallet addresses reaching roughly 42 million as of today.

The Masses. The single most impactful metric correlated to the price of bitcoin are Google search trends. “Buy Bitcoin” searches peaked at its US$20,000 ATH (all-time high) and “Bitcoin halving” also peaked last month as the bull run started to take shape indicating that new money is possibly entering the space.

But moving on to the single most important factor that could lead the strongest Bitcoin bull-run in its history…

One Conclusion, Three Parts

As the pace of our busy lives slows briefly while our nations grapple with COVID-19, it provides us an unique opportunity to understand the effects of government monetary and fiscal intervention. It is not possible to predict exactly how a world of negative interest rates will develop. However, it is clear that the very foundations of the system of international finance are coming under increasing strain.

In this context, digital currencies such as Bitcoin and the unique attributes they possess can no longer be ignored by international investors. It is time to readjust your investment portfolio to the new market paradigm.

Inflation: An Illusion

It may not be visible or obvious but as the money supply increases with quantitative easing (“QE”), the value of fiat currency depreciates. Although our purchasing power regarding primary consumer goods doesn’t seem to have changed much over the last 10 years (as reflected in the CPI), there are other factors that will hit us very hard. Unions and workers still exist today but workers, even as an economic aggregate, are replaced either by outsourcing the production to countries with cheaper labor and poorer working conditions or by centralised automation. Therefore, in an extremely competitive and well organized international market, we face the illusion that prices will never go up and inflation is not significant. On top of this, malicious practices such as built-in obsolescence have become the norm and although this doesn’t impact the facing price of consumer goods but, by shortening our life expectancy, creates indirect inflation. But none of these factors have been taken into account with the vanity metrics coming from the CPI. The exact same negative spirale has been going on for over a century,

Quantitative Easing, Buybacks & Fiat Debasement: A Reality

On the contrary, assets such as stocks, bonds or real estate are constantly heading north. As the economy became more and more leveraged through endless buybacks indicating that inflation can be observed and it’s dangerous. Approximately $60 trillion of US dollar denominated debt (demand) is held globally relative to a monetary base (supply) of around $4.5 trillion.

This is only the beginning of aggressive central bank intervention. With global debt at $255 trillion or 322% of global GDP, it’s unlikely that these accommodative policies will ever be reversed. During the great financial crisis and over the course of 1.5 years, the Fed added $1.5 trillion to its balance sheet. In 2020, the Fed has printed over $2 trillion in less than 60 days!

When a massive amount of money like this is injected into the system, investors are looking to hedge themselves against the risk of monetary debasement and start to buy assets in limited supply: real estates, stocks, precious metals and more recently Bitcoin as a non-correlated asymmetric return asset.

Bitcoin is controlled by no government or central entity and its quantitative tightening monetary policy is enforced by an algorithm that can’t be reversed. It is an asset of unique characteristics in the current environment. To this point, and often misunderstood by traditional investors, Bitcoin is gaining in popularity among long term investors:

Asymmetric Distribution of Returns: Sustainability

“The essence of investment management,” said by the legendary investor Benjamin Graham, “is the management of risks, not the management of returns.”

Market Crashes of the past twenty years have led many investors to reexamine some of the key assumptions that lie at the heart of modern portfolio theory. The favorite topic of investment gurus Nassim Nicholas Taleb, Ray Dalio among others is portfolio management focusing on “asymmetric returns” (i.e investment strategies that maximize upside potential while capping downside risks) This has become the recipe for sustainable investment strategies.

When comparing the distribution of daily returns between Bitcoin and S&P 500, it is clear that the digital currency outclasses the performance of the 500 largest US companies by a far stretch. The recent market deep episode is a good illustration of that difference, as noticed by Bloomberg senior analyst Mike McGlone: “Bitcoin is showing divergent strength versus the wobbly stock market,” noting the cryptocurrency’s rapid decline on March 12, when it plunged 27%. As for the record, BTC rose past $10,000 in early May, largely spurred by the impending halving.

As shown in SwissBorg research or Binance research, over the course of the last 7 years, a portfolio composed of 50% of MSCI WORLD Index & 50% Core Total USD Bond Market can greatly improve its risk/return ratio by incorporating as little as 2% of Bitcoin in its allocation.

Another interesting fact is that the correlation between Bitcoin and gold is now at a historical high, signaling that Bitcoin is now considered by international investors as a safe haven.

With Bitcoin now up more than 100% off of its March 12th lows and a lagging recovery in the stock market, it is more than likely that Bitcoin follows the path of gold a few decades ago in becoming part of the international investors asset universe.

A final note… While Bitcoin halving events are important, it is still limited to a single and limited factor mainly impacting miners in the short-run. If we really want to understand bitcoin’s potential as money 2.0, it is important to understand the future devaluation and debasement of the major fiat currencies while taking into consideration all 5 of the players directly impacting the BTC’s price action.

If you believe in Bitcoin’s properties and potential, you can now buy BTC with best execution through the connectivity of 4 top exchanges directly with GBP by using SwissBorg’s wealth app

Authors Credits: Anthony Lesoismier

Email anthony@swissborg.com

Linkedin

Alex Fazel

Email alex@swissborg.com

LinkedIn

https://www.linkedin.com/in/alexfazel/