Binance Deals With ‘Stress Test’ as Crypto Market Leverage Drops, FTX Founder is Charged

Data from CryptoCompare shows that the price of Bitcoin started this past week moving up steadily from around $17,000 to a high above the $18,000 mark, before it quickly collapsed and dropped to $16,500.

Ethereum’s ether, the second-largest cryptocurrency by market cap, traded in a similar way, seeing a high of $1,350 after starting the week at $1,250, but quickly dropping to $1,185 amid a wider market sell-off.

Headlines in the cryptocurrency this week focused on the founder and former CEO of cryptocurrency exchange FTX, Sam Bankman-Fried, who was arrested by Bahamian authorities after the United States Attorney for the Southern District of New York shared a sealed indictment with the Bahamian government.

The U.S. Securities and Exchange Commission (SEC) has charged Sam Bankman-Fried, the founder of cryptocurrency exchange FTX, with orchestrating a “scheme to defraud equity investors” in the collapsed cryptocurrency exchange.

The SEC said that in his representations to investors, Bankman-Fried promoted FTX as a “safe, responsible crypto asset trading platform,” and specifically touted its “sophisticated, automated risk measures to protect customer assets.”

In reality, the complaint alleges, FTX’s founder “orchestrated a years-long fraud to conceal from FTX’s investors the undisclosed diversion of FTX customers’ funds to Alameda Research” and the “undisclosed special treatment afforded to Alameda on the FTX platform.”

In the wake of FTX’s collapse several exchanges have been under scrutiny. The founder and CEO of leading exchange Binance, Changpeng Zhao, has welcomed a “stress test” the exchange has been enduring as users move to withdraw their funds.

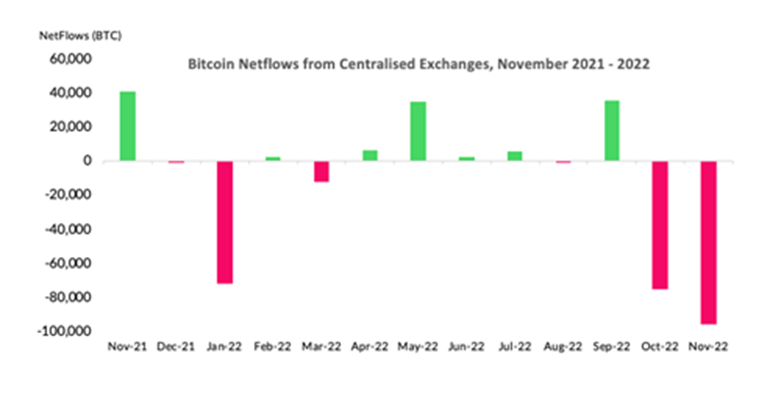

In November, BTC Netflows recorded the largest negative flow from CEXs in its history, with a netflow of -91,363 BTC, worth over $1.6 billion.

The significant outflows were also a result of various cryptocurrency exchanges releasing reports on their reserves that have drawn skepticism. Binance, KuCoin, and Crypto.com are among the exchanges that issued proof-of-reserves and proof-of-liabilities verification conducted by accounting firm Mazars’ South African affiliate.

These reports, according to experts, only showed “part” of their assets and liabilities and did not “address the effectiveness of internal financial controls” or “express an opinion or assurance conclusion.”

Crypto Market Leverage, Open Interest Historically Low: Citi

The bear market has been taking its toll on cryptocurrency trading volumes, as well as on its leverage, volatility and open interest, which according to analysts at Citi have “faded as investors battle with declining prices.”

The decline has “coincided with a more general decline in volatility” and in institutional interest. Per the analysts, led by Joseph Ayoub, there was a “loss of trust” following the failure of major centralized entities that was reflected in exchange-traded product (ETP) flows.

According to the report, the total value of the cryptocurrency market decreased by 61% amid high inflation, rising interest rates, and tightening financial conditions, while the S&P 500 index saw a decline of 18%. It stated that Bitcoin’s open interest fell from over $23 billion to $9 billion.

Notably, cryptocurrency platforms applying for registration in Canada will now have to agree to tighter rules, including a ban on margin and leverage trading. Firms will also have to hold the assets of their clients separately from their proprietary business.

The regulator reiterated that it sees digital assets as highly speculative, high-risk investments, with risks that could result from various factors including “crypto trading platform non-compliance with registration terms and conditions or undertakings, interconnectedness within the crypto sector, insolvency, hacks, price volatility, and uncertain value propositions for individual assets.”

MetaMask Integrates PayPal for ETH Purchases

Cryptocurrency adoption has nevertheless kept on growing over the past week, with popular cryptocurrency wallet MetaMask integrating PayPal to allow its users to buy the second-largest cryptocurrency by market capitalization, Ethereum, directly from their wallets.

The integration will be similar to PayPal’s checkout feature at online stores like Etsy and eBay, as users will need to log into their PayPal accounts before making a purchase. In a statement, the company said select U.S.-based MetaMask users will be able to use the feature now and that it will roll out to other U.S. users in the coming weeks.

The United Nations Refugee Agency (UNHCR) is implementing a blockchain-based aid program that will transfer stablecoin USDC, created by Circle and Coinbase, to eligible recipients’ Vibrant digital wallets running on the Stellar network.

Recipients will be able to access the funds in dollars, euros, or another local currency at a MoneyGram location. There are 4,500 of these locations in Ukraine, and the funds will be distributed to those most affected by the war to cover basic expenses such as food, medical care, and heating.

The program, which is being launched in collaboration with the Stellar Development Foundation, is being piloted in Kyiv, Lviv, and Vinnytsia in Ukraine, with plans to expand to other regions in the future.

Francisco Memoria is a content creator at CryptoCompare who’s in love with technology and focuses on helping people see the value digital currencies have. His work has been published in numerous reputable industry publications. Francisco holds various cryptocurrencies.

Featured image via Unsplash.