Bitcoin and crypto markets feeling the effects of war in Ukraine

Data from CryptoCompare shows that the price of Bitcoin started last week recovering from a significant slump endured after Russia’s invasion of Ukraine was launched. The cryptocurrency reached a $44,000 high but, as the conflict raged on, it has since dropped to $38,000.

Ethereum’s Ether, the second-largest cryptocurrency by market capitalisation, moved in a similar way, starting the week at $2,600 and moving to a $3,000 high before its price dropped to $2,530 at the time of writing.

Headlines were dominated by Russia’s move, which started after President Putin gave a televised speech announcing military operations. The government of Ukraine has turned to raising funds through cryptocurrencies, among other methods, and has so far received nearly $60 million according to on-chain analytics firm Elliptic.

The funds were sent across more than 118,000 transactions through various blockchains and include a $5.8 million donation from Polkadot founder Gavin Wood, as well as a CryptoPounk non-fungible token (NFT) donations worth more than $200,000.

According to a tweet shared by Michael Chobanian, CEO of Ukrainian cryptocurrency exchange Kuna, which has been supporting Ukraine’s cryptocurrency fundraising efforts, the $50 million mark was breached with mostly tokens on the Bitcoin and Ethereum networks, along with Wood’s donation.

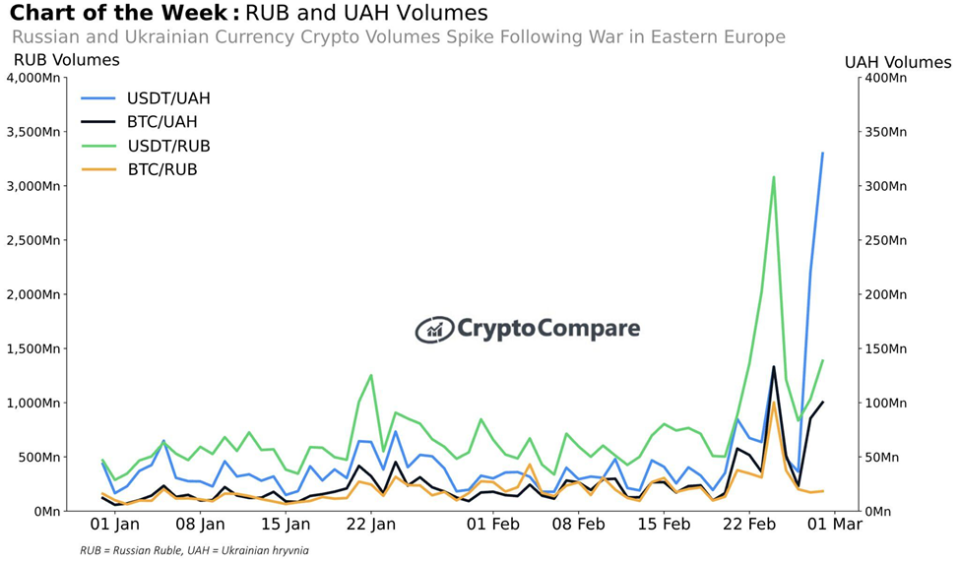

Over the week, Cryptocurrency trading volumes denominated in the Russian Ruble ($RUB) and the Ukrainian hryvnia ($UAH) have soared as both fiat currencies have been seeing their values plunge because of the conflict.

The Russian ruble has lost 46% of its value against the U.S. dollar, while the hryvnia dropped by 8% in the last three months. The largest volume spikes can be seen trading against Tether’s USDT stablecoin, likely as residents move away from devaluing fiat currencies.

Ukrainian cryptocurrency exchange Kuna, for example, saw its trading volume explode after Russia’s invasion was launched. On average the exchange’s trading volume was hovering around 45 million Ukrainian hryvnias (UAH) per day. On the day Russian forces entered Ukraine, its trading volume exploded to 150 million UAH, equivalent to around $5 million.

Both countries’ fiat currencies have been losing value because of the conflict, with Russia’s ruble being most affected because of western sanctions and companies cutting ties with the country.

Ukraine’s Vice Prime Minister and Minister of Digital Transformation Mykhailo Fedorov has asked cryptocurrency exchanges to block Russian users from their platforms. In response, most popular exchanges, including Binance, KuCoin, Kraken, and Coinbase denied the request.

Binance responded to the request saying it will block the accounts of Russian individuals who have been sanctioned but won’t “unilaterally” freeze the accounts of all of its Russian users. To the exchange “crypto is meant to provide greater financial freedom for people across the globe”.

Similarly, Coinbase responded saying it will “not institute a blanket ban on all Coinbase transactions involving Russian addresses,” adding that such a move would “punish ordinary Russian citizens who are enduring historic currency destabilization as a result of their government’s aggression against a democratic neighbour”.

Kraken’s CEO Jesse Powell has said on social media that the firm “cannot freeze the accounts of our Russian clients without a legal requirement to do so.” KuCoin responded to the request saying it would not freeze Russian user accounts “without a legal requirement.”

Non-zero Bitcoin addresses hit new high

On-chain data shows that the number of Bitcoin addresses with a non-zero BTC balance has reached a new all-time high above 40 million. Moreover, wallets with a positive Bitcoin balance are holding onto them for longer periods of time.

Out of these addresses, 817,445 have one whole BTC in them. The figure represents a 10-month high for wallets with one coin within them and appears to suggest Bitcoin users are looking to accumulate with time.

The number of non-zero BTC addresses has been growing as adoption of the cryptocurrency keeps on growing, despite the conflict. Major e-commerce platform eBay is reportedly looking into the possibility of adding cryptocurrencies as a payment method, with a potential announcement set to come on March 10 according to its CEO Jamie Iannone.

Last year, eBay changed its policies to allow non-fungible tokens (NFTs) to be traded on its platform. While it didn’t formally announce the change, NFT transactions have been taking place on eBay.

Swiss city to make Bitcoin and Tether legal tender

The Swiss city of Lugano has formed a partnership with stablecoin issuer Tether to establish BTC, USDT, and Lugano’s own LGVA Points token as legal tender in the city, in a move that goes beyond Swiss localities accepting crypto for tax payments.

Lugano is allowing cryptocurrency payments for taxes, while also aiming to have all of its businesses seamlessly use crypto for everyday transactions. The move was described as a ‘de facto’ legalisation, as the Swiss franc will remain the actual legal tender in the city.

Francisco Memoria is a content creator at CryptoCompare who’s in love with technology and focuses on helping people see the value digital currencies have. His work has been published in numerous reputable industry publications. Francisco holds various cryptocurrencies.