Binance slapped with lawsuit for ‘violating federal securities laws’ by SEC

Binance is being sued by the US Securities and Exchange Commission for allegedly violating federal securities laws.

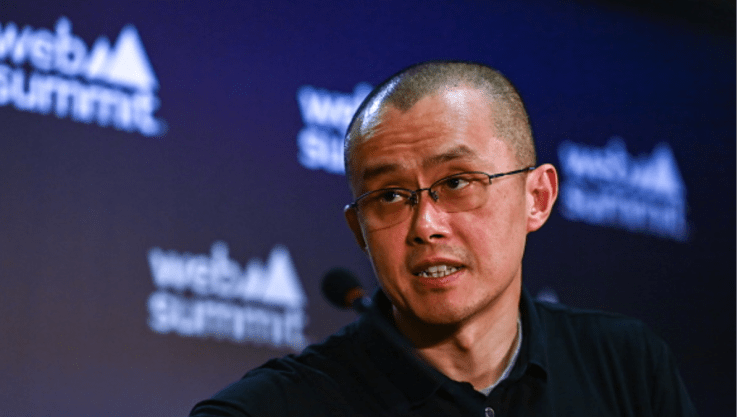

The independent government financial watchdog claims the exchange – and its CEO Changpeng ‘CZ’ Zhou – has been offering unregistered securities with its BNB token and the BUSD stablecoin.

Legal papers also accuse Binance’s staking service as a violation of securities laws.

There are similar charges against BAM Trading – the operating company for Binance.US – and Binance itself, including failure to register as a clearing agency, failure to register as a broker and failure to register as an exchange.

SEC chiefs have also raised questions over Changpeng Zhou’s handling of Binance US with suggestions that customer funds were being ‘co-mingled’, thereby inflating trading volume.

“Through thirteen charges, we allege that Zhao and Binance entities engaged in an extensive web of deception, conflicts of interest, lack of disclosure, and calculated evasion of the law,” SEC Chair Gary Gensler commented.

Further finger pointing from the SEC added that it believed Binance was allowing US citizens to trade on the exchange while claiming no such activity was taking place.

“As a second part of Zhao’s and Binance’s plan to shield themselves from US regulation, they consistently claimed to the public that the Binance.com Platform did not serve US persons, while simultaneously concealing their efforts to ensure that the most valuable US customers continued trading on the platform,” the papers allege.

“When the Binance.US Platform launched in 2019, Binance announced that it was implementing controls to block US customers from the Binance.com Platform.

“In reality, Binance did the opposite. Zhao directed Binance to assist certain high-value US customers in circumventing those controls and to do so surreptitiously because – as Zhao himself acknowledged – Binance did not want to ‘be held accountable’ for these actions.”