Big tech vs the market: what you need to know

Big tech has led the global market recovery in the wake of Covid-19. Can the dominance of the FAMAGs continue?

On 8 June the S&P 500 of US stocks recovered all their Covid-19 losses for 2020. The so-called FAMAGs (Facebook, Amazon, Microsoft, Apple and Alphabet (Google’s parent company)) led that recovery.

Even before the pandemic, these were already some of the largest-listed companies in the world.

The crisis has amplified the demand for their technology which helps us communicate, educate and shop, as well as keeping us entertained.

We wanted to find out how and why these companies have become so dominant. So, we spoke to Sean Markowicz, a strategist in the Research and Analytics Team, and Frank Thormann, a portfolio manager to get the answers.

The rise of big tech

How big are these companies?

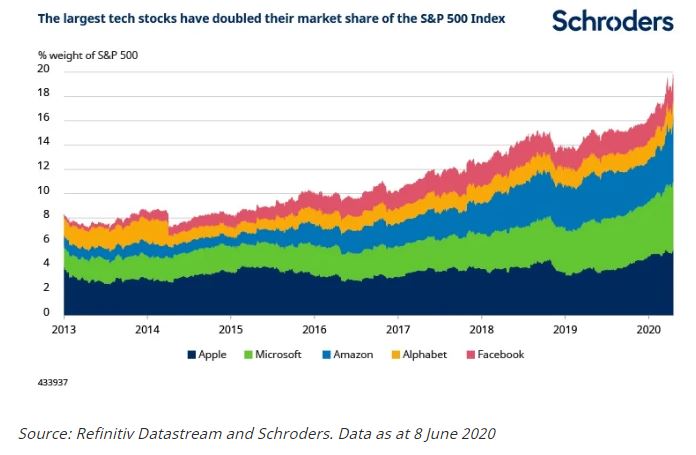

Sean Markowicz: “In terms of market weight, big tech has grown immensely over the last few years. Its combined weight in the S&P 500 index of US shares has more than doubled from roughly 8% in 2015. Today, FAMAGs make up 20% of the index in terms of market capitalisation.

“That means these five stocks account for a larger slice of the market than the five largest stocks at the peak of the dot com bubble in 1999 did.”

How have these companies become so dominant?

Frank Thormann: “These companies have become incredibly innovative at solving important problems such as how we shop, collaborate and keep in touch.

“The solutions these companies provide have set the standard globally. That has resulted in an impressive spurt in revenue and earnings growth, which the pandemic seems to have accelerated.”

How have their share prices performed?

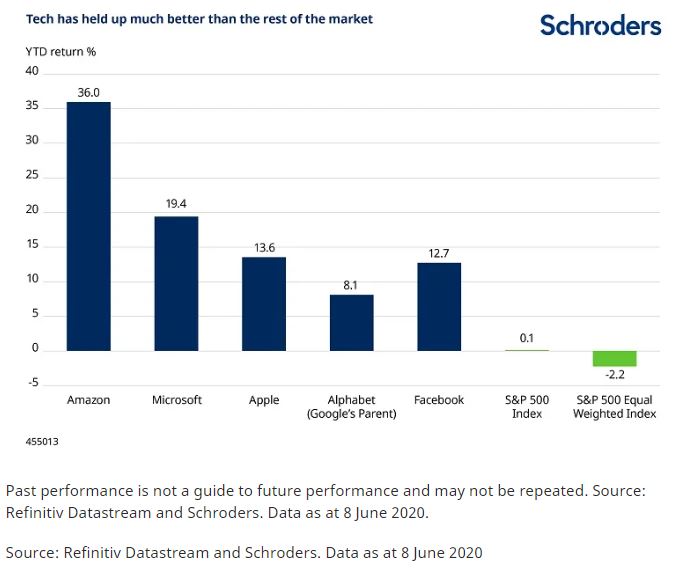

Sean Markowicz: “During the crisis, these stocks have outperformed the broader market index. They have risen by an average of 18% this year, as of 8 June. Amazon and Microsoft have led the pack, up 36% and 19% respectively. That compares with a 0.1% rise in the S&P 500.

“However, It is a bit circular to compare the tech stocks performance to this index, because the index itself is heavily influenced by the tech stocks.

“A better benchmark would be the equal-weighted S&P 500, which shows the performance of the average US company. That has fallen by 2.2% this year.

“This means we are seeing the larger stocks outperform the smaller ones.”

Big tech has held up much better than the rest of the market

The risks posed by big tech

Are the tech companies becoming too powerful?

Sean Markowicz: “Concentration of corporate power is not just a problem for tech companies, this is happening across a few sectors.

“For example, in the year 2000, the top two telecom providers controlled about 30% of industry sales, today they control 70%.

“If you take the US airline industry, the top four have taken their share of domestic air travel from around 50% in 1997 to around 70% today, according to the industry regulators.

“Competition today is much weaker than in the past.”

What dangers does that dominance pose?

Sean Markowicz: “The concentration of power is on the regulator’s radar and that has the potential to stifle some of big tech’s momentum.

“For instance, in the past, action was taken against telecom provider AT&T, software provider Microsoft and tech firm IBM. As a result, stock valuations and prices fell between the time the lawsuits were filed and solved. That was followed by a fall in sales growth.

“Tech companies have already faced a barrage of criticism over their anti-competitive behaviour from data privacy issues to unfair business practices. These could impact future growth prospects.

“It is something for investors to monitor.”

Discover more:

– Watch: Why do markets rise when economies slump?

– Read: Which stock markets look cheap

What risk does “big government” pose?

Frank Thormann: “Tech companies have been allowed to grow unopposed through their innovation and fruits of their own internal research and development.

“The risks are that the companies become so dominant that they rest on their own laurels and future innovation starts to suffer.

“If that happens, governments could take action to invigorate the competitive spirits. “

Are tech companies becoming too big to fail?

Sean Markowicz: “The crisis has highlighted just how important these companies are. Travel restrictions and social distancing rules illustrate our reliance on the services the tech companies provide whether its shopping, entertainment or keeping in touch.

“There is an argument that these companies are so important to our society that they pose a systemic risk. That is where regulators could get involved.

“At the moment it is unclear as to how that would happen. So far, the only suggestion has been that their data becomes a public good that could be distributed among competitors. It won’t affect all firms but the ones most likely to lose out would be Google and Facebook.

“Limiting how they monetise data and which markets they participate in has also been discussed. But that is not to say that they won’t maintain their dominant market shares.

“For instance, IBM is still the biggest supplier of mainframe computers. Microsoft is still the leading company for software.

“There is a possibility that these companies could still be eclipsed, which is something we should be aware of.”

What lessons can we learn from the past?

Sean Markowicz: “Dominant firms seldom maintain their dominance over time. Half of all market leaders fall out of the top 10% during each business cycle, according to the Mckinsey Global Institute.

“Think of Nokia and BlackBerry. We all used to own one but their market share has evaporated into thin air.

“There is another study by investment manager Research Affiliates. It found that once companies achieve a dominant status they have historically underperformed the market and their industry.

“They call it the winner’s curse.”

What remains so desirable about big tech?

Frank Thormann: “Often when companies become so dominant and successful they become complacent. They seem to think they are infallible and they should be a leader forever, which results in a decline in research, development and innovation.

We have to analyse the speed at which these companies continue to innovate. One way to do that is to monitor their research and development spending.

“As long as these companies don’t become complacent and succeed in making our lives more productive there continues to be a positive future. But that is not set in stone.”

How do you value these tech stocks?

Frank Thormann: “Investors can use a variety of measures. They can compare the company’s valuation relative to its earning power today and relative to its perceived earning power in the future.

“Even more important is the cash being generated. These tech companies are extremely cash generative, which makes them more attractive relative to other companies. So you can look at free cash-flow power today compared to the future.

“The final point is research and development. Investors could look at the cumulative stock of all the research and development spending that has been undertaken by these companies. The total of which compared to their market valuation is another measuring stick of how much you are going to have to pay for the company.

“There is no broad answer.”

What effect could the size of big tech have on portfolios?

Frank Thormann: “The bigger these companies become, the larger bearing their stock prices have on the direction of the wider market.

“It is something to be mindful of as an investor if you have purchased a passive fund which tracks the performance of the S&P 500.

“One-fifth of your investment by definition is invested in these five companies.”

This information is not to be relied upon and should not be taken as a recommendation or advice to buy/and or sell, if you are unsure as to your investments speak to a financial adviser.

The value of investments and the income from them may go down as well as up and investors may not get back the amounts originally invested. past performance and historic market patterns are not a reliable guide to the future

Important Information: This communication is marketing material. The views and opinions contained herein are those of the author(s) on this page, and may not necessarily represent views expressed or reflected in other Schroders communications, strategies or funds. This material is intended to be for information purposes only and is not intended as promotional material in any respect. The material is not intended as an offer or solicitation for the purchase or sale of any financial instrument. It is not intended to provide and should not be relied on for accounting, legal or tax advice, or investment recommendations. Reliance should not be placed on the views and information in this document when taking individual investment and/or strategic decisions. Past performance is not a reliable indicator of future results. The value of an investment can go down as well as up and is not guaranteed. All investments involve risks including the risk of possible loss of principal. Information herein is believed to be reliable but Schroders does not warrant its completeness or accuracy. Some information quoted was obtained from external sources we consider to be reliable. No responsibility can be accepted for errors of fact obtained from third parties, and this data may change with market conditions. This does not exclude any duty or liability that Schroders has to its customers under any regulatory system. Regions/ sectors shown for illustrative purposes only and should not be viewed as a recommendation to buy/sell. The opinions in this material include some forecasted views. We believe we are basing our expectations and beliefs on reasonable assumptions within the bounds of what we currently know. However, there is no guarantee than any forecasts or opinions will be realised. These views and opinions may change. To the extent that you are in North America, this content is issued by Schroder Investment Management North America Inc., an indirect wholly owned subsidiary of Schroders plc and SEC registered adviser providing asset management products and services to clients in the US and Canada. For all other users, this content is issued by Schroder Investment Management Limited, 1 London Wall Place, London EC2Y 5AU. Registered No. 1893220 England. Authorised and regulated by the Financial Conduct Authority.