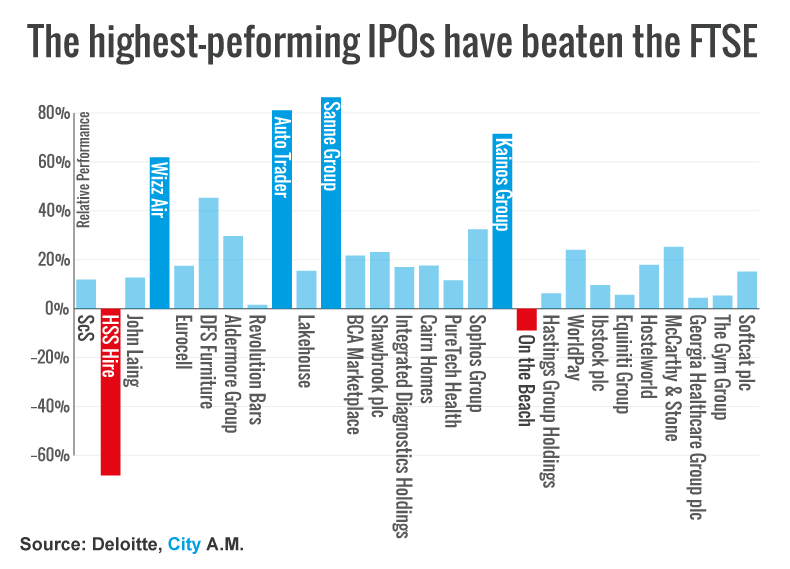

Biggest IPOs of 2015, including Aldermore, The Gym Group, Shawbrook, Worldpay and Auto Trader, have beaten the FTSE 100’s performance

The volatile markets this year have not been ideal for company flotations. But despite this, the 28 biggest IPOs in the UK this year have beaten the FTSE 100 by 21.2 percentage points, generating an average return of 17.2 per cent according to Deloitte

An investment of £1,000 in each of the 28 IPOs would now be worth £32,811, whereas a £1,000 investment in the FTSE 100 at each IPO date would have fallen slightly to £26,867.

Auto Trader, which floated in March valued at £2.3bn, had one of the most impressive returns, beating the FTSE's returns by 81.1 percentage points. Budget airline Wizz Air and IT-service provider Kainos, which went public in July have also performed well. Kainos, which was valued at £161m when it floated, has returns 71.5 percentage points higher than the FTSE.

Read more: The biggest IPOs of 2015

Floats have also performed better than last year, when 30 IPOs produced an average return of 12.4 per cent, 14.4 percentage points better than the FTSE.

However, a strong start to the year was undermined by uncertainty over the General Election, which dampened market activity considerably, while later in the year a commodity rout and fears over China’s slowdown hit investor confidence.

Continuing market volatility has seen several IPOs put on hold in London and in Europe, including smartcard-maker Oberthur Tech.

Read more: City looks to end of year float flurry

Despite this rollercoaster, nine companies have floated since the beginning of October, including Worldpay, whose estimated £4.8bn market cap made it the biggest IPO of 2015, and retirement housebuilder McCarthy & Stone.

John Hammond, head of Equity Capital Markets at Deloitte, said:

Going into the New Year, the IPO pipeline looks reasonably robust and the period of uncertainty has not discouraged companies from starting to plan for an IPO in 2016. In general, investors seem well accustomed to the prospect of a Fed rate rise later this month and there remains strong demand for high quality companies.

He said that all sectors and industries were getting involved: "There is a bit of everything, with companies from the consumer and financial services sectors being particularly prevalent," adding:

What is particularly telling is the number of overseas companies in our pipeline, which demonstrates continued confidence in the strength of London equity markets.