Bitcoin Breaks Past $10,000 as Fight Against Crypto-Related Scams Intensifies

This week the price of Bitcoin (BTC) went from about $9,150 to a $10,250 high as demand related to decentralized finance projects has been boosting the cryptocurrency space, and as the fight against crypto scams has started to intensify.

Ether (ETH), the second-largest cryptocurrency by market capitalization, started the week close to $240 and steadily moved up to its current $330 price tag, breaking a longstanding resistance at the $250 mark to hit a 13-month high.3

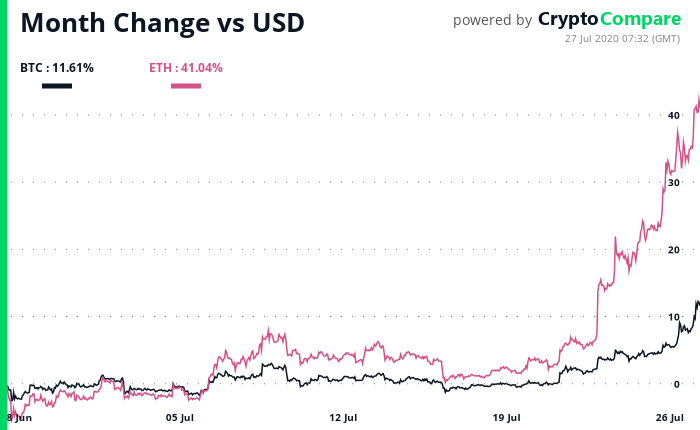

Year-to-date bitcoin has been outperforming gold, even though the precious metal is now close to a new all-time high. In the last 30 days, BTC went up 11%, while Ethereum is up 40%.

This week headlines have been pointing to a potential cryptocurrency service PayPal is set to soon announce. According to CoinDesk, people familiar with PayPal’s upcoming crypto offering have revealed the fintech giant partnered with Paxos Crypto Brokerage to start letting some of its over 300 million users buy and sell crypto through both PayPal and Venmo.

Which cryptocurrencies PayPal will let its users buy and sell is not clear. Paxos holds a New York state trust charter and is a qualified custodian, legally allowing it to hold gold and cryptoassets such as bitcoin and ether on behalf of institutional clients. It handles regulatory compliance while letting clients offer cryptos to their users.

The Office of the Comptroller of the Currency (OCC) has this week started letting nationally chartered banks in the U.S. provide custody services for cryptocurrencies, according to a letter from Senior Deputy Comptroller and Senior Counsel Jonathan Gould.

The letter details any national bank can hold the private keys of a cryptocurrency wallet, which means banks can now hold cryptoassets on behalf of clients. It also notes these may offer “more secure storage services compared to existing options,” and could be a solution for investment advisors and consumers.

The document also reaffirmed banks may “provide permissible banking services to any lawful business they choose, including cryptocurrency businesses.” Banks that are to enter the crypto space, it adds, should develop and implement their custody services “with sound risk management practices.”

The price of bitcoin moving past the $10,000 mark came alongside another major milestone in the cryptocurrency space. Tether’s USDt stablecoin, the most prominent cryptocurrency pegged 1:1 with the U.S. dollar, has seen its market cap surpass $10 billion. Its growth has cemented its position as the third-largest crypto by market cap, behind only BTC and ETH.

Web browser Opera has also revealed it expanded cryptocurrency wallet top-ups to the UK, allowing users to buy crypto directly from its built-in wallet without using an exchange. The browser has over 350 million monthly active users, but only 170,000 use its crypto wallet.

Fight Against Cryptocurrency Scams Intensifies

The hackers that managed to access Twitter’s internal tools and systems and used them to hijack dozens of high-profile accounts to promote a fake bitcoin giveaway have once again put cryptocurrency scams in the limelight.

The hackers made a total of $120,000 worth of bitcoin, but Coinbase revealed over the week it prevented users from sending $300,000 worth of BTC to the hackers by acting quickly and blacklisted the address they were asked the funds to be sent to. The hackers have been trying to launder the funds, and have already moved them to gambling and peer-to-peer platforms, but blockchain analytics firms are tracing the funds.

Google-owned video-sharing platform YouTube has been hit with a lawsuit from Apple co-founder Steve Wozniak, who argued the platform has been failing to stop scammers from using his name and image in bitcoin giveaways similar to those promoted on Twitter.

The lawsuit argues, however, that while Twitter reacted quickly YouTube has been “unresponsive” to Wozniak’s repeated requests to take down fraudulent videos and promotions. It adds

YouTube has been unapologetically hosting, promoting, and directly profiting from similar scams.

YouTube has denied liability for the cryptocurrency scams, responding to another lawsuit filed by Ripple and its CEO Brad Garlinghouse, on the grounds of Section 230 of the Communications Decency Act, which serves to protect platform publishers from being liable for third parties.

The video-sharing giant argued that scam and impersonation channels represent content created by third parties, regardless of the platform’s “unwitting verification.”